Spring Cleaning

Spring cleaning has long been a cherished tradition embraced by households worldwide. Stemming from a practical need to freshen up living spaces after the long winter months, this annual ritual has evolved into a symbol of renewal and rejuvenation. Beyond simply tidying up, spring cleaning holds significant importance for both physical and mental well-being. By clearing out clutter, dust, and grime accumulated over the winter, we create a cleaner and healthier environment for ourselves and our families. Moreover, the act of spring cleaning can have positive effects on our mindset, providing a sense of accomplishment, satisfaction, and a renewed energy to tackle new challenges. Embracing this tradition allows us to start the new season on a clean slate, fostering a sense of optimism and positivity as we welcome the warmer days ahead.

Follow along for a comprehensive spring cleaning checklist to help you tackle every corner of your home:

Declutter and Donate

- Make your home more inviting by decluttering. Go through each room and declutter by getting rid of items you no longer need or use.

- Donate, sell, or discard items that are no longer serving a purpose for you. Consign your items at places like My Sisters Closet, or host a yard sale and feel a sense of accomplishment when you can fund something new. Whatever you find yourself still left with donate to a local thrift store. Island Thrift, WAIF Thrift Shop , and Treasure Island-Antique and Thrift are just a few of the many options on Whidbey Island.

Dust

- Open your windows and breathe a breath of fresh air.

- Dust all surfaces, including shelves, countertops, furniture, and electronics.

- Don’t forget to dust ceiling fans, light fixtures, and vents.

Clean Windows

- Spring brings so much outside beauty. Make sure you can enjoy it all with sparkling windows.

- Wash windows inside and out, including the window frames and sills. If your window has weeping holes, be sure to make sure they are not clogged so that excess water can drain properly.

- If cleaning your windows is out of reach there are companies like A Clean Streak or Oh Say Can You See that can help.

- Clean blinds, curtains, or drapes according to manufacturer’s instructions.

Vacuum and Clean Floors

- Vacuum carpets and area rugs thoroughly.

- Sweep and mop hard floors, paying special attention to corners and baseboards.

Deep Clean Kitchen and Restrooms

- Clean and disinfect countertops, cabinets, and drawers, all bathroom surfaces, including sinks, toilets, and tubs/showers.

- Clean appliances inside and out, including the refrigerator, oven, microwave, and dishwasher.

- Degrease stove hood and filter.

- Scrub tile grout and remove any mold or mildew.

Organize Closets and Cabinets

- Out with the old and in with the new… or maybe just move the sweaters to the back (we are still in the PNW and occasionally will still need those sweaters), but break out the vibrant tank tops it is spring already!

- Declutter and organize closets and cabinets, donating or discarding items as needed.

- Use storage bins or baskets to keep items organized and easily accessible.

Freshen up Bedding

- Launder bedding, including sheets, pillowcases, and duvet covers.

- To increase the life of your mattress, rotate and flip it for even wear.

Clean Upholstery and Furniture

- Vacuum upholstery and cushions to remove dust and debris. Make sure you get behind and underneath.

- Spot clean stains and spills on furniture.

Tidy Outdoor Spaces

- Sweep or pressure wash outdoor patios, decks, and walkways.

- Clean outdoor furniture and cushions.

- Trim bushes, trees, and clean up garden beds.

Inspect and Maintain

- Ensure your families safety every season.

- Check smoke detectors and carbon monoxide detectors, replacing batteries as needed.

- Test and clean ceiling fans.

- Schedule routine maintenance for HVAC systems, plumbing, and electrical systems.

Final Touches

- Brings some of the outside in.

- Add finishing touches such as fresh flowers or plants to bring life into your space.

- Sit back, relax, and enjoy your freshly cleaned and organized home!

Spring cleaning isn’t just about tidying up—it’s also an essential part of home maintenance and preparation for the warmer months ahead. For homeowners, it’s an opportunity to refresh their living spaces and ensure that their property is in top condition. Beyond the aesthetic benefits, a thorough spring cleaning can enhance the value of a home by improving its curb appeal and overall appeal to potential buyers. By decluttering, organizing, and performing deep cleaning tasks, homeowners can showcase their property’s full potential and make a positive impression on prospective buyers. Additionally, addressing maintenance issues early can help prevent costly repairs down the line and contribute to the long-term health and durability of the home. So, as spring approaches, embrace the tradition of spring cleaning as a valuable investment in both your home and your well-being.

If you are considering selling this Spring, connect with us.

To help get you motivated listen to our Spring Cleaning Playlist Here.

How Long Does it Take to Save For a Down Payment?

Saving enough money for a down payment on your first home can be one of the biggest obstacles to homeownership. Depending on your circumstance you might need anywhere from 3% – 20%. Speaking with a reputable local lender will help you find out exactly what your percentage will be.

But how long should it take, you ask!?

Follow along as we estimate the amount of time it takes a person earning a median income and paying a median rent to save up for a down payment on a median-priced home.

To accomplish this task we use the concept that homeowners should pay no more than 28% of their total monthly income on housing expenses. We use this information in combination with data from the U.S. Department of Housing, Urban Development (HUD), and Apartment List to determine our estimation.

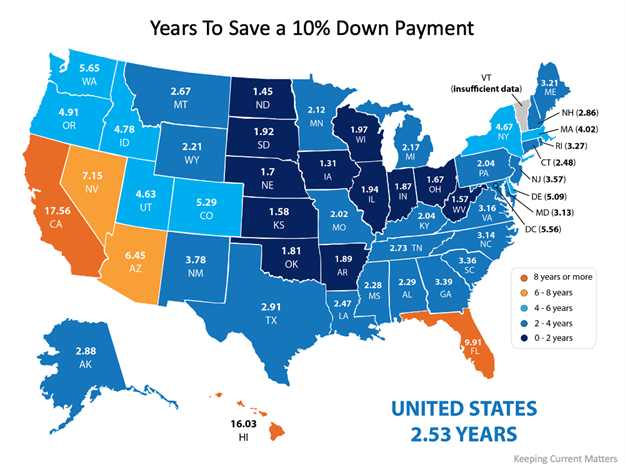

According to the data pulled, the national average for the time it would take to save for a 10% down payment is roughly two and a half years (2.53). Looking at the diagram below you can also see that those living in Iowa can save for a down payment in as little as 1.31 years while those in California could take 17.56 years. The map below can help you determine the amount of time (in years) it can take for you to save in your state:

What if you only need to have a 3% down payment?

It is a common misconception that you need to have a 20% down payment to buy a home.

The reality is there are reasonable alternative options out there. First-time home buyers have an advantage with a plethora of down payment assistance programs available to them. You just have to find the right lender and ask. Need help finding a lender? Ask us to connect you with one here.

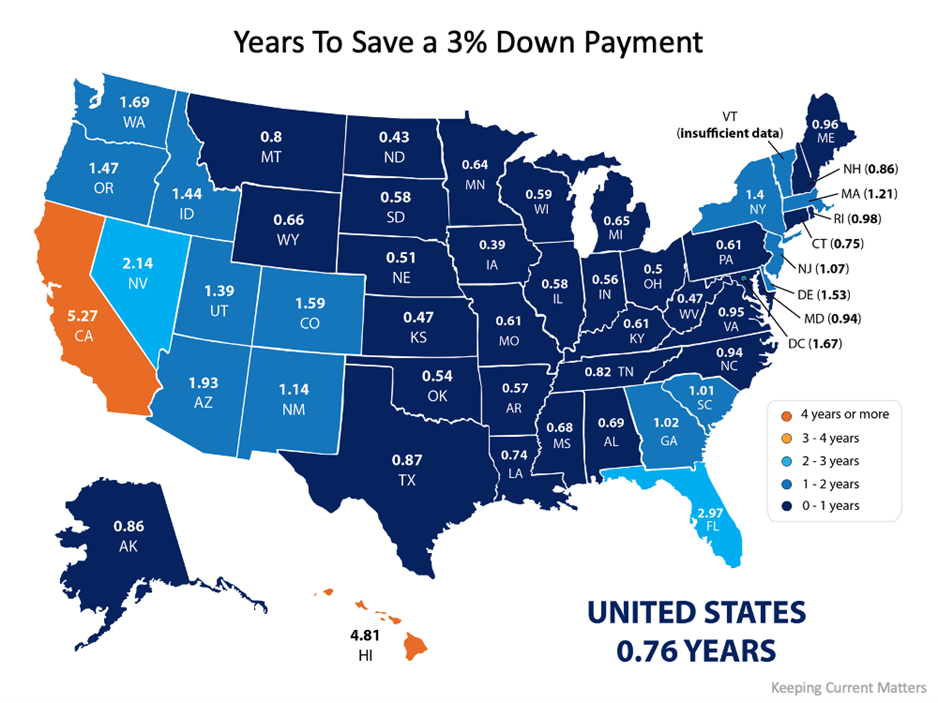

What if you qualify to take advantage of one of the 3% down payment programs?

If you qualify for a 3% down payment program, then you only have to come up with 3% of the total cost of the home at closing instead of ten or the typical 20% we have seen required in the past. Saving for a 3% down payment might not take you very long. In fact, it could take less than a year in most states, as shown in this map here:

At the end of the day

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Connect with us to explore the options available to you in our area and how they support your plans for buying a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link