Understanding Property Assessments and Taxes in Island County

At Windermere Whidbey Island, we are committed to providing our clients with valuable insights and information about the real estate market on Whidbey Island, Washington. One topic that frequently comes up in discussions with our clients is how property assessments and taxes work in Island County. To help clarify this complex process, we recently had a presentation by Jason Joiner from People’s Bank, who previously served as the Deputy Assessor at Island County. His expertise has equipped us with the knowledge to better serve our clients, and we are excited to share these insights with you so that you can have an understanding of property assessments and taxes in Island County.

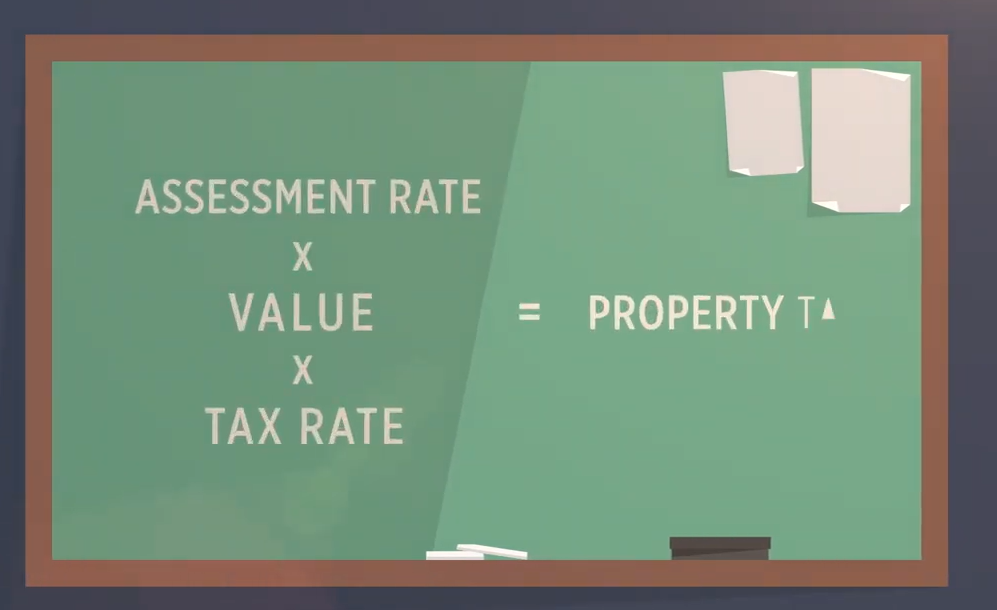

The Basics of Property Assessments and Taxes

In Washington State, property taxes are determined through a budget-based system rather than a rate-based system. Understanding this distinction is crucial for comprehending how property taxes are calculated in Island County. In a budget-based system, the county sets its annual budget, and property owners contribute a portion of that budget based on the assessed value of their property. This means that the total property tax collected is determined by the budget, not the property tax rate.

For a more detailed explanation, we recommend watching this YouTube video that breaks down the basics of property assessments and their connection to taxes.

Lid Lifts and Property Tax Increases

Washington State law restricts property tax increases to 1% per year. However, it is sometimes necessary to raise the baseline beyond this limit to keep up with rising costs and inflation. This process is known as a “lid lift,” which requires voter approval. Essentially, voters may be asked every few years to approve a lid lift to ensure the county can continue to meet its budgetary needs without falling behind due to inflation.

Property Tax Rates in Island County

One of the benefits of living in Island County is our relatively low property tax rates compared to other areas in the state. This advantage is significant for property owners and is an important consideration for those looking to move to the area.

The Assessment Process

Island County is divided into six appraisal areas. Each year, county assessors are required to physically inspect one of these areas. The remaining areas are adjusted based on a conservative market-based increase. This method, known as the “catch up method,” means that property owners will typically see a more noticeable increase in their property value during the year their area is physically inspected.

This approach ensures that property values remain accurate and reflect any significant changes in the market or the property itself. However, it also means that property owners should be prepared for potential fluctuations in their assessed value from year to year.

Preparing for Potential Property Tax Increases

When purchasing a property, it is essential to budget for potential property tax increases, especially if the purchase price is significantly higher than the current assessed value. A good rule of thumb is to budget about 1% of the purchase price for property taxes. This conservative estimate helps ensure that buyers are not caught off guard by a substantial tax increase after their purchase.

The Role of Permits in Property Assessments

The Island County Planning Department provides a list of permits to the assessor’s office, which uses this information to adjust assessed values as needed. For example, a permit for a hot water heater replacement might not affect the assessed value, but a permit for a new kitchen would likely lead to an upward adjustment.

It is important to note that assessors conducting physical inspections are not reporting unpermitted improvements to the planning department. This means that while unpermitted improvements may eventually be discovered and assessed, the assessors themselves do not report these findings.

Appealing Your Property Assessment

If you disagree with your property assessment, you have the right to appeal. When you receive your assessment notice in June, you have 30 days from the date on the letter to file an appeal with the Board of Equalization. The instructions for filing an appeal are provided on the back of the notice. This process allows property owners to present their case and potentially receive a revised assessment.

Understanding the Workload of Assessors

It is worth noting that private sector appraisers typically charge around $800 per appraisal, while the Island County Assessor’s office receives about $23 per assessment. Despite this significant difference in compensation, the public often expects the same level of service and accuracy from county assessors. This disparity highlights the challenges faced by public sector assessors in maintaining high standards of service with limited resources.

Final Thoughts

Understanding the intricacies of property assessments and taxes in Island County can be daunting, but it is an essential aspect of property ownership. By familiarizing yourself with the process, you can better navigate your financial responsibilities and make informed decisions about your property investments.

At Windermere Whidbey Island, we are dedicated to guiding and educating our clients on all aspects of property ownership. Whether you are considering buying a new home, appealing your property assessment, or simply want to learn more about how property taxes work, we are here to help. Please feel free to reach out with any questions or concerns you may have. Let’s work together to make your real estate journey as smooth and informed as possible.

Windermere Whidbey Island is here to assist you every step of the way. If you are not currently working with a realtor and would like to, connect with us here.

Expedite the Loan Process

Knowing what to expect not only calms your nerves but also expedites the lending process.

During your search for a lender, you will discover that most lenders will sincerely work on your behalf to help you attain the financing needed to quickly get you into the home you have chosen.

Your chosen lender will guide you through the process and shed light on the documents you need to prepare as well as provide you with the various options available to you. Talking to a lender well in advance about your goals and your financial situation will better prepare you for home ownership. The journey is different for everyone. We cannot stress enough how important it is to talk to a lender early on. The lender can help you determine a realistic timeline and address any problems early on to prevent a problem from arising later that could cost you your dream home.

To expedite the loan process come prepared with the following documentation.

- Your most recent pay stubs (this should be computer generated and include the YTD earnings and deductions).

- Last two years’ W2s.

- Two years’ tax returns.

- Copy of your valid U.S. picture ID (bring the ID with you)

- Two months’ bank statements for all your accounts (must include the date, name, and account numbers)

- Last two statements for asset accounts such as IRA, 401K, investment, ect.

- Contact information for whom you anticipate getting your home insurance. (Connect with us if you need help finding home insurance companies)

- If applicable, bankruptcy documentation including discharge paperwork

- If applicable, a divorce decree and/or child support court order

What if I’m self-employed?

If you are self-employed it is of the utmost importance for you to speak with a lender as soon as possible if homeownership is on your wish list.

You will need to come prepared with things like the last two years of Business Tax Returns and if possible, a letter from your CPA detailing at the very least two years of self-employment with a continued positive outlook for your business.

To help you get started with your search check out Guild Mortgage, Peoples Bank, and Home Bridge for a few lenders here on Whidbey Island. Don’t forget to check out our Neighborhood Guide when you are ready to start looking for your dream home on Whidbey.

We hope this was of help to you. If you need help connecting with a lender, send us a message here. If you are ready to start speaking to an agent about the next steps let us know you are ready to start looking in a message to us here.

A Different Approach to Developing Wealth

Mynd recently released their 2022 Consumer Insights Report that demonstrates how millennials and Gen Z’s have taken a different approach to developing wealth than previous generations.

For example, while 9% of Baby Boomers are contemplating the idea of investing in rental properties over 43% of Millennials and Gen Zs are choosing to remain in their current living environments and invest in rental properties elsewhere to build their wealth.

BUT IS IT WORKING?

This strategy is becoming increasingly popular. It allows the investor to remain living without disruption to their lifestyle in a place they may not be able to afford to purchase a home of their own. Instead of uprooting their lives and relocating elsewhere to attain the dream of homeownership the investor achieves homeownership by purchasing a home in a more affordable location with the intention of renting it out.

With no disruption to their life, they become a homeowner and investors at the same time. Their purchase not only creates monthly passive income for their pocketbooks but also builds equity over time – ultimately increasing their overall net worth.

They can later choose to continue to rent out the home, sell for an increased price, or move into the home if or when they want or need to.

READY TO EXPLORE THIS APPROACH?

If you would like to explore this idea further connect with us so we can help you build your wealth through real estate.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link