Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

The Orchestra of Real Estate

Have you ever wondered who all is involved during a real estate transaction? If so, follow along as we discuss the orchestra of Real Estate. Keep reading as we share how Realtors coordinate the players in every transaction.

In the world of real estate, orchestrating a successful transaction is akin to conducting a symphony. Behind the scenes, an ensemble of professionals comes together, each playing a vital role in bringing the deal to fruition. At the helm of this operation is the realtor, the conductor, who ensures that every note is played in harmony. Let’s take a closer look at the diverse cast of characters involved in a real estate transaction and how the realtor orchestrates their collaboration to create a seamless experience for buyers and sellers alike.

Staging Professionals:

Staging professionals specialize in enhancing a property’s appeal by arranging furniture, decor, and accessories to showcase its potential. Their expertise creates an inviting atmosphere that resonates with buyers and helps them envision themselves living in the home.

Photographers:

Photographers capture the essence of a property through stunning visuals that attract potential buyers. Their images highlight the property’s best features and create a compelling first impression in marketing materials.

Sign Companies:

Signage is a critical component of marketing a property, both online and offline. Sign companies design and install signs that grab attention and direct interested buyers to the property, increasing visibility and exposure.

Marketing:

Marketers develop comprehensive strategies to promote properties through various channels, including digital advertising, social media, and print materials. Their efforts ensure that listings reach the widest possible audience and generate interest from potential buyers.

Transaction Coordinators:

Transaction coordinators serve as the backbone of the transaction, managing paperwork, deadlines, and communications between all parties involved. They keep the process on track and ensure that nothing falls through the cracks.

Lenders:

Lenders provide financing to buyers, enabling them to purchase properties. They evaluate borrowers’ financial qualifications, underwrite loans, and facilitate the transfer of funds at closing. To learn more about the importance of using a local lender click here.

Title & Escrow:

Title companies conduct thorough searches to verify property ownership and facilitate the transfer of title from seller to buyer. Escrow agents hold funds and documents in trust until all conditions of the sale are met, ensuring a secure and transparent transaction. To learn more about escrows role in your transaction click here.

Insurance:

Homeowners insurance protects buyers against damage or loss to their property, while mortgage insurance protects lenders in case of borrower default. Both types of insurance provide financial security and peace of mind to parties involved in the transaction.

City Officials:

City officials play a pivotal role in the real estate process by ensuring compliance with local regulations and zoning ordinances. They oversee permits, inspections, and other administrative tasks that are essential for a smooth transaction.

Contractors:

Contractors are the craftsmen who bring properties to life through renovations, repairs, and improvements. From painters to plumbers, their expertise is essential in preparing a property for sale or addressing any issues uncovered during inspections.

Lawyers:

Legal professionals provide invaluable guidance on matters such as contracts, disclosures, and property rights. They ensure that all legal aspects of the transaction are handled correctly and protect their clients’ interests throughout the process.

In the intricate dance of a real estate transaction, every player has a role to play, and every role is essential to the symphony’s success. Behind the scenes, the realtor orchestrates this collaboration, ensuring that each element comes together seamlessly to create a harmonious outcome for buyers and sellers alike. As the conductor of this ensemble, the realtor’s expertise and guidance are invaluable in navigating the complexities of the real estate market and guiding clients towards their goals. If you are considering buying or selling and are not currently working with a Realtor, connect with us here.

Maximizing Your Purchasing Potential

When it comes to purchasing a home, understanding your buying power and strategically taking steps to enhance your position are key to maximizing your purchasing potential. Beyond just envisioning your dream home, it is crucial to recognize the numerical factors lenders consider when approving you for a mortgage. By strengthening the following key areas, you can elevate your financial standing and position and find success in a competitive housing market.

Strategies to Maximize Your Purchasing Potential

First and foremost, give yourself time to prepare. Change will not happen overnight. Be patient and give yourself grace. Create a list of attainable goals and make consistent efforts to reach them. Over time, you will see the difference. We suggest talking to a lender as soon as possible so they can help identify specific key areas unique to you. Overall, you can increase your buying power by preparing for a down payment, increasing your credit score, and reducing your debit-to-income ratio.

Prepare for a Down Payment

Before 1956, down payments needed to be 20% of the home’s sale price. In 1956, banks adjusted their regulations, permitting homebuyers to make down payments of less than 20%. There was a crucial condition attached to this change. Those who used this option would be required to make an extra monthly payment called private mortgage insurance (PMI). Essentially, PMI serves as a safeguard for the bank in case of default by the borrower. While 20% is not a requirement today, in fact, there are loan options as low as 0 down, there are significant advantages to putting 20% or more down.

Putting 20% down eliminates the requirement for the PMI fee, keeping more money in your pockets. Even more so, making a down payment of 20% or more distinguishes your offer. Doing so, makes it more attractive to sellers and potentially enables you to secure a reduced interest rate for your mortgage through negotiation.

Finally, the more money you put down upfront reduces your monthly mortgage payment and the overall amount of interest you will pay. This keeps even more money in your pocket.

Set aside funds each paycheck

Consider saving by earmarking a portion of each paycheck to bolster your down payment fund. You can steadily accumulate funds over time by setting a clear savings goal and allocating a consistent amount from each pay period. If you prefer a more structured approach, consider opening a separate savings account dedicated solely to your down payment savings. Sometimes, you yield higher interest rates with a savings account.

Explore alternative avenues to boost your income

If you have skills or interests beyond your primary job, consider seeking part-time or freelance opportunities to generate additional revenue. You can expedite your journey toward homeownership by channeling this extra income directly into your down payment fund.

Review your current spending habits

Commit to reducing excessive spending. Perhaps commit to one less meal out a week, make your coffee at home instead of from the coffee shop, or skip out on the big vacation this year to increase your down payment. Consider using one of the many money management apps like Rocket Money to help you with your spending and saving goals.

Increase Your Credit Score

Your credit score is a factor considered when applying for a mortgage. A higher credit score maximizes your purchasing potential by potentially reducing your interest rate. The lower your rate, the more purchasing power you have.

To boost your credit score, prioritize paying down outstanding balances on your credit cards. Prioritize those with high-interest rates. Avoid opening unnecessary new lines of credit and steer clear of significant purchases leading up to the period when you’re ready to make a home offer. Remember that student loans also affect your financial profile, so consistently making payments will enhance your overall credibility with lenders.

Reduce Your Debit-To-Income Ratio

Lenders not only look at your creditworthiness, but they also consider your debt-to-income ratio. How much money do you owe vs. how much you make. This is important because you must be able to afford the home you are buying, pay off your current debts, and have enough money for day-to-day living.

The front-end ratio

Lenders assess your ability to repay a mortgage by examining your housing ratio. This ratio represents the percentage of your monthly gross income that will be allocated to your mortgage payment. It is calculated by dividing your monthly mortgage payment by your monthly gross income. A higher ratio indicates a greater risk of default.

The back-end ratio

The back-end ratio plays a crucial role in assessing your financial health. It gauges the percentage of your monthly income allocated to debt repayment. Included in this calculation is mortgage payments, credit card bills, student loans, and other loan obligations. It is calculated by dividing your total monthly debt expenses by your gross monthly income. This ratio offers insight into your ability to manage debt responsibly and affects your loan eligibility.

Increasing your credit score, reducing credit card balances, and making regular, on-time payments toward your loans contribute to lowering your overall debt while enhancing your debt-to-income ratios. This positive financial behavior demonstrates your ability to manage debt responsibly. In turn, it strengthens your financial position and enhances your buying power.

These key factors are not the only aspects of purchasing a home but they play a significant role. We strongly suggest speaking to a trusted lender early on to get specific recommendations based on your unique financial situation. Remember, increasing your buying power is a lengthy process. Having a specific strategy is key to staying on track. Make an attainable plan so that when your dream home comes along, you are in the best financial position to make it your reality.

Connect with us to get the conversation started.

6 Reasons to Attend Open Houses

Some people wonder whether or not they should attend open houses. We believe open houses can be incredibly advantageous for both buyers and sellers. Follow along for 6 reasons why you should be attending open houses whether you are planning to buy or sell.

Get an idea of how your home compares:

If you plan to sell your home, visiting open houses in your neighborhood can give you a good idea of how your home compares to your neighbors. By visiting several homes, you can gauge the pulse on the neighborhood’s market by watching what the homes sold for, how quickly they sold, and how they compared to yours. This information can prepare you for what you can expect your home to sell for and give you a to-do list of things to get done before you list your home. If you have not connected with a real estate professional and would like to, connect with us here so we can recommend some.

Get a clear idea of what you want in a home:

If you are preparing to buy a home, it is a good idea to have a wish list of things you want in a home when you buy. Download our Wishlist Form Here. Fill it out before visiting Open Houses, then fill it out again after you have visited a few. Compare how your desires changed. Attending several Open Houses can give you a clear idea of what you want in a home. Perhaps you thought 1100 sq feet was enough room for you, but after experiencing it in person, you decided 1500 was more realistic for your needs. Or vice versa. Maybe you wanted 2300 sq ft, but after spending time in homes that size, you realized 1900 would be a better fit. You might have strong opinions about specific floor plans, garage sizes, number of bedrooms, or heating options. Find open houses in your area by clicking here.

Get a realistic idea of how much you will spend on a home:

You might have your heart set on a specific neighborhood or features in a home. Attending several Open Houses gives you a realistic idea of how much you will spend on what you want. You might find that you cannot afford everything you want in a home. It is best to first connect with a lender to determine how much you can qualify for with your circumstances. If you need help finding a suitable lender, contact us for recommendations. If you cannot afford everything on your wish list, you either need to refine your wish list or keep saving. A trusted lender can also help you determine which type of loan best fits your needs and help you develop a financial plan. So, connect with a lender as early as possible. You can find a few local to Whidbey listed here.

Imagine your life inside the home:

A recent study determined that roughly half of all home buyers experience buyer’s remorse when purchasing their home. Can you imagine feeling buyer’s remorse after making the biggest purchase of your life? You can avoid this by doing your research ahead of time. Attend Open Houses and refine your wish list till you know precisely what you want and need in a home. Visit several different-sized homes to have a realistic idea of what each square footage looks and feels like. Consider the different layouts and which ones feel most comfortable to you. When you are confident you know exactly what you want in a home, you can quickly and confidently make that decision. Therefore you can communicate effectively to your agent exactly what you are looking for in a home. A good agent will help you finetune your wants and needs and make sure you don’t buy something you don’t truly love. Don’t have an agent? Connect with us and we will pair you with a great one. When you find the perfect home you will know it is the right one for you and will feel confident in the purchase because you have done your research.

Get familiar with the neighborhood:

If your children have grown up and gone off to college, you might not like having a noisy community park up against your property. On the other hand, if you have small children, don’t wait till you have moved in to discover your kids are the only ones on the block. While visiting open houses in the neighborhood, ask the realtors about the neighborhood. Some good questions to ask are:

a. Is there an HOA?

b. What kind of amenities does the neighborhood have to offer?

c. Is there a school nearby?

Find an agent that is a good fit for you:

Whether buying or selling, attending open houses can also allow you to get to know agents in your area for when you are ready. If you don’t already have an agent and would prefer to connect with one, email us here: WhidbeyCommunications@Windermere.com.

We strongly urge you to check out homes in various price points, locations, and styles during this time. You might surprise yourself with what you imagined liking versus what you discover you want and don’t want.

Attending several Open Houses before you get serious about buying might be one of the best pieces of advice. Once you know you are serious about buying and what you are looking for, or if you prefer a more personal experience tour homes that meet your wish list criteria with your Realtor. Don’t have a Realtor? Let us connect you with one. Call us at 360.675.5953.

Click here to find our interactive Open House list for your area. If you have any questions, please don’t hesitate to connect with us.

Mortgage Rate Predictions and Misconceptions

Written by Matthew Gardner

The Federal Reserve Bank of New York just released their 2023 Housing Survey, which shows how the U.S. population feels about the housing market. Windermere Chief Economist Matthew Gardner digs into the mortgage rate predictions, showing how demographics played a role in the results.

This video on mortgage rate predictions is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Mortgage Rate Predictions

Hello there! I’m Windermere Real Estate’s Chief Economist Matthew Gardner. This month we’re going to take a look at the latest SCE Housing Survey, which gives us a really detailed look at consumers’ psyche in regard to the housing market.

I’ve always been fascinated by surveys, as they frequently give me insights that I simply don’t get from just looking at raw data and, as luck would have it, the New York Fed just released its 2023 Consumer Expectations Housing Survey. Now, this particular survey has always given me some great and often surprising insights as to how the U.S. population views the overall housing market. We certainly don’t have time to cover all of the questions that the survey poses, but there was one section I wanted to share with you today as it really resonated with me, and it relates to mortgage rates.

Will mortgage rates continue to rise?

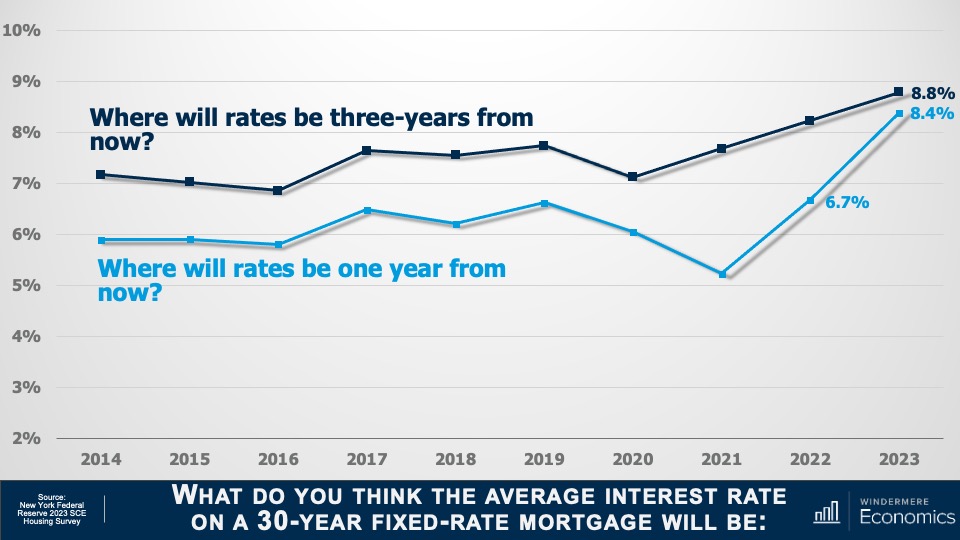

The first question asked was where they expected mortgage rates to be one year from now. And as you see here that, on average, households expected rates to rise all the way up to 8.4%. Although some may see this as extreme, you can see that in the 2022 survey respondents predicted rates would hit 6.7%, almost exactly where they were at the beginning of this March.

And when asked where they thought rates would be three years from now, on average, households expected to see them climb to 8.8%. Now, that’s a rate we haven’t seen since early 1995!

Well, I’m not sure about you, but I was very surprised by these results as they counter just about every analyst’s expectation regarding where rates will be over the next few years. In fact, myself and every economist I know believes that rates will slowly pull back as we move through this year. I haven’t seen a single forecast suggesting that mortgage rates will rise to a level this country hasn’t seen in decades.

But as they say, the devil’s in the details. When I dug deeper into the numbers, it became very clear to me that demographics played a pretty big part in guiding people’s answers. Let me explain.

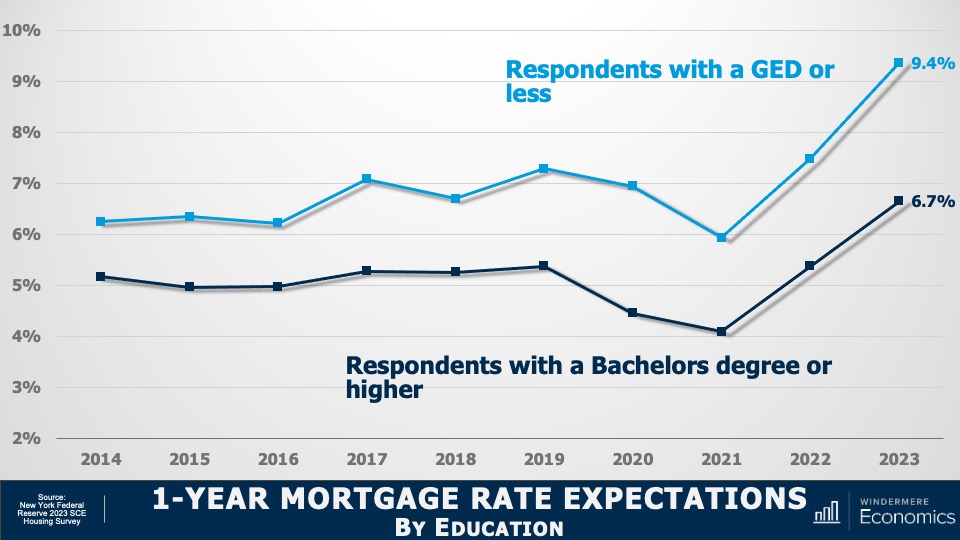

1-Year Mortgage Rate Expectations by Education

Here the data is broken down by educational achievement. You can see that survey respondents who didn’t have a college degree thought that mortgage rates would rise to 9.4% within a year. But college graduates were far more optimistic, and they expected rates to be in the high 6’s.

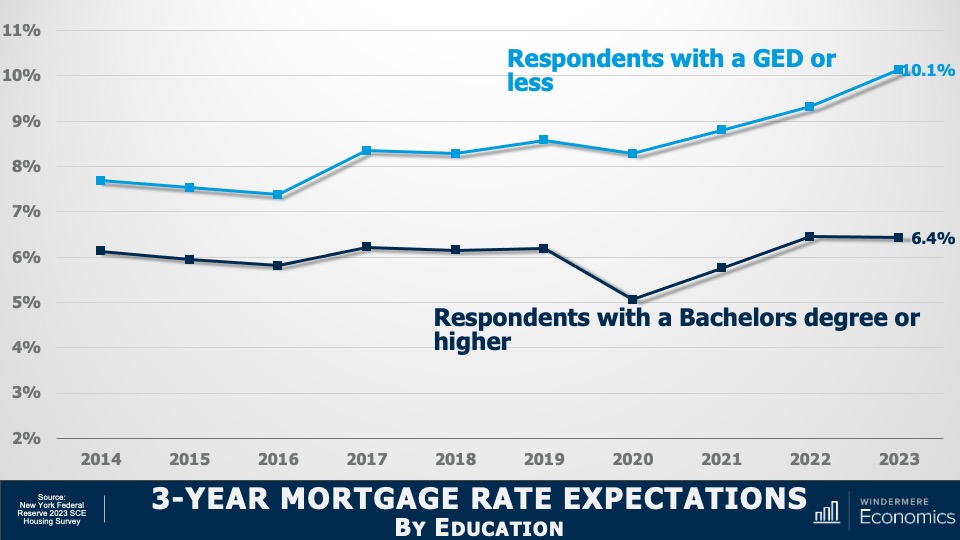

3-Year Mortgage Rate Expectations by Education

And when asked to look three years out, respondents without degrees expected rates to break above 10%. While college graduates saw them pulling back a little from their one-year expectations of 6.7%, down to 6.4%.

Now we are going to look at the survey results broken down by housing tenure.

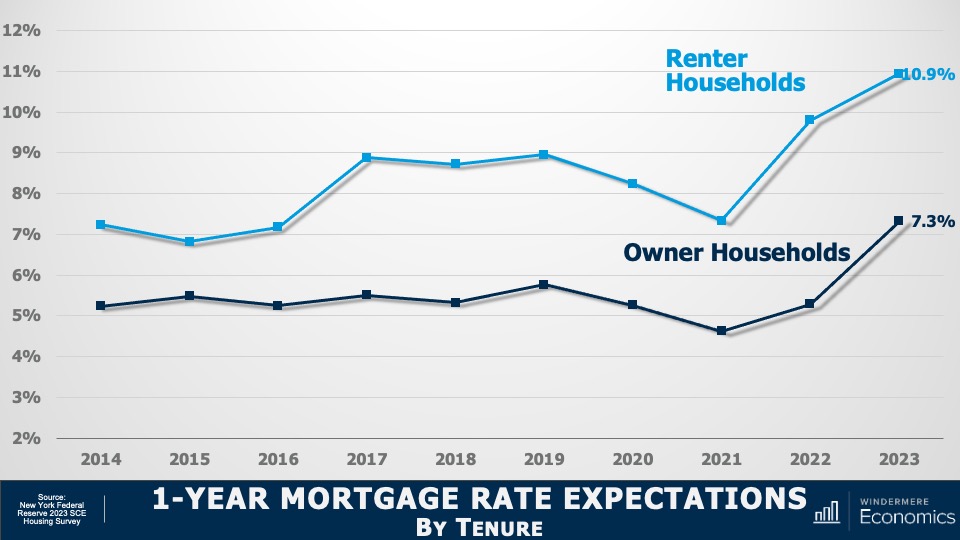

1-Year Mortgage Rate Expectations by Tenure

And here you see that renters expect mortgage rates to be at almost 11% within a year. And homeowners also saw them rising, but only up to 7.3%.

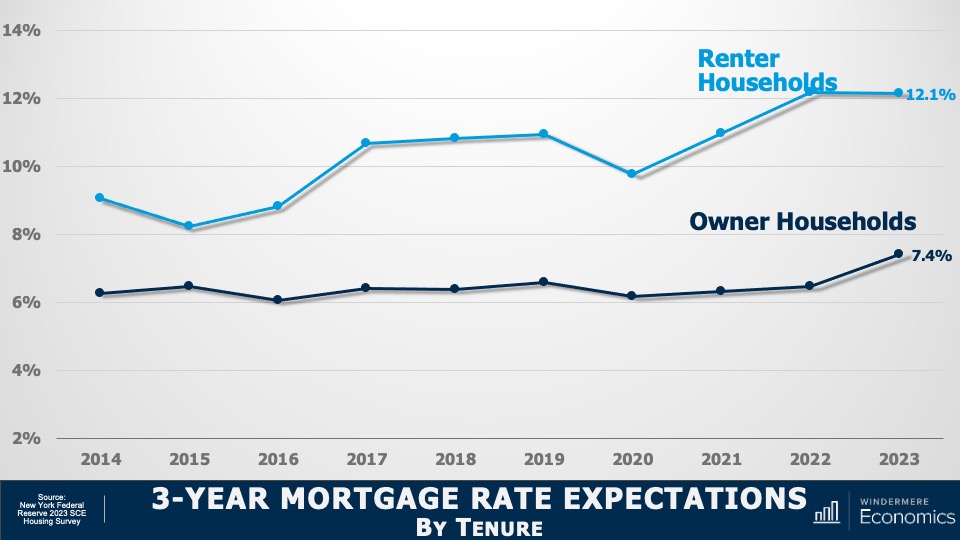

3-Year Mortgage Rate Expectations by Tenure

And over the next three years, renters expected rates to break above 12%. That’s a level not seen since the fall of 1985. But homeowners expected to see rates at a somewhat more modest 7.4%.

So, what does this tell us? I see two things.

Firstly, the rapid increase in mortgage rates that we all saw starting in early 2022 has a lot of people believing that we will see rates continuing to rise, sometimes at a very fast pace, over the next few years. I mean, if it happened before, why can’t it happen again? And this mindset leads me to my second point, which is that it’s very clear that a lot of would-be home buyers just don’t understand how mortgage rates are calculated.

The bottom line here is that I see a potential buyer pool out there that needs educating and that can give an opportunity to brokers to discuss how rates are set and where the market is expecting to see them going forward.

This may alleviate the concerns that many households have who may be thinking that they will never be able to afford to buy a home because of where they expect borrowing costs to be in the future. Education is everything, don’t you agree?

As always, I’d love to get your thoughts on this topic so please comment below! Until next month, take care and I will see you all soon. Bye now.

To see the latest housing data for your area, visit our quarterly Market Updates page.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

If you have further questions and would like to discuss with a Realtor connect with us here.

The Importance of Escrow in Real Estate Transactions

Real estate transactions can be complex and involve a considerable amount of money. Whether you are a buyer or a seller, real estate is often your biggest investment. That is why it is important for both buyers and sellers to protect their interests and ensure that the transaction is completed smoothly. This is where escrow comes in.

What is Escrow?

Escrow is a financial arrangement where a third party holds and regulates the payment of funds required for both the buyer(s) and the seller(s) involved in a transaction. Escrow helps ensure that the transaction is completed smoothly and according to the terms agreed upon by both parties. Both the buyer and the seller provide the escrow agent with written instructions. When all conditions have been met, the escrow officer sends the closing papers to the county recording office, where the new deed is recorded. The escrow officer then releases funds to the seller.

How is Escrow Used in Real Estate Transactions?

In a real estate transaction, escrow is used to ensure that the buyer’s funds are securely held until all the terms of the sale, such as the transfer of the property title, have been completed. In addition, the escrow agent may also be responsible for completing tasks such as ordering a title search, obtaining necessary documentation, and disbursing funds according to the instructions of the parties involved in the transaction. During this process you may hear the term title insurance and you might wonder what it is. Title insurance is like a safety net around your property. Sometimes hidden mistakes in previous deeds, mortgages, easements or other recorded documents might give someone else an ownership stake in the property. It is important for you to get Title Insurance to protect you and your home as it will save you time and money in the future if problems arise. You can learn more about it in our “What is title insurance and why is it important?” blog. Read it here.

In conclusion

Escrow is an important tool that helps to protect the interests of both buyers and sellers in a real estate transaction. It ensures that the transaction is completed smoothly and according to the agreed upon terms, and helps to reduce the risk of disputes or issues arising. If you are buying or selling a property, it is important for you to understand the role of escrow and how it can benefit you.

If you are ready to connect with an agent or have any further questions, please don’t hesitate to connect with us today by clicking here. If you are just getting started on your home buying journey, consider reviewing these real estate terms to help you along the way.

Buying a Home When You Are Self-Employed

If you are self-employed or thinking about becoming self-employed you are not alone. Did you know that roughly one-third of the American workforce is comprised of people who are self-employed and the number continues to rise? Self-employment allows people the flexibility to bring in an income when their life might otherwise not allow them to and in many cases can bring in a significant amount of income. More income and flexibility are incredible, but if you are planning on purchasing a home there are a couple of things to keep in mind. Mortgage lenders have to verify income (minimum of two years), see financial stability, and run your credit score. Let’s discuss these in more detail, see how each of these can be demonstrated to the lender, and what to keep in mind when you are self-employed and preparing to buy a home.

Verify Income:

When you apply for a home loan you have to disclose your income and the lender has to have a way to verify its accuracy. People who are employed turn in a W-2 form that comes from their employer, but when you are self-employed you don’t receive a W-2 so things are a bit more tricky. You may have received 1099’s and these can be helpful, but you might not receive them for ALL the work you have done or do. Typically, self-employed workers will offer their federal tax returns as they are the only complete way to verify income. Keep in mind lenders will oftentimes require two years’ worth of tax returns. If you have been self-employed for less than two years, or you do not have returns for the past two years, contact us so we can help you determine your alternative options.

Financial Stability:

If you are self-employed it’s likely that your income fluctuates month to month. You have to demonstrate to the lender that you are financially stable and that you know how to manage your money. Having savings when self-employed is imperative for several reasons. First, it demonstrates to the lender financial stability, but more importantly, your savings is an indicator as to how much you can put down on a house. The more you can put down for a home, the better your chances of being approved for a loan. This also means you should receive better terms, lower monthly mortgage payments, and reduced costs over the entirety of the loan. Regardless, if you don’t have significant savings but are self-employed you are still able to take advantage of low down-payment options like conventional loans with as low as 3% down, FHA loans requiring only 3.5% down, USDA loans that can have zero down on qualifying homes, zero down VA loans for eligible/qualifying active-duty, veterans and spouses. Check with your local lender to determine what you qualify for. Don’t have a lender and need one? Connect with us and we will help you find the perfect fit.

Credit Score:

Most importantly, the higher your credit score the better! Credit scores offer a solid indication of how you are with your money. If you are thinking about buying it is of the utmost importance for you to check your credit score as soon as possible to determine where your score is at. It takes time to build credit so if your score comes back less than favorable you will have ample time to work on it if you check it sooner rather than later. Not sure how to start building a stronger credit score? We do! Contact us and we will get you pointed in the right direction.

We suggest getting your free credit report once every four months on a rotating cycle from AnnualCreditReport.com who is authorized by federal law. You can get each of the three credit bureaus reports from this site. Review your report for errors and if you find any have them corrected immediately.

If you are self-employed and need help buying or selling a home don’t hesitate to contact us. We know the process might be long but we are here to help you along the way and have your best interest in mind. Contact us today to get connected with an agent to help.

Things to do Today to make you a Homeowner Tomorrow

As the gap between the cost of rent and the cost of a mortgage continues to close, we see an increasing number of renters interested in buying. But how can renters make the transition to owners?

The purpose of this article is to help renters implement three critical changes today to help them successfully purchase a home tomorrow. If implemented correctly, these changes will help renters overcome the feeling of never being able to purchase a home.

Start by talking with a local lender

Do your research. Find a trusted lender in the location you are planning to purchase your home. Why is it important to use a local lender? Each housing market is different depending on location. Despite the similarities in names, what might be happening in San Francisco may not be happening in San Antonio. It is important to talk to a lender that is not only familiar with but understands the current local market and can explain to you what it takes to become a first-time homeowner. Check out our full article here. Your trusted advisor can then look at your specific financial situation and make suggestions to help you navigate the local market, meet your specific needs, and discuss your available options. This conversation can help you build your timeline for when it is right for you to purchase. Having the right team of real estate and lending professionals on your side can help tremendously when planning for your first home. Together they can help you determine your goals, what you can afford, and help you get pre-approved when you are ready. Need help finding a lender? Click here.

Reduce your debt and build your credit

Your first step should be knowing your credit score and what it means. Check out this article here for more information on credit scores. According to the HUD, the average credit score of first-time homebuyers is 716. There are many online tools that can help you determine your credit score. If you don’t already know yours it would be advantageous for you to find out.

If you determine that your score is below 716, don’t freak out.

First, 716 is just an average which means that there are homeowners with credit scores both above and below that number. Knowing your score gives you a snapshot of how you are doing financially and helps you know how to adjust accordingly to reach your goals.

Second, there are numerous ways to increase your credit score BEFORE you apply for your home loan.

- HUD’s number one recommendation is to reduce your debt as much as possible. Start by reducing your current spending. This will not only help you have less debt, but it will also help you have more money to pay down your current debts. Start small, perhaps purchasing one less coffee a week or choosing water instead of the soda or martini. These small sacrifices now will add up to big wins later. We recommend TrueBill as an app that can help find hidden savings by canceling subscriptions you don’t use anymore or negotiating your existing subscriptions down. It can also help you develop and stick to a budget!

- Pay all your bills on time. Set up auto payments to avoid late payments.

- Use your credit card responsibly.

When you have your debt in a manageable place…

Start saving

It might already feel like you are barely making it. But it has been proven that setting aside even small amounts can make it possible for you to save for a down payment on a home over time. Having funds in savings is also taken into consideration when getting pre-approved for a home loan (See why getting pre-approved is imperative). You don’t always need a large down payment when buying a home but you will need a good house fund saved up for ongoing maintenance and repairs.

Many experts suggest using a hidden savings or a “sinking fund” when saving for your down payment. This is an “out of sight out of mind” savings account. Once money goes in you don’t take it back out till you are ready. Make sure you keep it separate from your emergency fund or your short-term savings for expenses. Set small attainable goals that make you feel accomplished rather than the large goal that might feel daunting and overwhelm you. Are you ready for the challenge?

See how long it takes the average person earning a medium-income in America to save for a down payment here.

In conclusion, get some professionals on your team by talking with a lender (ask your trusted Windermere Broker for recommendations) if you don't have an agent contact us here and we will get you connected, build credit, and start saving!

4 Online Resources That will Blow Your Mind!

…and help when buying vacant land on Whidbey Island.

ICGeo

This is a sophisticated GIS mapping tool for Island County that can show layers and layers of geographically specific data overlaid on a map. Just turn on the layers of data you are interested in and search till your heart is content!

Island County Public Portal

Use this tool to look up a parcel number or a street address to determine if there are any site registrations, septic permits, or septic as-builts done for the parcel. It will also disclose any permits a property has recently applied for and its status.

Groundwater Spatial Analysis Report

This tool analyzes the potential groundwater quality at any given spot on the island by grabbing the data on wells within 1/8 mile of the point you choose on the map (or the nearest 40 wells). It automatically generates a phenomenal report. Just submit the application and the report is emailed to you almost immediately. This document will offer you more detailed information on what you get in the report

Washington Coastal Atlas Map

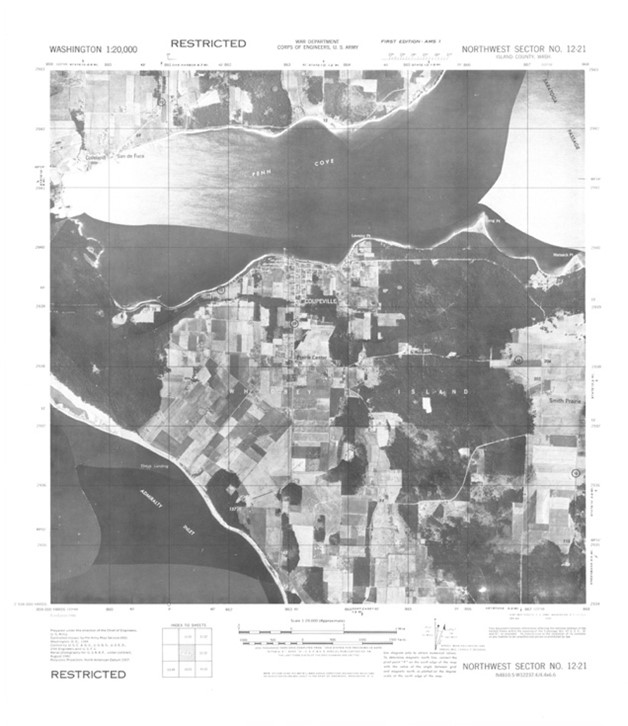

With the Shoreline Photo Viewer, you can compare what has happened to any stretch of shoreline over the last 50 years through photography! This tool uses 5 photo sessions capturing images of our shoreline all the way back to 1970. Even if you are not currently buying waterfront land this is a fun tool to compare what has happened to any section of our shoreline. There are even aerial photos from the 1940s. Check out the image below taken before Rolling Hills or Penn Cove Park were developed.

To find more amazing tools at your disposal or to get help using these tools to find specific information you can call us, and we will connect you with one of our knowledgeable Windermere brokers. You don’t have to be actively selling or buying a home! We just love to help! Contact us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link