Retirement in your future?

If retirement is in your near future, or perhaps you are already there (congratulations) you may find yourself wondering if staying in your home is still a good fit. When you live in a home for an extended period, it is normal for your needs to change as you progress through life’s milestones. You may find that your home is too big for the needs of this next chapter. Perhaps you have always had a dream destination in mind, whether to visit or to live or maybe you just want to be closer to family. Selling your home may just be the key to moving onto something that fits your life better.

Regardless of your why, understanding your options and the market can help you make the best next decision. We cannot stress enough that no one size fits all and suggest discussing your unique situation with a trusted Realtor. If you are not currently working with a realtor, connect with us. We will help find you the perfect match through a series of specific questions.

Follow along as we discuss why you might be in an advantageous position if you ARE considering a move and thinking about retirement.

Consideration 1: How long have you owned your home?

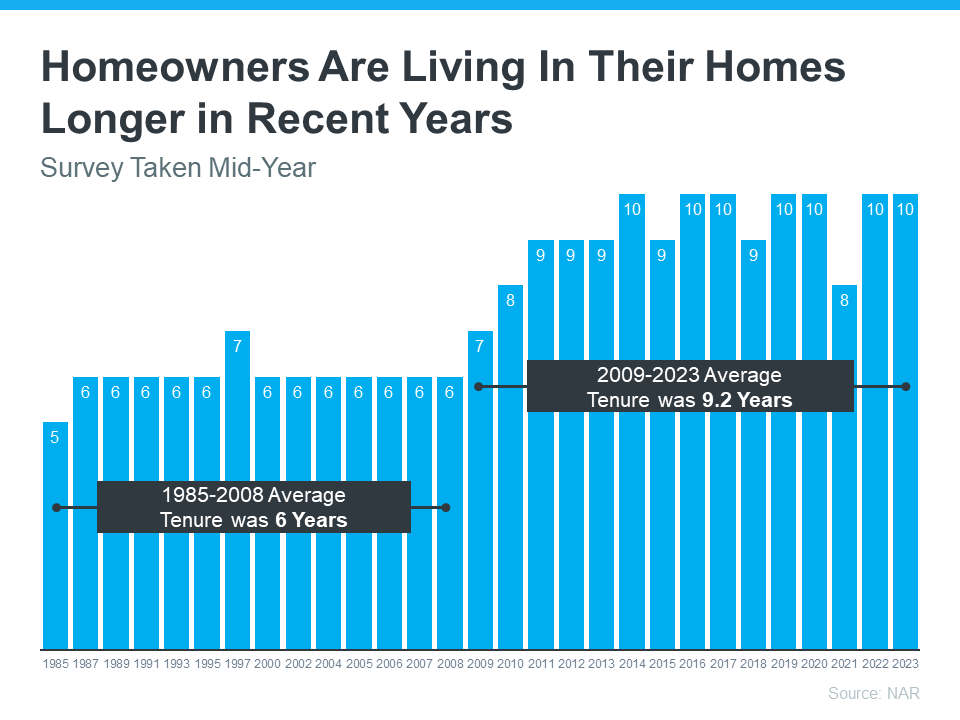

Today, people are living in their homes longer than they ever have in the past. The longer you live in the home the more likely that you are in a better position to sell. Let’s look at a few factors. The National Association of Realtors (NAR) shared that homeowners owned their homes for an average of six years between 1985 and 2008 whereas homeowners have been staying in their homes for an average of 9.2 years since 2009. See the graph below.

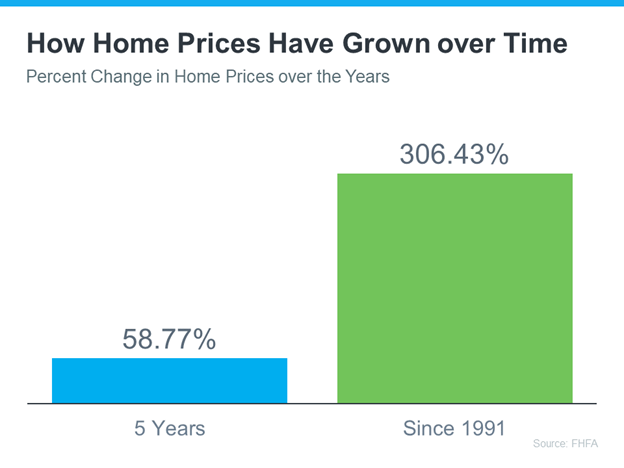

If you are like most homeowners today, you have been in your home for well over 5 years. If this is the case, it is an indicator that a move may be in your favor. Typically speaking, you have built significant equity after just 5 years in your home due to home price appreciation. The Federal Housing Finance Agency (FHFA) demonstrates this in their graph below.

If you have lived in your home for over 5 years, you might just be sitting on a large sum of money that could make your dreams a reality. The recent market has helped homeowners increase their equity by nearly 60% in the past 5 years. Those who have owned their homes since 1991 have experienced their home triple in value since they purchased it back in 1991.

Consideration 2: The Market

Currently, we are experiencing a sellers’ market. Home price appreciation is stable. There is a lack of inventory and a prediction that mortgage rates will decline. We have already begun to see the decline in rates. As rates drop, homeownership becomes an attainable option again for those looking to buy. If you are not currently working with an agent and would like to discuss a strategic plan, connect with us here.

Whether you wish to downsize, move to the destination of your dreams, have the funds to go on the vacation of a lifetime, or move closer to the ones you love, the equity in your home can help get you there.

No matter what your home goals are, a trusted realtor can help you discover the best options to get you there. They can help you sell your current home and get you into the that is right for life today.

Retirement in your future? Let’s connect and explore your options.

When Rents Rise, You Pay More But You Don’t Get More

When rents rise, you pay more but you don’t get more.

Interest rates might be rising, but so is rent! As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“There is no doubt that these higher rates hurt housing affordability. Nevertheless, apart from borrowing costs, rents additionally rose at their highest pace in nearly four decades.” So, which is right for you? Buying a house or renting? If you are finding yourself in a place where you are struggling to determine which is the right decision here’s some food for thought.

RENT CONTINUES TO RISE

Rent has continually risen significantly for decades with no end in sight. It is no coincidence that as costs rise rents do too. In fact, 72% of landlords intend on raising the rent on at least one of their properties within the next year. Could that be you? Have you ever stopped to think that when rents rise, you pay more, but you don’t get more? Not only can you make money in the long run by buying a home but buying a home can prevent you from getting trapped in the cycle of continually rising rent.

When you become a homeowner, you have the opportunity to lock in your monthly payment for 15 to 30 years without it increasing as rent does. Be sure to discuss the advantages of the different types of loan options you qualify for with your Mortgage Lender (don’t have one? You can find one here). This is where homeownership pays off. Not only does your monthly payment remain low as rents around you increase creating a shield of protection from inflation but you also gain equity as your home value increases, and your loan amount decreases with each additional payment producing significantly more equity in your home each month.

ON THE FLIP SIDE

On the flip side, you need to consider the maintenance and upkeep costs of owning your own home. There is no calling the landlord when things break down or wear out and depending on the age and condition of the home you could be looking at paying a big lump sum in the future. Beyond cosmetics maintenance, you will also need to consider the cost of replacing things like your hot water heater, furnace, or even the roof over time.

Homeownership is not the right decision for everyone but consulting with an experienced Windermere broker to help weigh through all the considerations is something we love to help with, and it doesn’t cost you anything. In the meantime check out this article to dig deeper into whether or not buying or renting is better for you. Don’t have your own Windermere agent yet? Connect with us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link