Low Housing Inventory Explained

If you are considering moving in today’s market, you are probably wondering why it is so hard to find a house to buy. The lack of inventory might leave you feeling a bit defeated and likely on the verge of giving up and waiting to try again when there are more options. But… that is NOT the best idea. Let us explain why.

The lack of inventory we are experiencing has been a problem for years and is likely to continue for quite some time. Follow along as we expose some of the long-term and short-term factors that contributed to the limited supply we are feeling in our housing inventory.

Shortage of New Construction

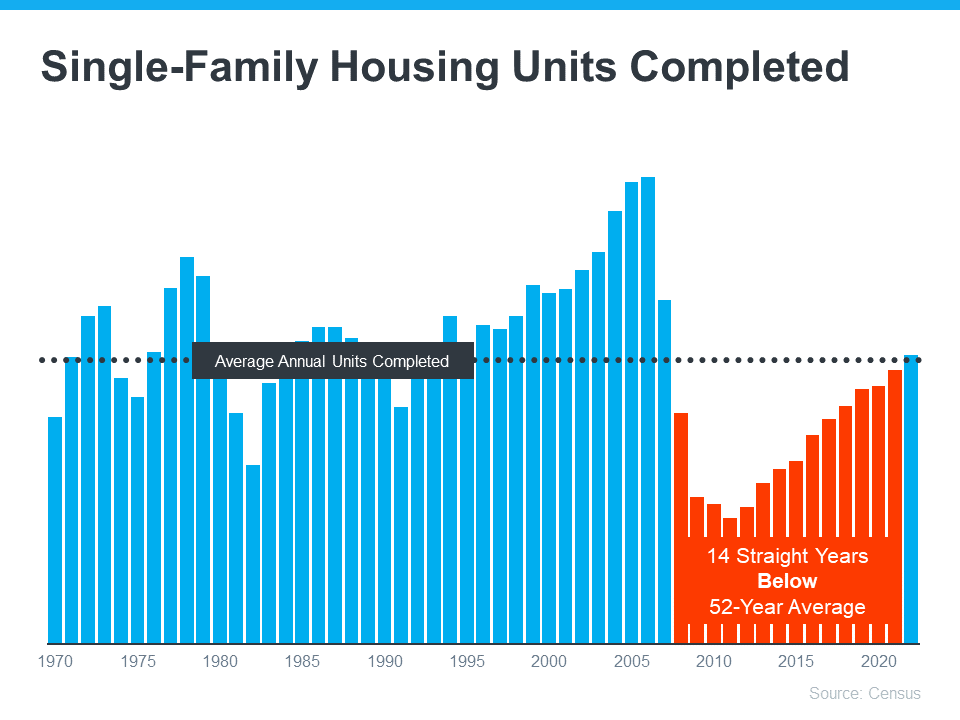

Changes in our economy and other contributing factors have slowed the rate at which builders are building new construction. For more than a decade, new construction has been below the national average. Consider the graph below. It demonstrates the past 5 decades of new construction of single-family homes.

Looking at the chart, the orange shows that builders did not construct enough homes to meet the historical average for the past 14 years. Underbuilding significantly contributed to the inventory deficit and will take a lot of work to get the housing market back to where it once was. While the graph shows improvement this last year, the long-term inventory shortage will not snap back overnight.

Owners are Locked in at Low Rates

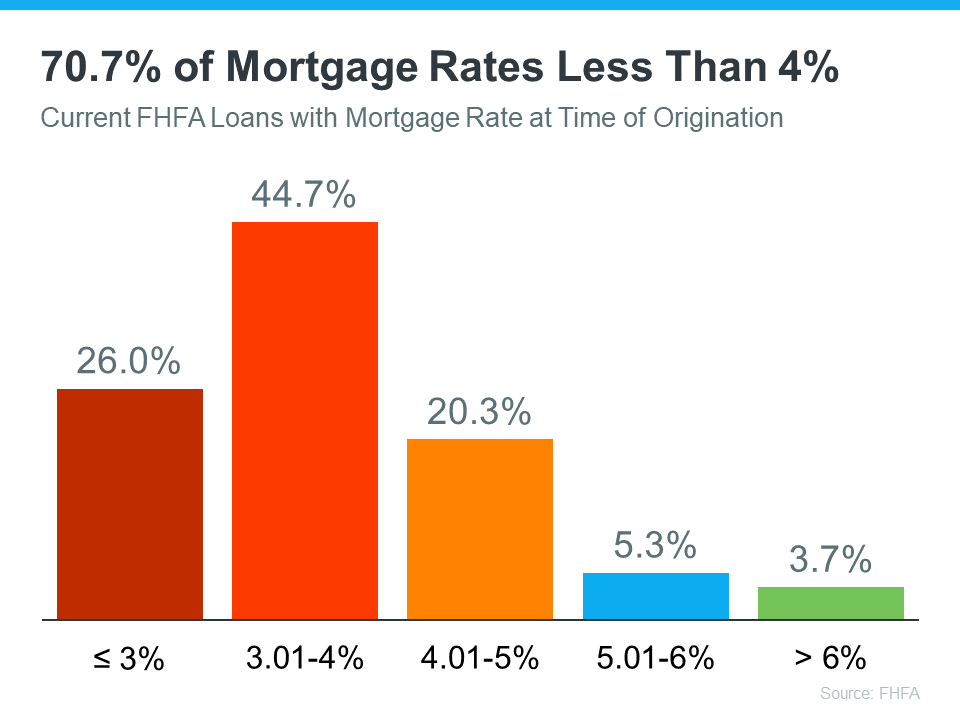

Several factors of today have created stumbling blocks for returning to a healthy market. One of the most obvious challenges is the mortgage rate lock-in effect. You might be wondering what the mortgage rate lock-effect is. We are here to explain. When mortgage rates were at all time lows, home owners locked in at incredibly low rates making their monthly house payments significantly less each month than what someone buying a home with todays rates would be. Many owners are hesitant to sell because mortgage rates are higher today. Homeowners don’t want to take on the higher mortgage rates and loose their low mortgage rate. The image below demonstrates how many homeowners are finding themselves in this predicament.

Homeowners are faced between low mortgage rates and their needs. Many are sacrificing their needs to keep their low interest rates. What homeowners need to keep in mind is that their needs may be just as important as the financial aspects of their move. A difficult predicament for sure. If you have found yourself faced with this situation and would like to schedule a personalized review of your unique situation and what options you might have available to you connect with us here.

Media Creates Unnecessary Fear

Have you ever heard the saying, “Don’t believe everything you read, see, or hear.” This statement couldn’t be more true. Media has fabricated fear surrounding the housing market that has people fearful of making any move and unsure of what to believe. You probably have been bombarded with headlines promising a housing crash or that home prices will fall by 20%, yet neither of those things came true. Regardless, the stories blemished your confidence just enough to keep you holding off just a little bit longer. Co-Founder and Chief Data Officer of Parcl, Jason Lewris articulated it perfectly saying:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

This increasing fear leads to decreasing housing inventory because people who would otherwise make a move are now hesitant to do so. The market is not doom and gloom though. Even if the headlines say that they are. Our realtors can help you decipher the facts from the fiction and help identify opportunities in your unique situation. If you are not currently working with an agent and would like to be connected with one, connect with us here.

Why This Should Matter to You

You might be wondering why any of this matters to you. The answer differs for both buyers and sellers and can vary depending on your personal situation. Talking with an agent is the best thing you can do. However, we will offer you an overview.

If you are a buyer:

Due to the limited number of homes available on the market you will need to seriously consider all of your options. Keep an open mind to different locations and housing types. A skilled professional will help you explore all of your options and what is available to you to help you find the home that best fits your needs. If you are not currently working with an agent and would like to be connected with one of our trusted realtors click here. Our agents will help expand your search and determine a solution that best fits your needs.

If you are a seller:

This market actually benefits you more than you might realize. The low housing inventory means that your home wont get lost amongst the other homes. Your home will stand out in this market. Connect with your agent to discover why it is especially worth your while to sell in todays housing conditions.

At the end of the day, low housing supply is not a new challenge. Both long-term and short-term factors have contributed to the inventory deficit we are experiencing. If you are considering making a move, let’s talk. Regardless of whether or not you decide to buy or sell you have an expert on your side and will have made an educated decision best for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link