As the gap between the cost of rent and the cost of a mortgage continues to close, we see an increasing number of renters interested in buying. But how can renters make the transition to owners?

The purpose of this article is to help renters implement three critical changes today to help them successfully purchase a home tomorrow. If implemented correctly, these changes will help renters overcome the feeling of never being able to purchase a home.

Start by talking with a local lender

Do your research. Find a trusted lender in the location you are planning to purchase your home. Why is it important to use a local lender? Each housing market is different depending on location. Despite the similarities in names, what might be happening in San Francisco may not be happening in San Antonio. It is important to talk to a lender that is not only familiar with but understands the current local market and can explain to you what it takes to become a first-time homeowner. Check out our full article here. Your trusted advisor can then look at your specific financial situation and make suggestions to help you navigate the local market, meet your specific needs, and discuss your available options. This conversation can help you build your timeline for when it is right for you to purchase. Having the right team of real estate and lending professionals on your side can help tremendously when planning for your first home. Together they can help you determine your goals, what you can afford, and help you get pre-approved when you are ready. Need help finding a lender? Click here.

Reduce your debt and build your credit

Your first step should be knowing your credit score and what it means. Check out this article here for more information on credit scores. According to the HUD, the average credit score of first-time homebuyers is 716. There are many online tools that can help you determine your credit score. If you don’t already know yours it would be advantageous for you to find out.

If you determine that your score is below 716, don’t freak out.

First, 716 is just an average which means that there are homeowners with credit scores both above and below that number. Knowing your score gives you a snapshot of how you are doing financially and helps you know how to adjust accordingly to reach your goals.

Second, there are numerous ways to increase your credit score BEFORE you apply for your home loan.

- HUD’s number one recommendation is to reduce your debt as much as possible. Start by reducing your current spending. This will not only help you have less debt, but it will also help you have more money to pay down your current debts. Start small, perhaps purchasing one less coffee a week or choosing water instead of the soda or martini. These small sacrifices now will add up to big wins later. We recommend TrueBill as an app that can help find hidden savings by canceling subscriptions you don’t use anymore or negotiating your existing subscriptions down. It can also help you develop and stick to a budget!

- Pay all your bills on time. Set up auto payments to avoid late payments.

- Use your credit card responsibly.

When you have your debt in a manageable place…

Start saving

It might already feel like you are barely making it. But it has been proven that setting aside even small amounts can make it possible for you to save for a down payment on a home over time. Having funds in savings is also taken into consideration when getting pre-approved for a home loan (See why getting pre-approved is imperative). You don’t always need a large down payment when buying a home but you will need a good house fund saved up for ongoing maintenance and repairs.

Many experts suggest using a hidden savings or a “sinking fund” when saving for your down payment. This is an “out of sight out of mind” savings account. Once money goes in you don’t take it back out till you are ready. Make sure you keep it separate from your emergency fund or your short-term savings for expenses. Set small attainable goals that make you feel accomplished rather than the large goal that might feel daunting and overwhelm you. Are you ready for the challenge?

See how long it takes the average person earning a medium-income in America to save for a down payment here.

In conclusion, get some professionals on your team by talking with a lender (ask your trusted Windermere Broker for recommendations) if you don't have an agent contact us here and we will get you connected, build credit, and start saving!

Buying your first home can be easy when you are adequately prepared and you have a good agent on your side. But where to start and what actions are most important? We will get you pointed in the right direction. Let’s get started!

-

Know your credit score.

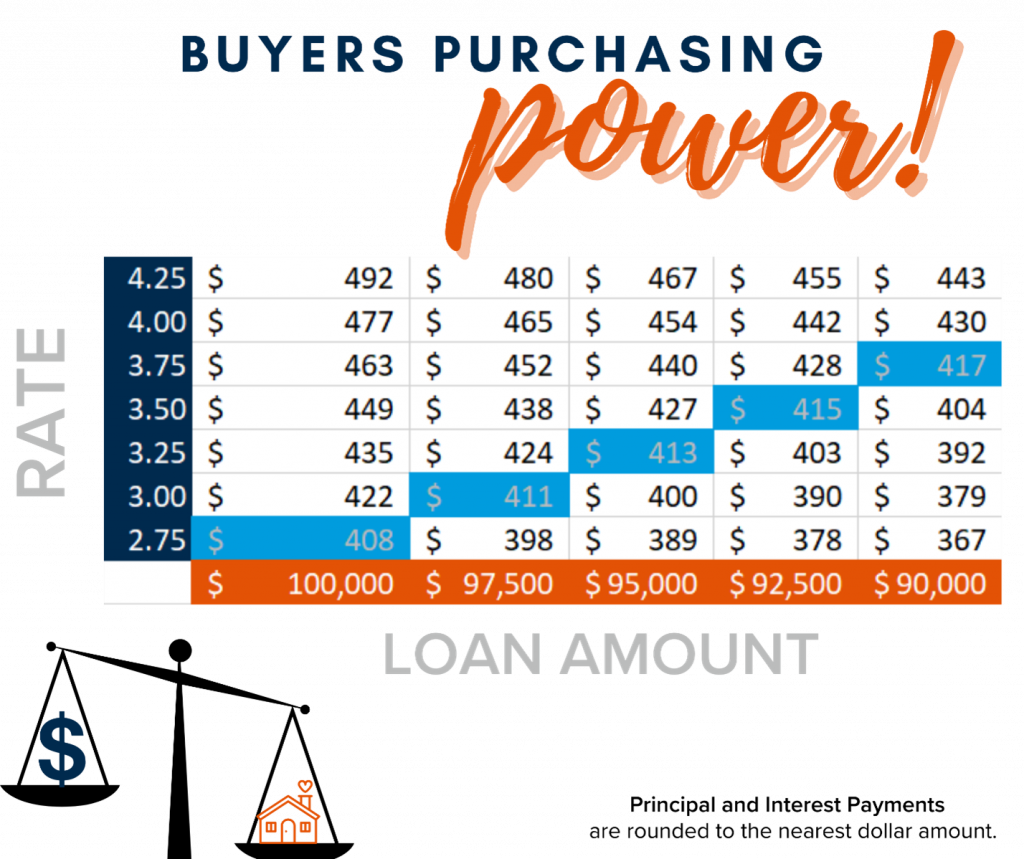

Many first-time homebuyers fail to recognize that one of the most important factors in getting approved for a mortgage is their credit score. The health of the score determines not only the interest rate but also whether they will be approved for a mortgage in the first place. Some people wonder why the interest rate really matters. The truth is that the slightest difference in rate can mean big money over 30 years! As the chart below demonstrates, a lower interest rate helps buyers afford a higher-priced house and still pay less monthly. Check out this article to learn more about Credit score rankings and what they mean.

-

Set a clear budget and stick with it.

Another big mistake first-time homebuyers make is not budgeting realistically and then finding out they cannot really afford the house they chose. A great way to get an idea of how much you should realistically spend on a mortgage is to determine your debt-to-income ratio. This number can be calculated by adding all your monthly debt payments (mortgage, credit card bill, car payment, etc.) together and then dividing by the gross monthly income. A conservative percentage of your income spent paying down debt would be 20-25%, a medium would be 25-30%, and a high would be 30-38% (or higher when using gross income vs. net).

-

Remember there are other fees other than the mortgage payment.

Homeownership comes with fees and other bills that you may not have as a renter. In addition to principal and interest on the mortgage payment, there will be real estate taxes and homeowner’s insurance. Check to see if the home is part of a homeowner’s association as there may be annual or monthly dues for that (a great agent will let you know about this). These fees typically show up as part of the mortgage payment. However, what is often forgotten or inaccurately calculated is the utility bills like water, sewage (or septic inspections/pumping), garbage, and energy bills. Furthermore, unlike renting if a pipe breaks or roof leaks there is no maintenance man that just shows up to repair it. Remember to budget for the maintenance of the home. This includes mowing the lawn… do you have a lawnmower yet?

-

Leave a cushion.

As discussed, buying a home has a lot of upfront costs. A bank account that seemingly had a plethora of cash can quickly be drained after the down payment, closing costs, moving expenses, and furnishing a new home. Having a healthy emergency fund is so critical as a homeowner.

Check out this helpful article by Dave Ramsey.

-

Once steps 1-3 are completed get pre-approved.

Don’t just meet with any lender, be sure to find a highly reputable local lender that the top listing brokers recommend (this will give you a competitive advantage). Not only does the pre-approval give buyers a realistic idea of how much they can borrow, but it can also be the defining factor of whether or not they get the home. Let us explain. A pre-approval speeds up the process and demonstrates the person is a serious buyer, not just a lookie-loo. When it comes down to multiple offer situations, as we see so frequently now, it is critical to have the most well-presented offer. Showing the seller that you are not only serious but that you have been pre-approved for the funds needed to buy with a lender they respect sends a strong message that you are the one the seller should choose! Check out our local lenders here.

-

Ask questions about your options!

Not everyone’s situation is the same. Similarly, loans are uniquely created to fit individual needs. Historically, it has been thought that buyers need to come to the table with at least a 25% down payment. Today that is just not true. While it is always good to have money for your mortgage down payment, there can be alternative options if you don’t. VA mortgages can be secured for 0% down and conventional mortgages for as little as 3%. Check out these different mortgage types meant to uniquely fit your life.

-

Hold off on any spending spree and do not take out a line of credit.

Remember that “debt-to-income ratio” mentioned above? Your mortgage approval is linked heavily to this number. This is not the time to go out and buy a new sportscar, purchases new appliances, and or upgrade your electronics. Borrowing money after getting pre-approved increases the debt-to-income ratio, and this will be re-checked just prior to the loan being approved. Applying for a new loan or credit card will also likely decrease your credit score. If either of these things happen prior to closing it could mean losing the mortgage and the interest rate you locked in. So, hold off on spending or even giving out your social security number to anyone!

We hope this helps point you in the right direction. We would love to be your guide as you prepare and navigate the path to homeownership! Call us today and we can connect you with an expert Buyers Broker! 360.675.5953.

If you enjoyed this you might also like: