Knowing When You’re Ready to Buy

Homeownership is a lifestyle choice. Therefore, choosing homeownership isn’t a decision made overnight. The decision often takes careful planning for how the purchase of a home will fit into your life now and in the future. Additionally, the decision will take financial planning for how to pay for the home of your dreams. How will you know if you are ready? Follow along as we explain the fundamentals of preparing for homeownership so that you know when the time is right for you.

When renting…

When renting, you usually don’t have to worry about maintaining the property, making repairs, or remodeling the home. Are you ready to take on those responsibilities as a homeowner? If so, are you ready to be tied down to one place? Renting offers a bit of flexibility because leases are renewed on a regular basis allowing you ease of relocation. As a homeowner you’ll need to spend time and money selling or renting out your home before relocating.

As a renter you never gain any long term savings in the form of home equity. As a homeowner, the longer you are in the home the more equity you can expect to gain. You can get a better idea of why by the explanation in our article, Is It Better to Buy a Home or to Rent One?.

A couple of good questions to ask yourself if you are considering becoming a homeowner are:

If you needed to move in a couple years, would you feel comfortable renting out your home or selling it?

Could it potentially bring in a cash flow?

As a homeowner you are ultimately responsible for paying the mortgage. Are you financially stable enough to not default on your loan?

Most importantly, becoming a homeowner means putting down roots. Are you and your household emotionally ready to make that change and commitment?

If you answered yes to the above questions, you are on your way to homeownership. Let’s dig a little deeper to see if you are financially ready to take the leap:

Do you know how much home you can afford?

There are a lot of factors that play into knowing how much home you can afford. Of course, there is the price of the home, but you must also consider interest rates as they play a significant role in your monthly mortgage payment. For a good demonstration of the effect of interest rates on your monthly mortgage payments check out this article, Rising Mortgage Rates. Furthermore, what many first-time home buyers forget to consider in addition to the down payment and monthly mortgage payments are closing costs, moving expenses, inspection fees, property taxes, and homeowners’ insurance just to name a few. A great agent will connect you with a lender that will walk you through how these will affect your payment and if they pertain to your loan. Don’t have an agent? Connect with us here to get paired with the perfect agent for you. Identifying how much you can afford is not a task to do alone. You must connect with a lender. They will look at your financial position and get you pre-approved for a home.

Are you working to reduce your debt-to-income ratio?

Lenders know that it is not realistic to have no debt. Therefore, lenders are looking to see that you are making progress towards paying down your debt. Demonstrate your plan to get your debt paid off. Your lender can help you determine the best course of action so connect with them sooner rather than later.

Are you prepared for a downpayment?

Lenders recognize 20% down payments as a demonstration of financial stability. 20% down payments decrease the initial risk to the lender and benefits the buyer by not having to pay PMI when they put 20% down. You can read more about those benefits here. However, we know not everyone can afford 20% down, but everyone needs a place to live. Therefore, there are different programs and flexible options that make owning a home attainable even when you do not have funds for a 20% down payment. It is important to talk to your lender to determine which fits your unique needs.

Maybe you already got a pre-approval letter, but you aren’t satisfied with the limits. You have several options. Provide your agent and lender with a clear expectation of your wants and needs. If you aren’t exactly sure what you want, try reading 6 Reasons to Attend Open Houses to solidify your desires. You can use this form to help identify your wants and needs to share with your agent and lender. Once you have a clear list your lender can help create a financial plan to reach your desired goal. Your agent can simultaneously watch the market for homes meeting your criteria and help you understand the dynamics of the local market. Knowing the market can help you understand your purchasing power. Your agent can help you understand the difference between a buyers’ and sellers’ market and help you understand what to expect and how to leverage the market to your advantage.

If you are ready to buy or still unsure, you should begin talking to an agent. If you don’t already have an agent, you are in luck! We have incredible agents and connections with lenders who can guide you through your unique situation and help you know when you are ready to purchase a home. Connect with us here.

Expedite the Loan Process

Knowing what to expect not only calms your nerves but also expedites the lending process.

During your search for a lender, you will discover that most lenders will sincerely work on your behalf to help you attain the financing needed to quickly get you into the home you have chosen.

Your chosen lender will guide you through the process and shed light on the documents you need to prepare as well as provide you with the various options available to you. Talking to a lender well in advance about your goals and your financial situation will better prepare you for home ownership. The journey is different for everyone. We cannot stress enough how important it is to talk to a lender early on. The lender can help you determine a realistic timeline and address any problems early on to prevent a problem from arising later that could cost you your dream home.

To expedite the loan process come prepared with the following documentation.

- Your most recent pay stubs (this should be computer generated and include the YTD earnings and deductions).

- Last two years’ W2s.

- Two years’ tax returns.

- Copy of your valid U.S. picture ID (bring the ID with you)

- Two months’ bank statements for all your accounts (must include the date, name, and account numbers)

- Last two statements for asset accounts such as IRA, 401K, investment, ect.

- Contact information for whom you anticipate getting your home insurance. (Connect with us if you need help finding home insurance companies)

- If applicable, bankruptcy documentation including discharge paperwork

- If applicable, a divorce decree and/or child support court order

What if I’m self-employed?

If you are self-employed it is of the utmost importance for you to speak with a lender as soon as possible if homeownership is on your wish list.

You will need to come prepared with things like the last two years of Business Tax Returns and if possible, a letter from your CPA detailing at the very least two years of self-employment with a continued positive outlook for your business.

To help you get started with your search check out Guild Mortgage, Peoples Bank, and Home Bridge for a few lenders here on Whidbey Island. Don’t forget to check out our Neighborhood Guide when you are ready to start looking for your dream home on Whidbey.

We hope this was of help to you. If you need help connecting with a lender, send us a message here. If you are ready to start speaking to an agent about the next steps let us know you are ready to start looking in a message to us here.

Nervous About Getting Approved For a Home Loan?

Are you nervous about getting approved for a home loan?

Don’t be! Staying informed about what to expect and what you should and should not do will help ease some of that worry. We are here to help you. Follow these simple DOs and DON’Ts and they will help you avoid hiccups during the approval of your home loan.

Dos:

- Continue to your current rent or mortgage payments on time.

- Stay up to date on all existing accounts (even if you are paying them off).

- Continue to work for your same employer.

- Continue to use the same insurance company.

- Continue living at your current residence.

- Continue to use your credit cards as normal.

- Call your trusted lender if you have any questions.

Don’ts:

- Make any major purchases like cars, boats, furniture, jewelry ect.

- Apply for a new line of credit (credit card or loan) even if you are pre-approved.

- Open a new credit card.

- Transfer any balances from one account to another.

- Pay off any collections or accounts without first checking with your trusted lender.

- Close any credit card accounts.

- Change bank accounts or banks.

- Max out or overcharge your current credit cards.

- Consolidate your debts into fewer accounts.

- Take out a new loan.

- Start any home improvement projects.

- Finance any elective medical procedures.

- Open new cell phone accounts.

- Create a new fitness membership at a gym or club.

If you run into any unique situation that leaves you questioning whether you should proceed it is in your best interest to connect with your lender and ask before you make any decisions. Your lender can help you determine what is right for you in your unique situation to achieve your financial goals.

If you do not have a lender of your own or would like to discuss buying or selling a home, please do not hesitate to connect with us so that we can help you.

Email us at WhidbeyCommunications@windermere.com or call us at 360.675.5953

Drop in Mortgage Rates, What that Means for You

Mortgage rates rise and fall in response to varying inflation. If 7% was too high for you, it is likely now a better time to connect with your lender to see if the current rates better align with your monthly housing allowance goals, as mortgage rates have begun to decline. Keeping an eye on inflation will offer you a strong indicator to where mortgage rates will go.

While there is no comparison to the rates offered at the beginning of 2022 there is hope that they will ease a bit from the dramatic climb.

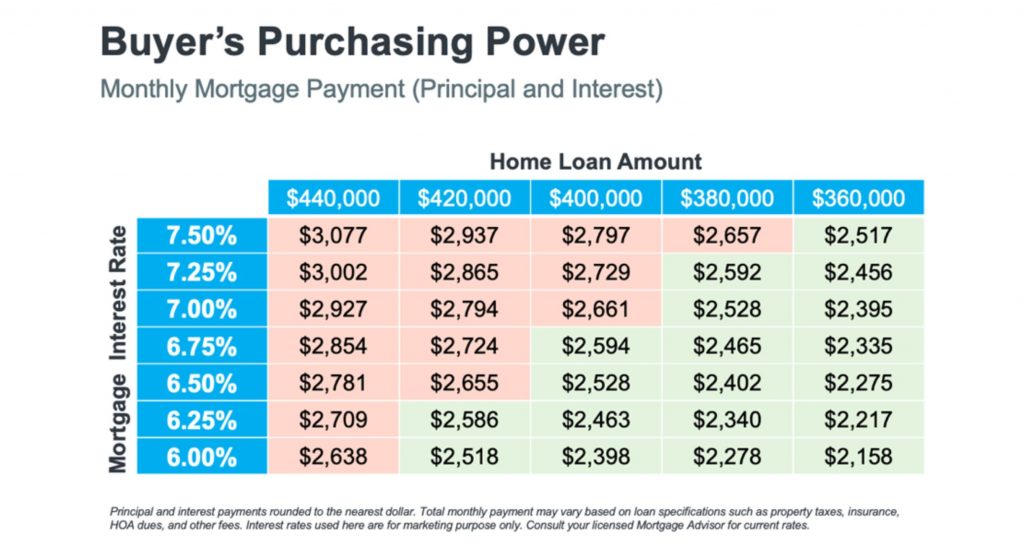

Buyers Purchasing Power

If you are considering buying, this decline in mortgage rates means an increase in your purchasing power. For example, let’s assume you want to buy a $400,000 home with a monthly payment between $2,500 and $2,600. Consider the chart below to see how your purchasing power changes as mortgage rates move up and down. The red demonstrates payments above your desired threshold while the green represents payments within and below your desired price range.

This is a small example of how a little quarter-point change in mortgage rates can significantly impact your monthly mortgage payment. It is of the utmost importance to work with a trusted real estate professional and lender who follow the market and understand the projected mortgage rates for the days, months, and year ahead,

If you are considering buying and do not have a trusted real estate broker already on your side, connect with us and we will pair you with a broker that will meet your needs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link