Title Insurance: Protecting Your Property Investment

When you purchase a home, you receive a deed to the property which typically means you have full ownership. Unfortunately, sometimes mistakes happen where hidden inaccuracies in previous deeds, mortgages, and easements might leave someone else with a claim to your property. Title insurance is a type of insurance policy designed to protect property owners from financial loss due to title defects, liens, or other issues with a property’s title. Title insurance provides peace of mind to homeowners and lenders alike, ensuring that their investment in the property is secure. In this blog, we will look at who is covered by title insurance and what risks are covered.

Who is Covered by Title Insurance?

Title insurance typically covers both the property owner and the lender. The policies can be separate policies so always check with your insurer regarding who and what is covered. The policy holder can be either an individual or a corporation, and the insurance covers their financial interest in the property. For homeowners, title insurance provides protection against any challenges to their ownership of the property, such as disputes over ownership, missing heirs, forgeries, or encumbrances that were not disclosed during the sale. For lenders, title insurance protects their investment in the property and ensures that their loan is secured by a valid title.

What Risks are Covered by Title Insurance?

Title insurance covers a wide range of risks, including but not limited to:

- Title defects: This refers to any challenges to the property’s title, such as disputes over ownership, missing heirs, forgeries, or encumbrances that were not disclosed during the sale. Title insurance protects the policy holder against these title defects and provides the necessary financial support to resolve any issues.

- Liens: Liens refer to claims or encumbrances against a property, such as mortgage loans, taxes owed, or judgements against the property owner. Title insurance provides coverage against any liens that exist and protects the policy holder’s financial interest in the property.

- Fraud: Fraudulent activities such as forgeries or false impersonation can pose a threat to a property’s title. Title insurance provides protection against any fraudulent activities that may affect the property’s title.

In conclusion, title insurance is an important investment for property owners and lenders. It provides peace of mind by ensuring that the property’s title is secure and that any issues with the title can be resolved without incurring significant financial losses. Whether you are a homeowner or a lender, title insurance is an investment worth considering.

If you are preparing to purchase a home and need help connecting with a lender or would like help answering your questions while preparing to buy please don’t hesitate to give us a call at 360.675.5953.

How Long Does it Take to Save For a Down Payment?

Saving enough money for a down payment on your first home can be one of the biggest obstacles to homeownership. Depending on your circumstance you might need anywhere from 3% – 20%. Speaking with a reputable local lender will help you find out exactly what your percentage will be.

But how long should it take, you ask!?

Follow along as we estimate the amount of time it takes a person earning a median income and paying a median rent to save up for a down payment on a median-priced home.

To accomplish this task we use the concept that homeowners should pay no more than 28% of their total monthly income on housing expenses. We use this information in combination with data from the U.S. Department of Housing, Urban Development (HUD), and Apartment List to determine our estimation.

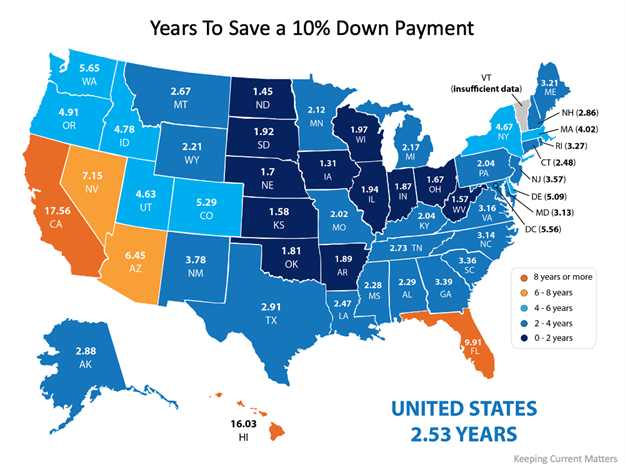

According to the data pulled, the national average for the time it would take to save for a 10% down payment is roughly two and a half years (2.53). Looking at the diagram below you can also see that those living in Iowa can save for a down payment in as little as 1.31 years while those in California could take 17.56 years. The map below can help you determine the amount of time (in years) it can take for you to save in your state:

What if you only need to have a 3% down payment?

It is a common misconception that you need to have a 20% down payment to buy a home.

The reality is there are reasonable alternative options out there. First-time home buyers have an advantage with a plethora of down payment assistance programs available to them. You just have to find the right lender and ask. Need help finding a lender? Ask us to connect you with one here.

What if you qualify to take advantage of one of the 3% down payment programs?

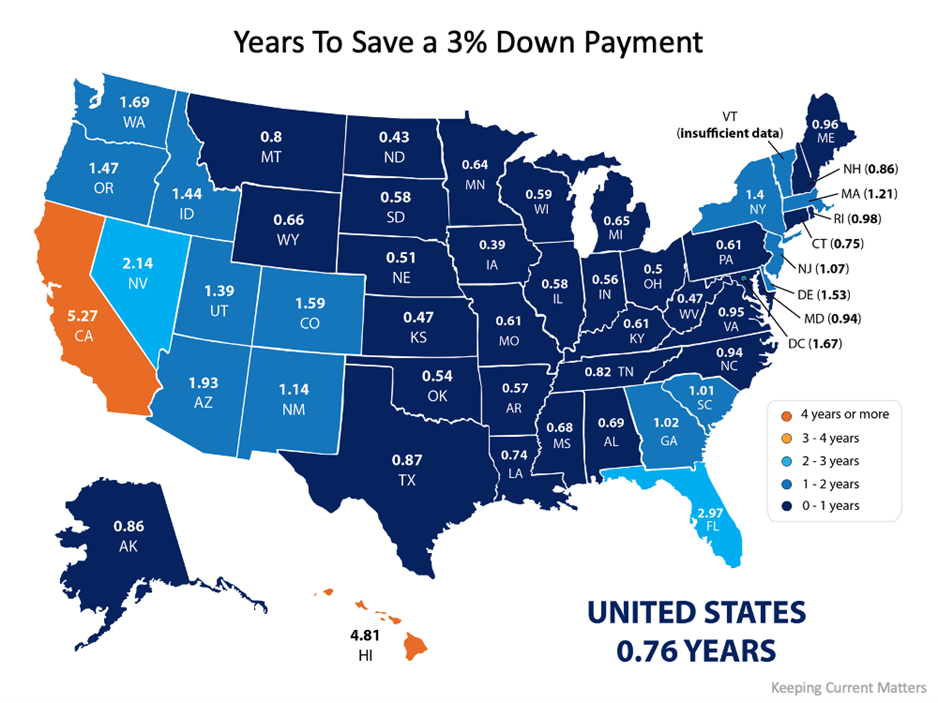

If you qualify for a 3% down payment program, then you only have to come up with 3% of the total cost of the home at closing instead of ten or the typical 20% we have seen required in the past. Saving for a 3% down payment might not take you very long. In fact, it could take less than a year in most states, as shown in this map here:

At the end of the day

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Connect with us to explore the options available to you in our area and how they support your plans for buying a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link