We are NOT in a Housing Bubble: Here’s Why!

Home buyers are beginning to believe we are heading into a housing bubble. It is easy to acknowledge this premonition, as year-after-year home price appreciation has continued to remain in the double digits.

However, we are here to put your mind at ease as this market is very different than it was during the housing crash 15 years ago. Follow along as we explain four fundamental reasons why today's market is nothing like the market was back then.

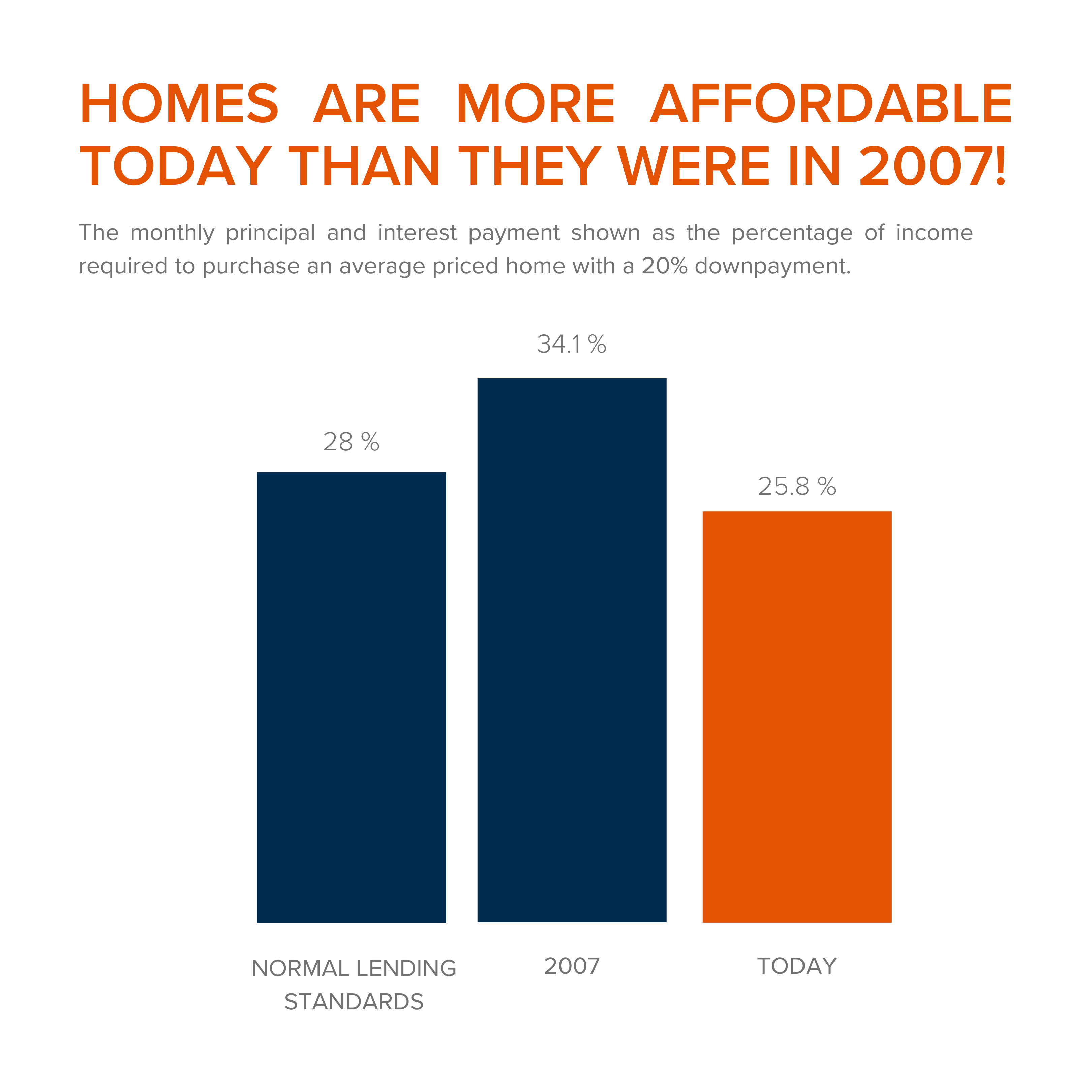

1. Houses Are Affordable Unlike During the Housing Boom

To understand this, one must understand the affordability formula. The affordability formula consists of three parts: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time of purchase. Conventional lending standards suggest a purchaser should spend no more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. While today's home prices are high, wages have increased significantly, and despite the latest spike, mortgage rates are still well below 6%. This means that todays average buyer spends less of their monthly income toward their mortgage payment than buyers did back then.

In the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta speaks to this stating, "The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward."

Undeniably, affordability is not as strong as it was last year, but it is significantly better than it was during the boom. The graph below demonstrates that difference:

How did so many homes sell during the housing boom with such prohibitive costs?

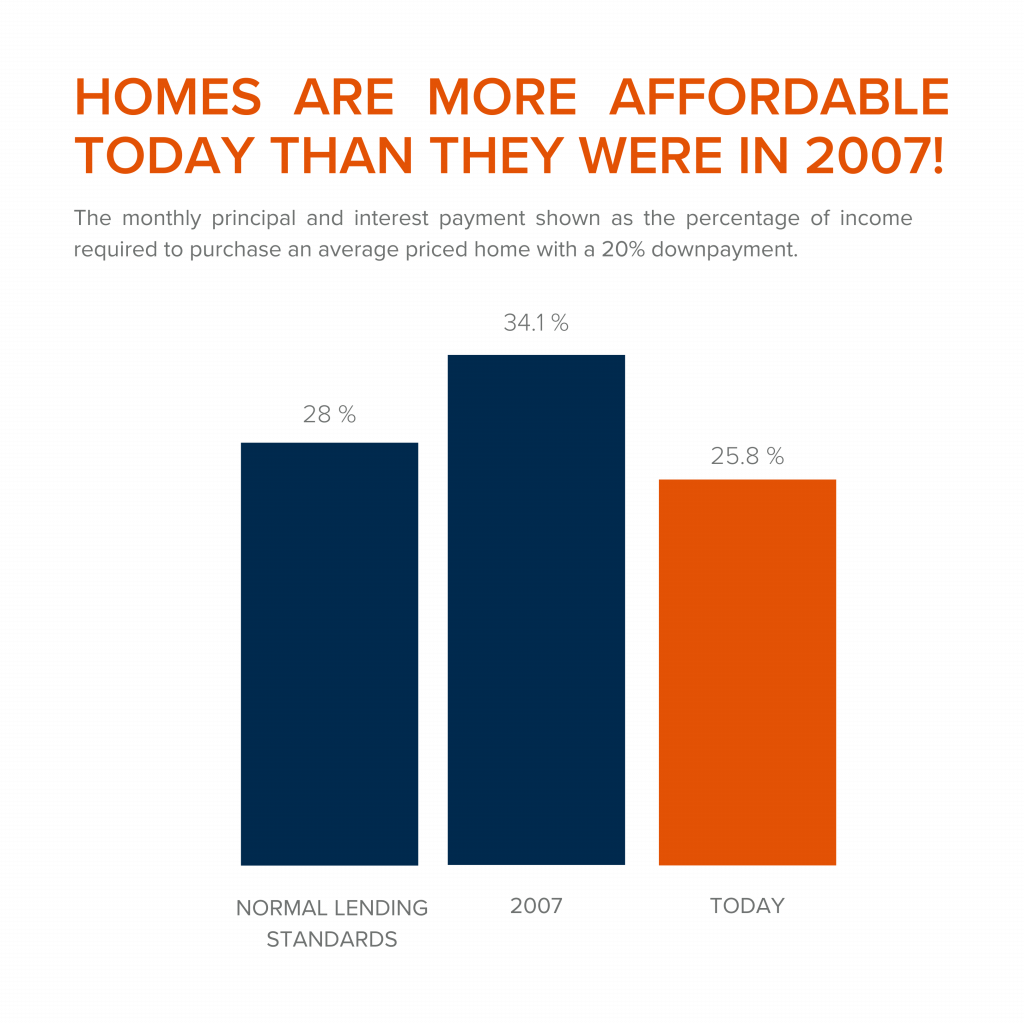

2. Mortgage Standards Were Much More Relaxed During the Boom

Getting approved for a mortgage loan was significantly more attainable during the housing bubble than it is today. According to credit.org, a credit score between 550-619 is considered poor. They define those with a score below 620, by stating that, "Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk."

While buyers can still qualify for a mortgage with a credit score within that range they are considered riskier borrowers. If you are in that range, read our How Long Does it Take to Save for a Down Payment article here. Below is a graph illustrating the mortgage volume issued to buyers with a credit score less than 620 during the housing boom, in compression to the following 14 years.

Mortgage standards are significantly different than they were last time. Buyers that obtained mortgages during the past decade are better qualified for the loans. Lets look at what that means moving forward.

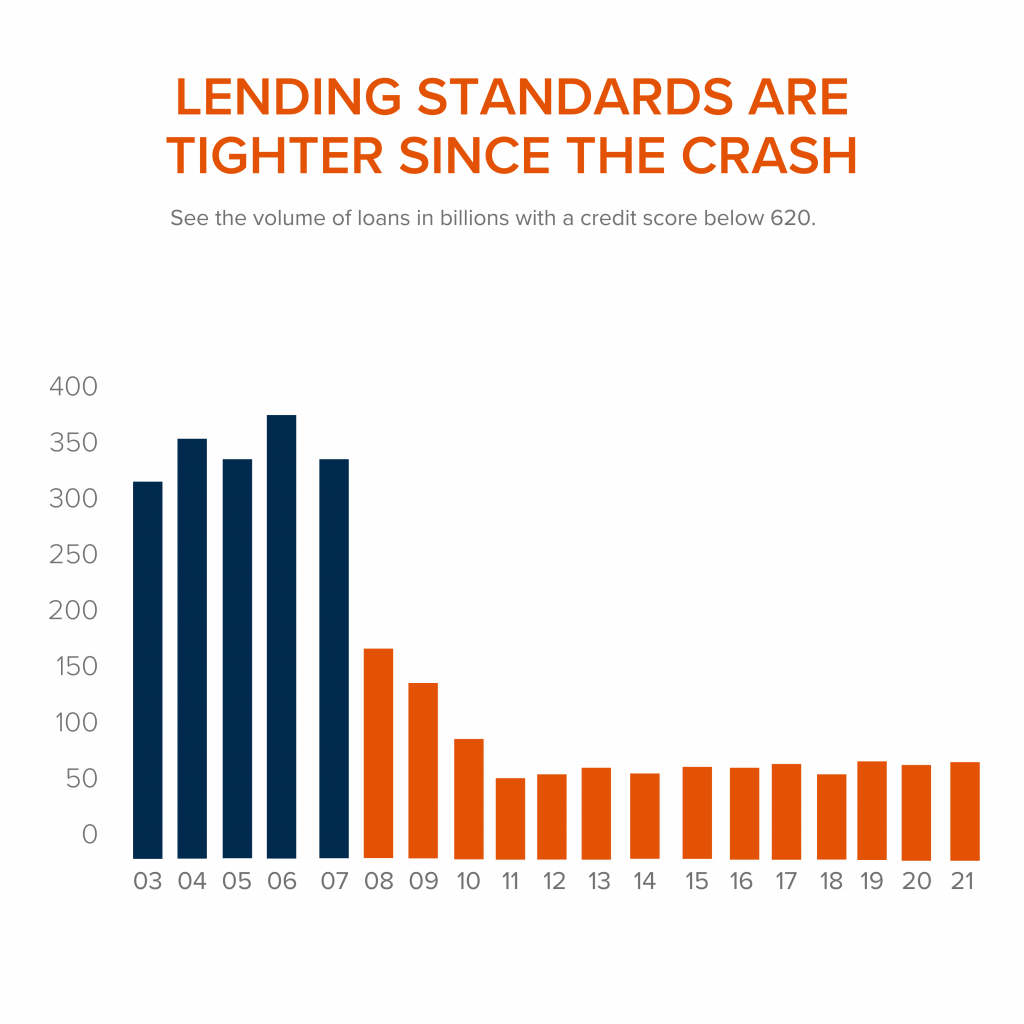

3. Foreclosure Are Completely Different Than They Were During The Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

Undoubtedly the 2020 and 2021 numbers are impacted by the forbearance program, which was created to help homeowners facing uncertainty during the pandemic. Keep in mind, there are less than 800,000 homeowners remaining in the program today, and the majority of those will be able to work out a repayment plan with their banks.

Rick Sharga, Executive Vice President of RealtyTrac, explains, "The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure' narrative was incorrect."

Why are there significantly less foreclosures seen today? Well, homeowners today are equity rich. They are not tapped out.

During the build-up to the housing bubble, some homeowners were using their homes as personal ATM machines. We saw a plethora of people withdrawing their equity the moment it was built up. When home values began to fall, many homeowners found themselves in a negative equity situation where the amount they owed on their mortgage had surpassed the value of their home. Many were faced with the decision of walking away from their homes. When that happened it led to a rash of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of comparable homes in the area.

Homeowners, have since learned their lessons. Prices have risen nicely over the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like they had previously, as indicated by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now standing at $300,000. What happened last time will not happen today.

As the latest Homeowner Equity Insights report from CoreLogic explains, "Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they've also enabled many to continue building their wealth."

There will be nowhere near the same number of foreclosures as we seen during the crash. What does that mean for the housing market today?

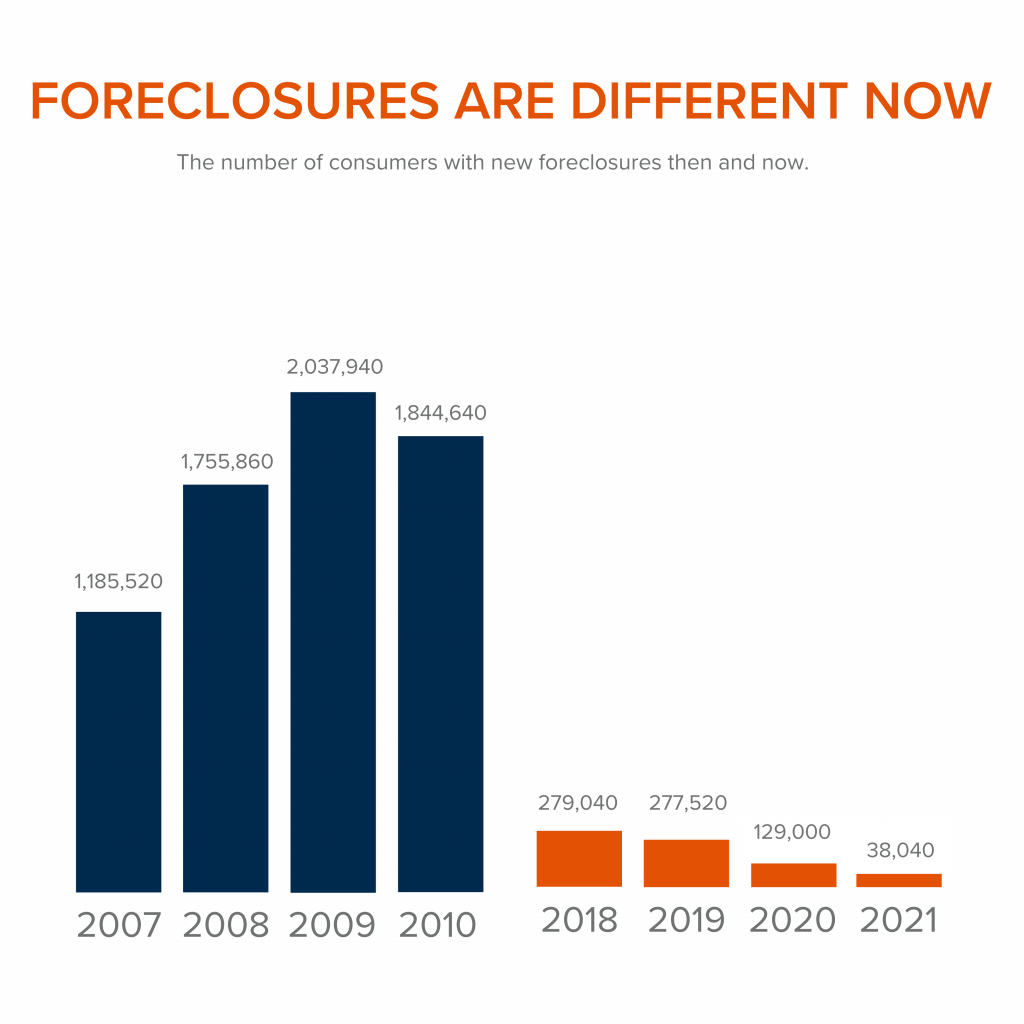

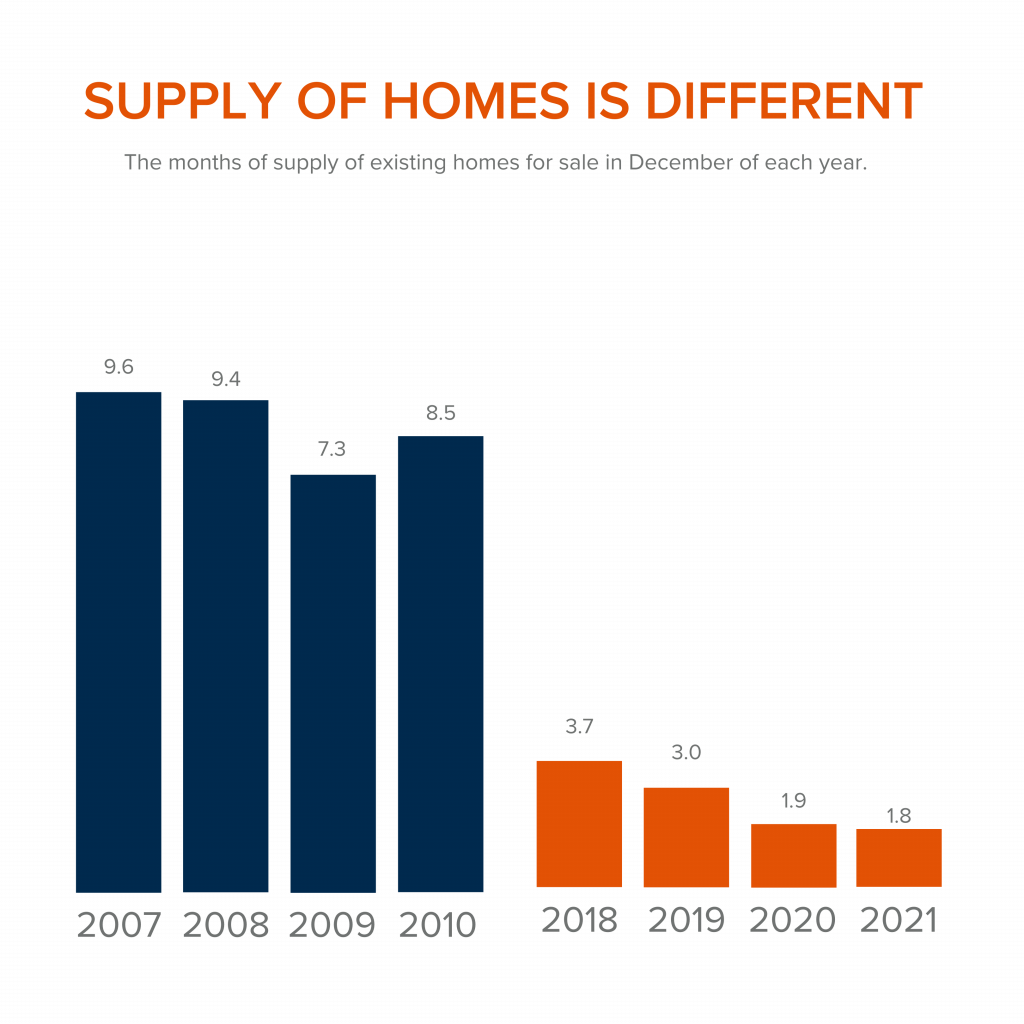

4. There is Not a Surplus of Homes on the Market – We Have a Shortage

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. The following graph demonstrates, the surplus of homes for sale between 2007 to 2010 (many of which were short sales and foreclosures). That caused prices to tumble. Today, there is a shortage of inventory, which is creating the increasing home values we are witnessing today.

Inventory is drastically different in comparison to last time. Prices are rising because there is a healthy demand for homeownership while at the same time there is a shortage of homes for sale.

At the end of the day,

if you are worried that we are making the same mistakes that led to the housing crash, the graphs above show data and insights to help alleviate your concerns. If you are considering buying or selling and would like to dive deeper into this subject we would be happy to schedule a consult with you. Call us today at 360.675.5953.

Penn Cove Mussel Rafts

Gracing the waters of Penn Cove floats a particularly unique & quite famous feature of our island. Wood & rope intertwine to create seemingly countless rafts bobbing on the waves above and creating magic below… You may not know this, but Island county is home to the oldest & largest mussel farm in the United States. Penn Cove Mussels, Inc. began culturing mussels in 1975 with the desire to harness the cove’s naturally nutrient-rich water to harvest bigger and better mussels than the ones currently available on the market. The results were incredible! Penn Cove mussels grow at a remarkable rate, enabling the mussels to reach harvest size within one year. This rapid growth rate causes Penn Cove mussels to have a firmer texture, sweeter flavor, and a thinner shell with more meat. These crowd-pleasing mussels are a favorite of chefs all over the country and with only two hours separating Penn Cove from the Sea-Tac Airport; mussels harvested in the morning are easily on dinner plates in Houston by the evening. To read more about this local aquaculture visit our blog here.

Follow the photographer on Instagram @abhithapa.art

Check out the rest of Whidbey’s beautiful destinations from this series here.

Annual Report 2021

Racial Discrimination in Real Estate

This room might seem simple to you, but to me, it marks the saddest day in my career. 💔

This picture was taken shortly after I had finished staging one of my client’s homes. I wanted to show the owners all I had done – admittedly looking for a pat on the back. Although I was showered with compliments for almost every other room in the home (all boho-themed to my aesthetic), I was given an off-putting request when they saw this photo.

This picture was taken shortly after I had finished staging one of my client’s homes. I wanted to show the owners all I had done – admittedly looking for a pat on the back. Although I was showered with compliments for almost every other room in the home (all boho-themed to my aesthetic), I was given an off-putting request when they saw this photo.

“Can you remove the painting?”

Having fallen in love with this painting months ago, I was fairly disappointed and a bit taken back by the request. I decided to inquire about the reasoning behind the request and my client’s response broke my heart into a million little pieces.

“We are afraid we’ll get less money if people know we’re Black.”

I was speechless.

In an attempt to comfort my clients and resolve the issue I made the mistake of saying ignorant things such as “that’s not as prevalent on the west coast” and “it’s just art, it won’t tell people who you are.” Ultimately though, the panting came down and was replaced by a lovely little beach scene.

Recently I was reminded of this interaction in the most heartbreaking way. In December of 2021 residents of San Francisco, California filed a lawsuit against their appraiser whose estimated value of the home came in nearly half a million dollars less than market value. After removing their family photos from the home and having it re-appraised it was clear that this discrepancy was in no small part due to the family’s race. You can read more about the story here.

My client was right. The fight is nowhere near over.

The real estate industry has a long and troubling history when it comes to the struggles of racial divide in America. In many ways, the housing industry served and serves as a stronghold for preserving racial discrimination long past the judicial end of segregation. In Richard Rothstein’s book The Color of Law, he delves into the multitude of ways in which the real estate industry fought to preserve racial segregation using subversive tactics that appeared innocent. By discreetly elongating the effects of racial segregation within the housing industry, the inability for people of color to obtain reasonable homes helped to widen the American wealth gap further than anyone thought possible.

How could the housing industry make such a profound impact on the financial prosperity of America’s minorities? The answer to this question is LONG and although I am not a professional economist, I can give you the two biggest reasons.

Real Estate is the Best Source of Generational Wealth

It is no surprise to anyone that land is one of, if not the most, finite resource we have in this world. Sure, there are always going to be those few who talk about building an underwater civilization or creating an outpost on Mars. However, if we are to assume that we do not live in a Syfy film – what we got is what we got. This means that real estate is one of the most secure investments you can make. Without the ability to create more supply and the fact that it is a basic necessity for all humans, the value of property really has little way to go other than up. This makes it a major player when it comes to building generational wealth.

A home is a unique asset in the fact that it not only provides vital accommodations to its owners but also greatly increases in value through the years and can be passed down from generation to generation. On top of that, those who own homes can withdraw equity from those homes to re-invest and grow that wealth even further.

This asset was withheld from minorities for multiple generations through the process of redlining while being generously provided to their Caucasian counterparts. By excluding minorities (especially the Black community) from the ability to build this kind of compound wealth, the prospect of even being able to buy into the investment grew further and further away with every increase in market prices. By the time segregation and redlining “ended,” the ability for minorities to purchase a suitable home was already too far gone and it would take more than just a few generations to close the gap.

Housing Taxes are Connected to Education

One of the cleaver and subversive ways in which the housing industry was able to sustain discrimination in real estate and the wealth gap was through intertwining housing taxes with access to education. By excluding minorities from suitable housing which was projected to rise in value at a far greater rate, early real estate developers were successfully able to ensure educational discrepancies between the two communities.

In exclusively Caucasian communities where home values greatly exceed their minority counterparts, schools were well funded through the taxation of those higher valued properties. As a result, the children of those communities were granted better educational programs, higher paid and more competent teachers, as well as better recognition from potential universities. Later in life, this would result in better and higher-paying jobs for the children of those exclusively Caucasian communities.

In contrast, the home systematically set aside for minority communities did not come close to meeting the values of their Caucasian counterparts. The result of this was that children raised in these communities would have fewer educational programs, poorly paid teachers, and would often have a “black mark” on their college applications due to their school’s reputation. As adults this lack of suitable education would result in working lower-paying jobs – only greatening the wealth divide.

Unfortunately, minorities today still face discrimination through illegal real estate practices such as steering and, as we saw with the San Francisco family, discriminatory appraisals. For people like me, it can be easy to think such things as “that’s all in the past” or “minorities can’t possibly still be affected by this.” However, it is through the fear in my client’s eyes as they looked at that beautiful painting that I see the truth – this battle is so far from over.

I am grateful, however, to work with Windermere Real Estate in fighting this injustice within our industry. In 2020 Windermere heard the call for equality and chose to answer. Windermere is one of the few Real Estate companies in the nation that have chosen to hire a consulting agency to help them promote Diversity, Equity, and Inclusion within our industry. Step-by-step they are helping their brokerages learn what it truly means to be inclusive and how we can all help to close the gap.

You can help too! Windermere Real Estate is partnering with HomeSight to increase Black homeownership in Washington state through what they are calling the “Hi Neighbor” fund. Through this fund, HomeSight is bridging the affordability gap for Black homebuyers so that they can increase their purchasing power. Starting in 2022 I will do my part by giving a portion of every commission I make to the fund. To learn more about this fund and to donate, click here!

This beautifully written article was submitted by our very own, Victoria Paris to discover more articles written by our agents click here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link