5 Reasons to Use a Local Lender

When it comes to buying a home, choosing the right lender is an important decision that can have a significant impact on your home buying experience. While it’s possible to work with a lender from anywhere, working with a reputable local lender in the area you are purchasing provides many benefits that make the process smoother and more enjoyable. In this article, we will share five reasons why you should consider using a reputable local lender for your next home purchase.

5 Reasons to Use a Reputable Local Lender:

1. Personal Connection:

A local lender provides the opportunity to have a face to face conversation and build a personal relationship, which can be especially helpful when dealing with complex issues. How much better is it to have the ability to sit down face to face with someone and discuss, ask questions, smile and laugh with or even cry if necessary? It is so much better than trying to solely do things over the phone or email with someone hundreds of miles away. When the going gets tough, you (or your trusted real estate broker) can go directly to the office and discuss the issues in person to figure it out rather than be put on hold.

2. Knowledge of the Market:

A local lender is more likely to have a deep understanding of the local real estate market, including contractors, permit requirements, and more. It is not unheard of to have a local lender provide contact details for a roofer that can get the fix done in time for closing or the local Labor and Industries permit guy who can solve the problem faster than driving an hour to the nearest office. Reputable local lenders understand when there is delay due to septic repairs or how to get the water quality test results ASAP.

3. Reputation:

Local lenders have a reputation to uphold in their community, which can provide added accountability and ensure a higher level of service. When you run into your clients in the grocery store or watch their kids play on the same soccer team you naturally put a little more into making sure your service is impeccable. Anonymity creates distance and reduces accountability.

4. Strong Relationships with Escrow Teams:

Good relationships with local escrow teams can lead to smoother and more efficient transactions. Often the most stressful point of the transaction is right at the very end as the final underwriter is reviewing the file and potentially finding issues that need more documentation. This can lead to delays in critical milestones that need to be met to close on time. Getting the necessary documents from the lender to escrow on time can be the difference in closing as expected or experiencing costly delays and even the possibility of losing the home. You can use a lender from almost anywhere, but the escrow team is nearly always local to the property being purchased. When lenders are well known and respected by the local escrow offices you can expect excellent communication and problem solving between them. This will make overcoming obstacles to closing on time more likely.

5. Competitive Terms:

Local lenders often offer competitive terms and rates, making them a cost-effective option. When comparing lenders, be sure to compare all the terms and costs of the loan, not simply the advertised interest rate. When you do, you’ll often find the local lender has lower overall costs than national corporate lenders.

In conclusion, using a reputable local lender provides a range of benefits that make the home buying process more enjoyable and efficient. From the personal connection to the knowledge of the local market and their reputation to uphold, there are many reasons to consider using a local lender for your next home purchase. So why not choose a lender who is well-known and highly regarded in your local real estate community? Contact us today to be put in touch with a great lender on Whidbey Island!

How Long Does it Take to Save For a Down Payment?

Saving enough money for a down payment on your first home can be one of the biggest obstacles to homeownership. Depending on your circumstance you might need anywhere from 3% – 20%. Speaking with a reputable local lender will help you find out exactly what your percentage will be.

But how long should it take, you ask!?

Follow along as we estimate the amount of time it takes a person earning a median income and paying a median rent to save up for a down payment on a median-priced home.

To accomplish this task we use the concept that homeowners should pay no more than 28% of their total monthly income on housing expenses. We use this information in combination with data from the U.S. Department of Housing, Urban Development (HUD), and Apartment List to determine our estimation.

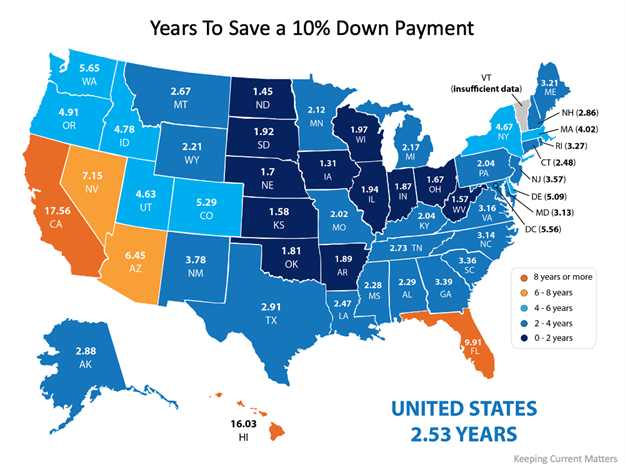

According to the data pulled, the national average for the time it would take to save for a 10% down payment is roughly two and a half years (2.53). Looking at the diagram below you can also see that those living in Iowa can save for a down payment in as little as 1.31 years while those in California could take 17.56 years. The map below can help you determine the amount of time (in years) it can take for you to save in your state:

What if you only need to have a 3% down payment?

It is a common misconception that you need to have a 20% down payment to buy a home.

The reality is there are reasonable alternative options out there. First-time home buyers have an advantage with a plethora of down payment assistance programs available to them. You just have to find the right lender and ask. Need help finding a lender? Ask us to connect you with one here.

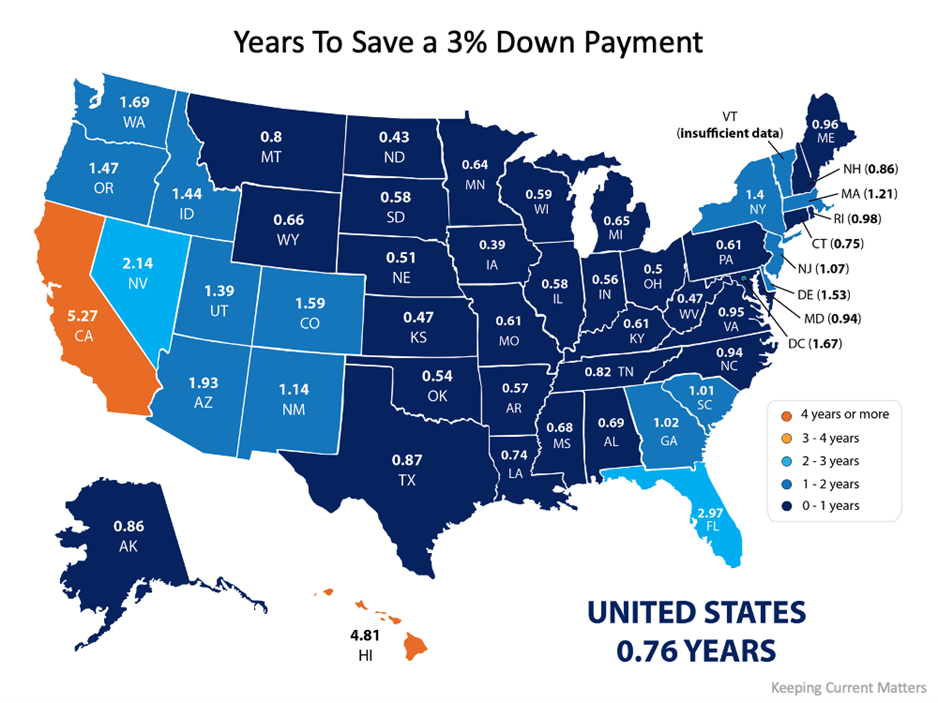

What if you qualify to take advantage of one of the 3% down payment programs?

If you qualify for a 3% down payment program, then you only have to come up with 3% of the total cost of the home at closing instead of ten or the typical 20% we have seen required in the past. Saving for a 3% down payment might not take you very long. In fact, it could take less than a year in most states, as shown in this map here:

At the end of the day

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Connect with us to explore the options available to you in our area and how they support your plans for buying a home.

How to Install Laminate Flooring

How to Install Laminate Flooring:

Written by: Anita Johnston

How many times have you thought “I can install laminate flooring” or “I wish I could do that?” Flooring is one of those renovation projects that allure newbies most often. After mastering the skill of installing your own floor it can liberate the home owner which can be good and bad for a home.

I have walked through many homes and within a second I can pick out a home owner renovation project. From spaces between cabinets that weren’t properly attached together or gaps that weren’t perfectly filled with a filler pencil. And flooring………. I have seen the worst flooring jobs while touring houses for sale. A new floor can add great value to a home. But an improperly installed floor can actually deduct value from a home. I just saw this recently with a home that the appraiser specifically noted the poor flooring installation and downgraded the value of the home.

There’s several things to keep in mind when installing flooring. Prepping the floor is a must. If you’ve removed carpet then you definitely had to endure the tedious task of removing staples that was holding down the carpet pad.

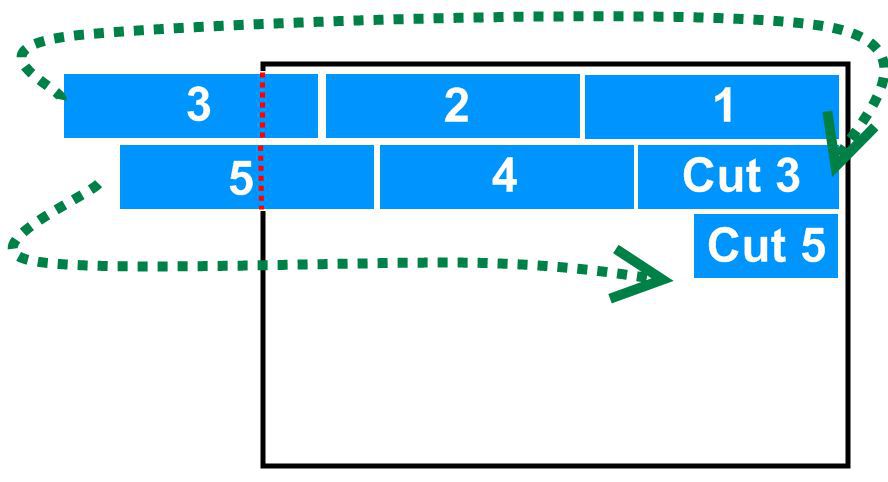

Sweeping the floor to make double sure that there’s nothing sticking up that won’t allow the floor to lie perfectly flat and level. Second you need to decide where to start. If it’s just one room that’s easier. You simply start running your flooring parallel to the entrance. Once you lay out your first row you will then take your cut board and lay it in place to start your next row. There should never be less than 4″ from the end of one board to and other ends the row before or after. You should tap the boards together until they click together and all gaps are gone.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link