Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Why you should NOT wait to list your house right now

As the year comes to an end, we recognize a trend where homeowners are motivated to make the move and finally get into a home that complements their changing lifestyles. It is clear that homeowners have begun to understand the benefits of today’s sellers’ market. With record-breaking home price appreciation, growing equity, low inventory, and competitive mortgage rates it makes perfect sense as to why.

To support this, take a peek at recent data from realtor.com that demonstrates a significant share of homeowners that intend to list their homes this winter.

What That Means for Homeowners:

That means more homes are about to hit the market increasing supply to be more in line with demand than we have recently seen. This means there will be more options for buyers to choose from when looking for their homes.

According to George Ratiu, Manager of Economic Research at realtor.com:

“The pandemic has delayed plans for many Americans, and homeowners looking to move on to the next stage of life are no exception. Recent survey data suggests the majority of prospective sellers are actively preparing to enter the market this winter.”

If you are thinking about waiting till the spring to sell your house, keep in mind that your neighbors might be one step ahead of you and sell this winter. If you want to stand out from the crowd, this holiday season is the best time to make sure your house is available for buyers. Here’s why.

Sellers Are Still Firmly in the Driver’s Seat:

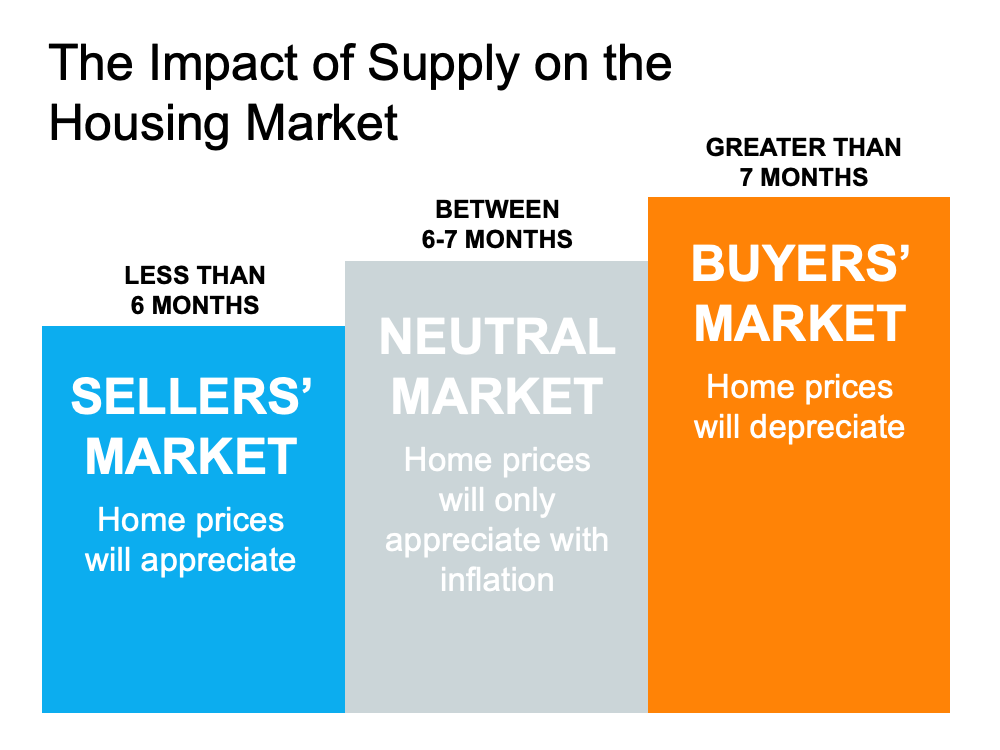

Historically, a 6-month supply of homes for sale is needed for a normal or neutral market. That level ensures there are enough homes available for active buyers (see graph below): The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the inventory of houses for sale sits at a 2.4-month supply. This is well below the 6-7 months supply needed for a neutral market.

The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the inventory of houses for sale sits at a 2.4-month supply. This is well below the 6-7 months supply needed for a neutral market.

What Does That Mean for You?

When the supply of homes for sale is as low as it is today, it is more difficult for buyers to find homes to purchase. This drives up competition among buyers, who then submit increasingly competitive offers to win out against others in the home search process. As this happens, prices rise and your leverage as a seller rises too, putting you in the best position to negotiate a contract that meets your ideal terms.

The low housing supply we are currently facing will not be solved overnight. Sellers this season should act quickly to maximize their potential. The data demonstrates that, with more prospective sellers planning to list their homes this winter, selling sooner rather than later helps your house rise to the top of a holiday buyer’s wish list so you can close the best possible deal.

Bottom Line:

Listing your home over the next few weeks gives you the best chance to be in front of buyers competing for homes this holiday season. Let’s connect today to discuss how you can benefit from today’s sellers’ market. Email us here.

The Search for Equestrian Property

Buying property suitable for horses is no small task. It is certainly not the typical home buying experience. There is so much to consider from what kind of property best meets the needs of your horses to what kind of home will best meet your wants and needs. Speaking from experience, the horses’ needs are typically the priority.

Working with an experienced Equestrian Advisor/Realtor will also help ensure your home search and purchase go as smoothly as possible. You can find one here.

The Property has Acreage: Is it Suitable for Horses?

Any Equestrian Advisor/Realtor will be the first to tell you that, just because a property has plentiful acreage does not mean it will be a suitable property for your horses. The best property will be flat to gently sloped with good drainage, open areas with grass for grazing, with few trees, and wet areas. Horses weigh 1000 to 1500 pounds on average, which puts a lot of weight on the ground. Therefore, horses can do a lot of damage in a short amount of time.

The priority is finding an Equestrian Property with useable land – meaning not acres of unusable gullies, steep edges, or too many bodies of water. More land doesn’t necessarily mean it is better, the useability is the priority.

Amenities:

Housing horses and livestock on your property can be done with ease with a few convenient amenities. It is important to consider these amenities as they add value to the Equestrian Property:

- Barn – Does it have an adequate number of stalls for your needs and the right size for your type of horse? Horse stalls can measure from 10 x 10 to 12 x 12 or even larger. Does it have the capability to increase the size of the stall to make foaling stalls? Are the stalls matted? Are there runouts (sacrifice paddocks) off the stalls?

- Hay Storage – What style is the barn? If it is a Monitor style barn, does it have a hayloft? How much hay can be stored in the hayloft? If there is no hayloft, is there adequate storage for hay elsewhere?

- Tack Room – Does the barn have a tack room? If so, is it insulated? It is important to be able to store tack, brushes, and other items in the tack room without them getting damp and moldy.

- Tack Area and/or Wash Bay – While one can do without this amenity it sure is a bonus to have it.

- Quality and Safe Fencing – Fencing can be quite costly (please watch for our future blog on fencing). It adds a lot of value to an Equestrian Property to have good quality and safe fencing. Equally important is how well it is laid out on the property. Is the property fenced and cross-fenced?

- Arena (Indoor and/or Outdoor) or Training Round Pen with good footing – It is a huge bonus to find a property with an arena, especially an indoor arena. Indoor arenas are getting increasingly more difficult to get approval to build and depending on the size can cost well over $100,000 to build. Outdoor arenas are great but have their challenges. It becomes difficult to manage the footing due to weather. Footing in the arena is something to really consider. Each discipline has its own preferences for footing type and depth. But any equestrian will agree that poor footing can cost you a lot – cause lameness in your horses resulting in expensive vet bills and not to mention the time to rehabilitate the horse from injury.

- Water source and location of water on the property. Are there ample spigots to the pastures/paddocks and arena?

- Electricity – Does the barn have electricity running to it?

Your Routine:

Transitioning to an Equestrian Lifestyle is a big adjustment. Make sure you are taking your daily routine into consideration when looking at properties. Consider the layout of the Equestrian Property. Does it seem that your daily routine will be seamless i.e., bringing horses in and out from pasture/paddocks to the barn? Are there turnouts off the barn that make it easier on your daily routine? Where is the manure kept? Ultimately, as an Equestrian, you want to be able to leave your property and know that your horses will be safe and sound while you are away.

Barn(s) and Outbuildings Should be Inspected Too:

You have found your Equestrian Property. It will cost you extra, but it is important to have your inspector inspect the Barn(s) as well as the Outbuildings. Your horses are part of your family, and you want to make sure that they will be safe in their surroundings. It is important to have a professional evaluate the Barn and Outbuildings for structural issues, electrical issues, or other potential problems.

Zoning Regulations:

Do not assume that the property is an approved horse property just because the owners or prior owners have had horses on the property in the past. Part of the Inspection process will be to do a little research with local city, county, and/or HOA regulations for agriculture and livestock. Do not let this lack of research cut into your dreams of owning an Equestrian Property.

Let us help you make your dreams of owning an Equestrian Property a reality:

To be honest this is all just the tip of the iceberg when searching for an Equestrian Property. It helps to have someone working for you that has done this before. Let’s get you connected. It would be an honor to help you make your dreams a reality.

Fort Casey Forts

Standing tall along the western coast of Whidbey Island, these 10” barrel guns tell the story of a relationship to the United States Department of Defense that began long before any plane took flight. At the time of its construction in the late 1800s, Fort Casey was a military marvel. Part of the “Triangle of Fire,” this military outpost was one of many strategically placed along the Puget Sound as the first line of defense against aquatic attack. Unfortunately, this magnificent fort’s usefulness was short-lived. By the 1920s Fort Casey’s impressive disappearing guns had already become obsolete and in 1956 the property was purchased by Washington State Parks and Recreation. Today, this fort is one of the most frequented state parks in Washington and a deeply embedded part of Whidbey Island culture.

Check out the rest of Whidbey’s beautiful destinations from this series here.

Things to do Today to make you a Homeowner Tomorrow

As the gap between the cost of rent and the cost of a mortgage continues to close, we see an increasing number of renters interested in buying. But how can renters make the transition to owners?

The purpose of this article is to help renters implement three critical changes today to help them successfully purchase a home tomorrow. If implemented correctly, these changes will help renters overcome the feeling of never being able to purchase a home.

Start by talking with a local lender

Do your research. Find a trusted lender in the location you are planning to purchase your home. Why is it important to use a local lender? Each housing market is different depending on location. Despite the similarities in names, what might be happening in San Francisco may not be happening in San Antonio. It is important to talk to a lender that is not only familiar with but understands the current local market and can explain to you what it takes to become a first-time homeowner. Check out our full article here. Your trusted advisor can then look at your specific financial situation and make suggestions to help you navigate the local market, meet your specific needs, and discuss your available options. This conversation can help you build your timeline for when it is right for you to purchase. Having the right team of real estate and lending professionals on your side can help tremendously when planning for your first home. Together they can help you determine your goals, what you can afford, and help you get pre-approved when you are ready. Need help finding a lender? Click here.

Reduce your debt and build your credit

Your first step should be knowing your credit score and what it means. Check out this article here for more information on credit scores. According to the HUD, the average credit score of first-time homebuyers is 716. There are many online tools that can help you determine your credit score. If you don’t already know yours it would be advantageous for you to find out.

If you determine that your score is below 716, don’t freak out.

First, 716 is just an average which means that there are homeowners with credit scores both above and below that number. Knowing your score gives you a snapshot of how you are doing financially and helps you know how to adjust accordingly to reach your goals.

Second, there are numerous ways to increase your credit score BEFORE you apply for your home loan.

- HUD’s number one recommendation is to reduce your debt as much as possible. Start by reducing your current spending. This will not only help you have less debt, but it will also help you have more money to pay down your current debts. Start small, perhaps purchasing one less coffee a week or choosing water instead of the soda or martini. These small sacrifices now will add up to big wins later. We recommend TrueBill as an app that can help find hidden savings by canceling subscriptions you don’t use anymore or negotiating your existing subscriptions down. It can also help you develop and stick to a budget!

- Pay all your bills on time. Set up auto payments to avoid late payments.

- Use your credit card responsibly.

When you have your debt in a manageable place…

Start saving

It might already feel like you are barely making it. But it has been proven that setting aside even small amounts can make it possible for you to save for a down payment on a home over time. Having funds in savings is also taken into consideration when getting pre-approved for a home loan (See why getting pre-approved is imperative). You don’t always need a large down payment when buying a home but you will need a good house fund saved up for ongoing maintenance and repairs.

Many experts suggest using a hidden savings or a “sinking fund” when saving for your down payment. This is an “out of sight out of mind” savings account. Once money goes in you don’t take it back out till you are ready. Make sure you keep it separate from your emergency fund or your short-term savings for expenses. Set small attainable goals that make you feel accomplished rather than the large goal that might feel daunting and overwhelm you. Are you ready for the challenge?

See how long it takes the average person earning a medium-income in America to save for a down payment here.

In conclusion, get some professionals on your team by talking with a lender (ask your trusted Windermere Broker for recommendations) if you don't have an agent contact us here and we will get you connected, build credit, and start saving!

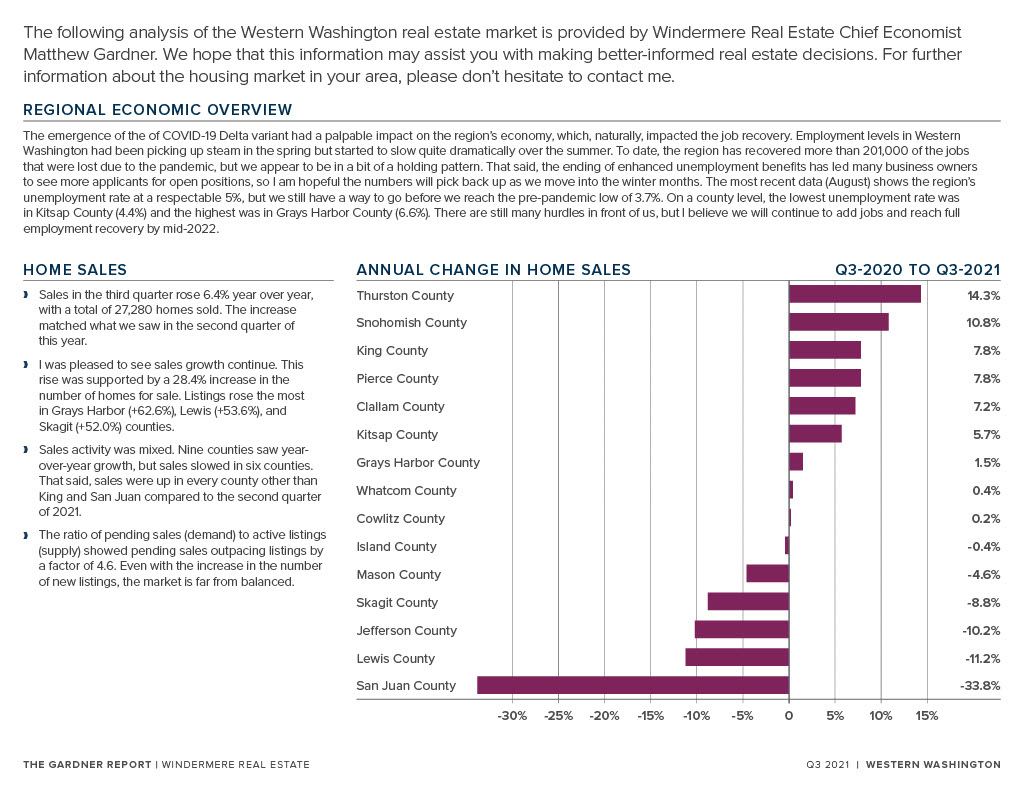

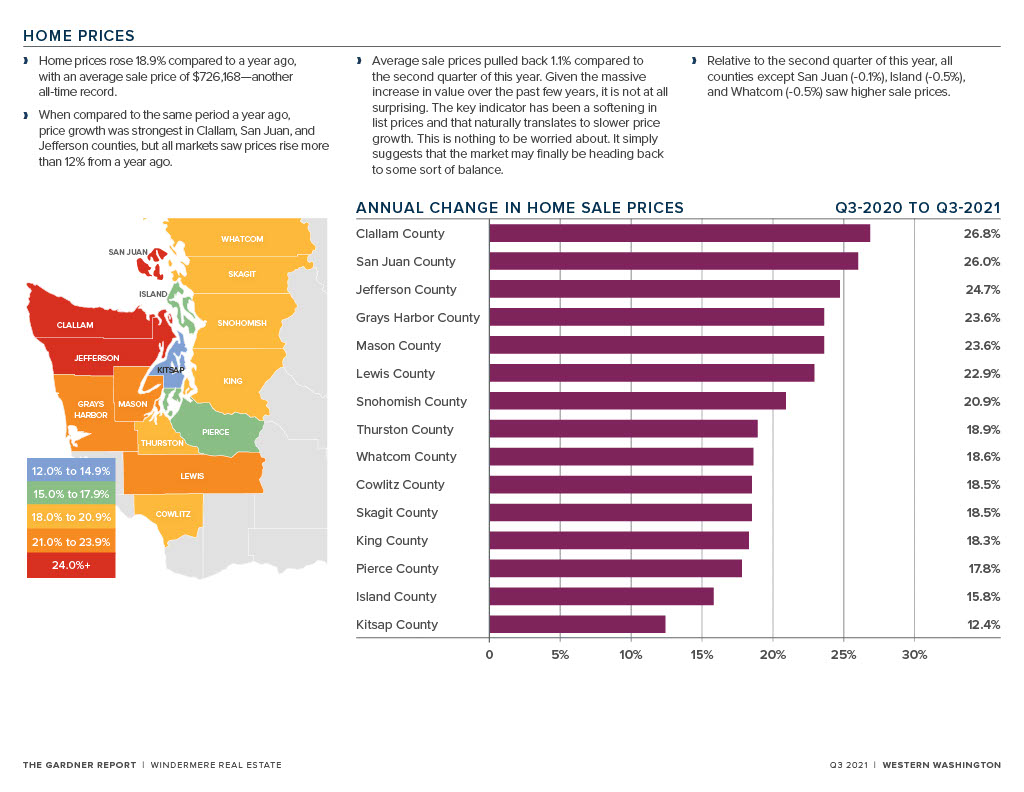

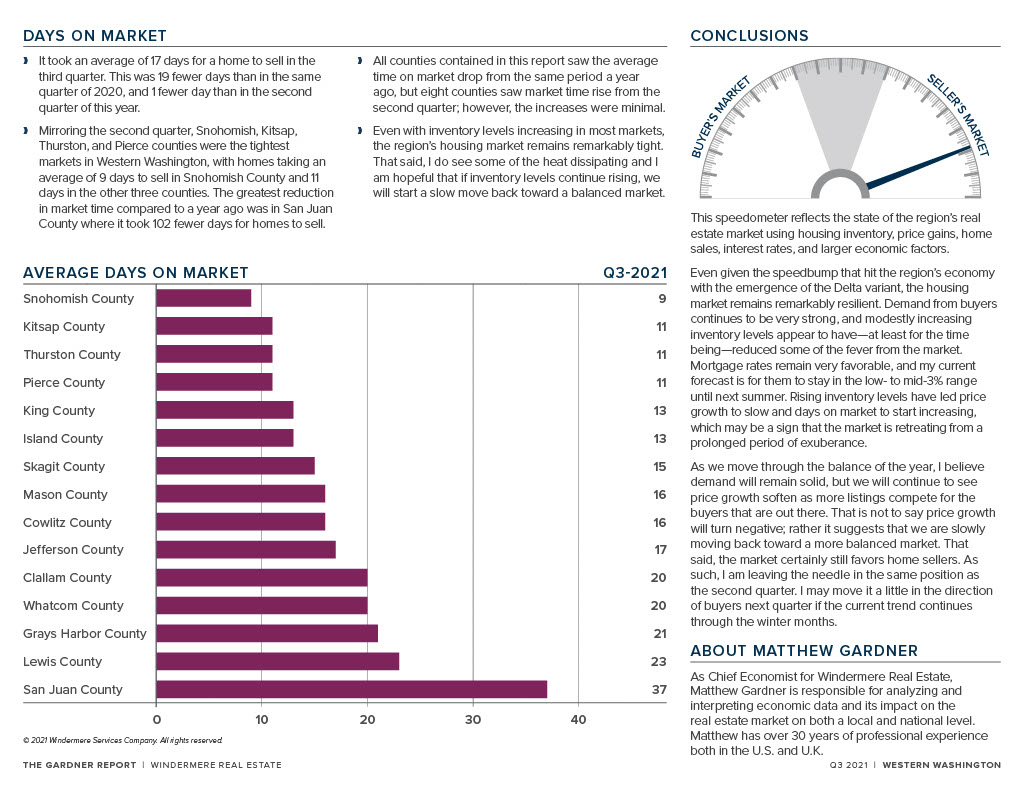

Q3, 2021 Gardner Report | Western Washington

Q3, 2021 Quarterly Stats

Q3, 2021 – Quarterly Stats by Windermere Whidbey Island

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link