Expedite the Loan Process

Knowing what to expect not only calms your nerves but also expedites the lending process.

During your search for a lender, you will discover that most lenders will sincerely work on your behalf to help you attain the financing needed to quickly get you into the home you have chosen.

Your chosen lender will guide you through the process and shed light on the documents you need to prepare as well as provide you with the various options available to you. Talking to a lender well in advance about your goals and your financial situation will better prepare you for home ownership. The journey is different for everyone. We cannot stress enough how important it is to talk to a lender early on. The lender can help you determine a realistic timeline and address any problems early on to prevent a problem from arising later that could cost you your dream home.

To expedite the loan process come prepared with the following documentation.

- Your most recent pay stubs (this should be computer generated and include the YTD earnings and deductions).

- Last two years’ W2s.

- Two years’ tax returns.

- Copy of your valid U.S. picture ID (bring the ID with you)

- Two months’ bank statements for all your accounts (must include the date, name, and account numbers)

- Last two statements for asset accounts such as IRA, 401K, investment, ect.

- Contact information for whom you anticipate getting your home insurance. (Connect with us if you need help finding home insurance companies)

- If applicable, bankruptcy documentation including discharge paperwork

- If applicable, a divorce decree and/or child support court order

What if I’m self-employed?

If you are self-employed it is of the utmost importance for you to speak with a lender as soon as possible if homeownership is on your wish list.

You will need to come prepared with things like the last two years of Business Tax Returns and if possible, a letter from your CPA detailing at the very least two years of self-employment with a continued positive outlook for your business.

To help you get started with your search check out Guild Mortgage, Peoples Bank, and Home Bridge for a few lenders here on Whidbey Island. Don’t forget to check out our Neighborhood Guide when you are ready to start looking for your dream home on Whidbey.

We hope this was of help to you. If you need help connecting with a lender, send us a message here. If you are ready to start speaking to an agent about the next steps let us know you are ready to start looking in a message to us here.

VA Home loans help Veterans Reach The American Dream

VA Home loans help veterans reach the American dream.

If you or a loved one has served in the military this article is meant for you.

It is important for you to not only know that there are Veterans Affairs (VA) home loans available to you, but also understand the program, its purpose, and the benefits available to you at its fullest.

Follow along as we break it down into bite-size pieces so that you can be best prepared for the purchase of your own home.

UNDERSTAND THE PROGRAM

Veteran Affairs home loans provide millions of veterans the ability to purchase their own homes. They have been providing these types of loans over the past 78 years.

To be eligible for a VA home loan one must be an active service member, a veteran, or an eligible surviving spouse.

UNDERSTAND ITS PURPOSE

The U.S. Department of Veterans Affairs wants to say thank you for serving by making homeownership a real possibility for those who have dedicated their lives to serving our country. They have made it their mission to serve you by providing home loan guarantee benefits in addition to other housing-related programs that assist you in buying, building, repairing, retaining, or adapting a home for your own personal use.

UNDERSTAND THE BENEFITS

Some of the major benefits of using a VA home loan is that most eligible borrowers can purchase the home with NO DOWN PAYMENT! That means you don’t have to save up to buy your own home and you are not penalized for not having a down payment. Typically, most other loans that have down payments below 20% require what is called Private Mortgage Insurance often referred to as PMI. This is an additional monthly fee tacked onto the mortgage that can be removed once you’ve reached 20% of the mortgage. How does this benefit you? You have an overall reduced monthly cost. In addition, VA loans offer competitive terms and mortgage interest rates.

The Executive Director of the Department of Veterans Affairs Loan Guaranty Service, John Bell, recently described the strength of the program by saying:

“It provides early ownership for many people that would not have that opportunity to begin with. Since there’s no down payment, it allows people to hold their wealth and it gives them the ability to have long-term financial security by being able to own a house and let that equity grow.”

Our veterans sacrifice so much during their service to our nation. One way we thank them is to ensure they have the best information about the benefits of VA home loans. Thank you for your service. If you are considering using your VA home loan and wish to speak with an agent, please connect with us here or email us at Whidbeycommunications@windermere.com.

How Long Does it Take to Save For a Down Payment?

Saving enough money for a down payment on your first home can be one of the biggest obstacles to homeownership. Depending on your circumstance you might need anywhere from 3% – 20%. Speaking with a reputable local lender will help you find out exactly what your percentage will be.

But how long should it take, you ask!?

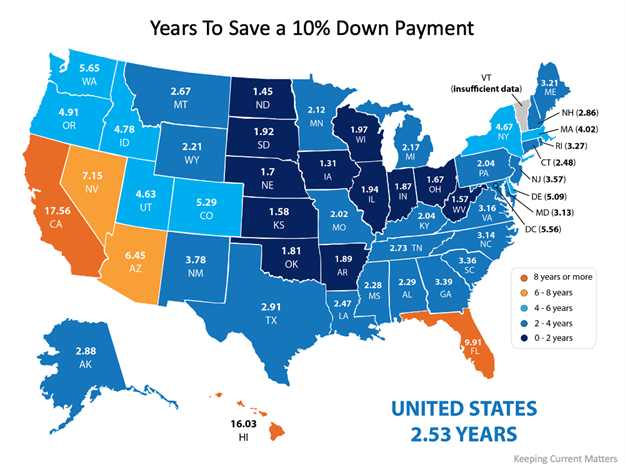

Follow along as we estimate the amount of time it takes a person earning a median income and paying a median rent to save up for a down payment on a median-priced home.

To accomplish this task we use the concept that homeowners should pay no more than 28% of their total monthly income on housing expenses. We use this information in combination with data from the U.S. Department of Housing, Urban Development (HUD), and Apartment List to determine our estimation.

According to the data pulled, the national average for the time it would take to save for a 10% down payment is roughly two and a half years (2.53). Looking at the diagram below you can also see that those living in Iowa can save for a down payment in as little as 1.31 years while those in California could take 17.56 years. The map below can help you determine the amount of time (in years) it can take for you to save in your state:

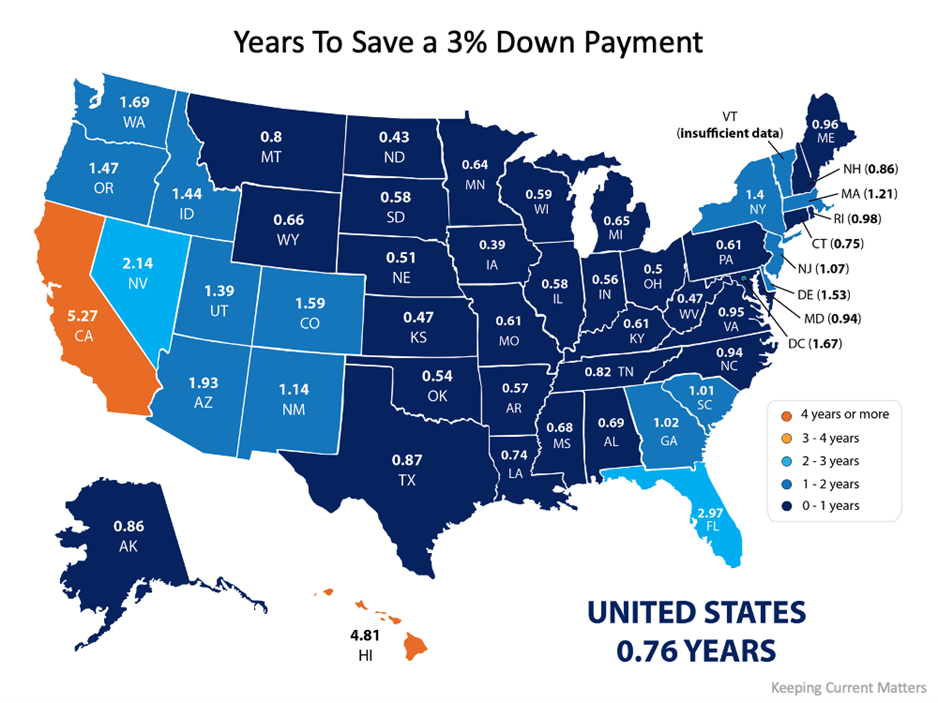

What if you only need to have a 3% down payment?

It is a common misconception that you need to have a 20% down payment to buy a home.

The reality is there are reasonable alternative options out there. First-time home buyers have an advantage with a plethora of down payment assistance programs available to them. You just have to find the right lender and ask. Need help finding a lender? Ask us to connect you with one here.

What if you qualify to take advantage of one of the 3% down payment programs?

If you qualify for a 3% down payment program, then you only have to come up with 3% of the total cost of the home at closing instead of ten or the typical 20% we have seen required in the past. Saving for a 3% down payment might not take you very long. In fact, it could take less than a year in most states, as shown in this map here:

At the end of the day

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Connect with us to explore the options available to you in our area and how they support your plans for buying a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link