Is the Current Surge in Available Homes Fact or Fiction?

Whether you are considering a move or just staying informed about the housing market, having the latest information is crucial. With all the latest headlines you might find yourself wondering, “is the current surge in available homes fact or fiction?” Let us help provide you some insight, follow along for a current update on the supply of homes for sale in your area. Whether you are in the market to buy or sell, the available inventory plays a significant role. Dive into the details below for insights.

The Truth About Today’s Housing Inventory:

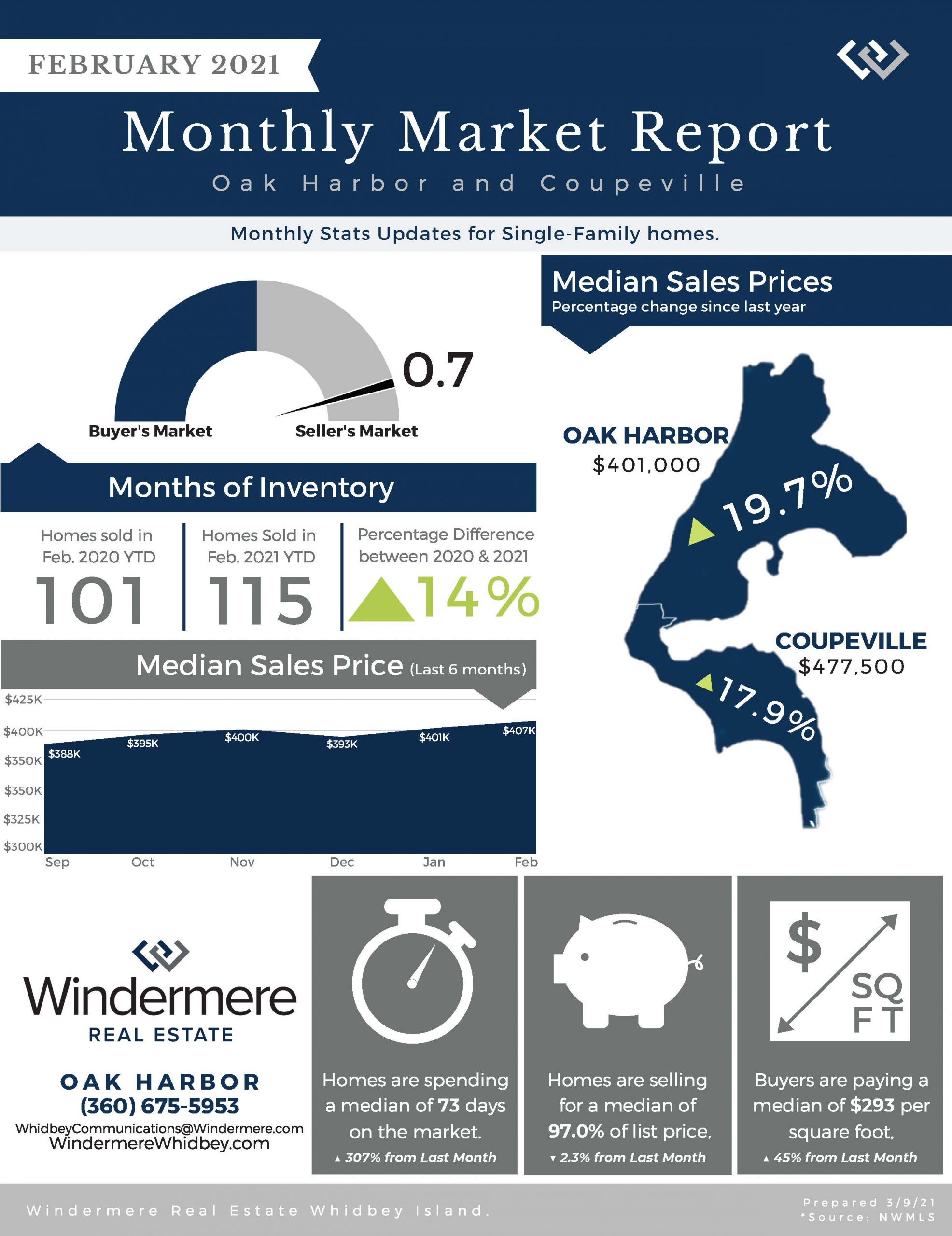

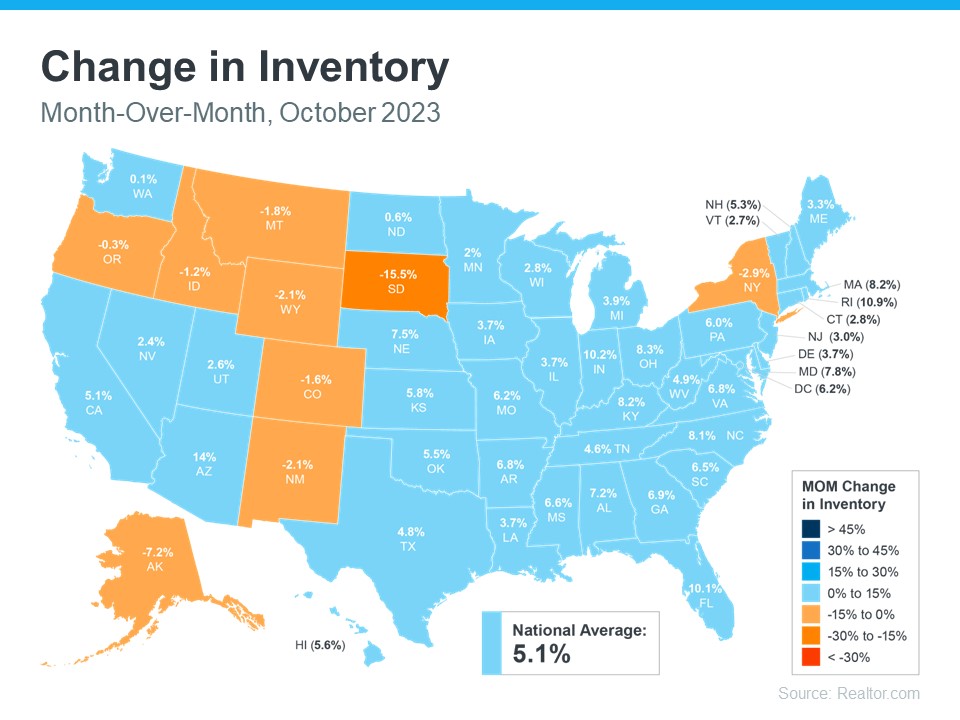

The narrative the past few years has been centered around the scarcity of homes on the market. However, recent national data demonstrates a twist to the story that if your like most might have you questioning the truth. According to Realtor.com, inventory is showing signs of growth month-over-month in numerous regions across the country (highlighted in blue on the map below).

Looking at the map, nationally, the housing supply has increased just over 5% last month alone.

Does This Mean the Days of Limited Housing Inventory is Over?

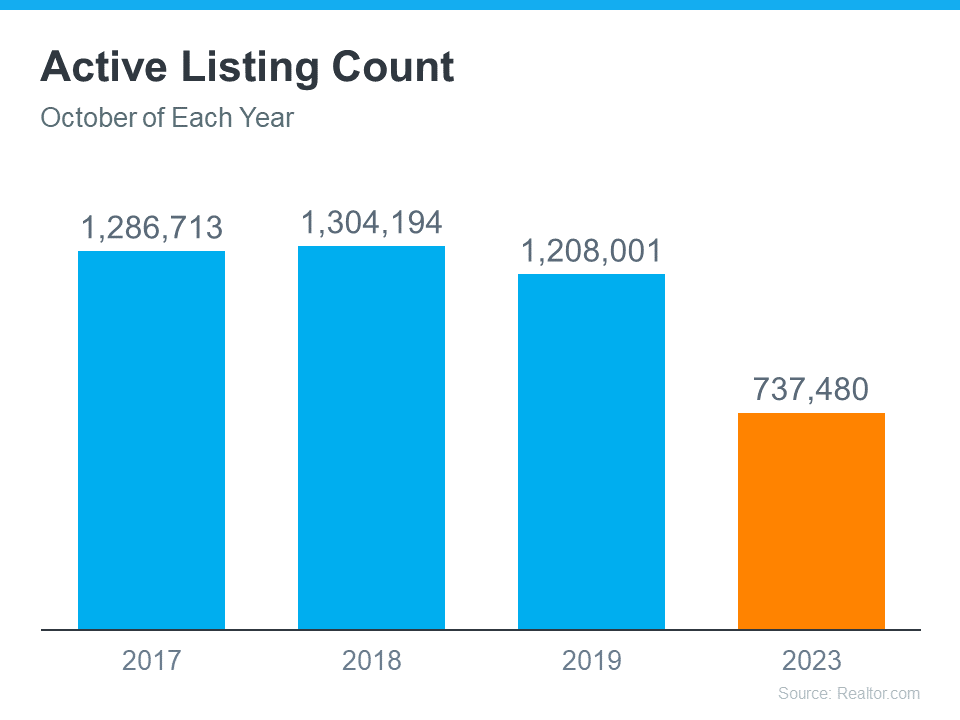

Many people are wondering if the days of limited housing supply is behind us. This is a fantastic question. The short answer is no. Understanding the full picture here is important. Headlines are stating that inventory is up. The statement is true when compared to the most recent market, but when you look further back, data shows that there are still significantly less homes for sale now than typically listed in a more normal market.

Let’s discuss the graph below.

This graph demonstrates homes listed for sale during the month of October for the three most recent normal years compared to homes listed in the month of October in 2023. As you can see there are significantly less homes listed in 2023 than in that of a normal market. Viewing this helps explain comments like the one ResiClub Analytics, founder, Lance Lambert made where he said, “Housing market inventory is so far below pre-pandemic levels that October’s big jump is still just a drop in the bucket.”

At the end of the day, real estate is hyper-local and changes vastly between locations. It is of the utmost importance, especially in times like these, to look to your trusted real estate agent for clarification of the market as they will help you gain better understanding of the inventory situations in your specific market. Don’t have an agent? Connect with us here.

If You Are Looking to Buy:

You might discover more options than you have in the most recent months. However, it would behoove you to prepare yourself for low inventory. Find yourself a great agent that will share their expertise and strategies that have helped others navigate today’s ongoing low housing.

If You Are Looking to Sell:

Know that you have not missed your window of opportunity to potentially get multiple offers or see your house sell quickly. While inventory has picked up some nationally, overall, it is still low. Having a professional Realtor on your side can help you significantly in understanding the market you are in. A great agent can craft your home a unique marketing plan that meets the requirements of the market to get your home sold.

Regardless of weather you are looking to buy or sell a home, let’s connect so that you are up to date on all of the latest trends that could potentially impact your move.

Annual Report 2022

Are you interested in buying or selling, or just wanting to learn more about the market or just Whidbey Island in general? We are here to help! Connect with us here.

Rising Mortgage Rates

Whether you are thinking about buying or planning to sell, it is critical for you to understand the role mortgage rates play on buyers purchasing power, and sellers listing prices.

But first, some definitions…

Mortgage rates:

the rate of interest charged on a mortgage loan.

Buyers purchasing power:

the amount of home you can afford to buy and is within your financial reach.

Seller’s listing price:

The sales price of a property when put on the market.

How the fluctuation in mortgage rates affect the two:

Buyers:

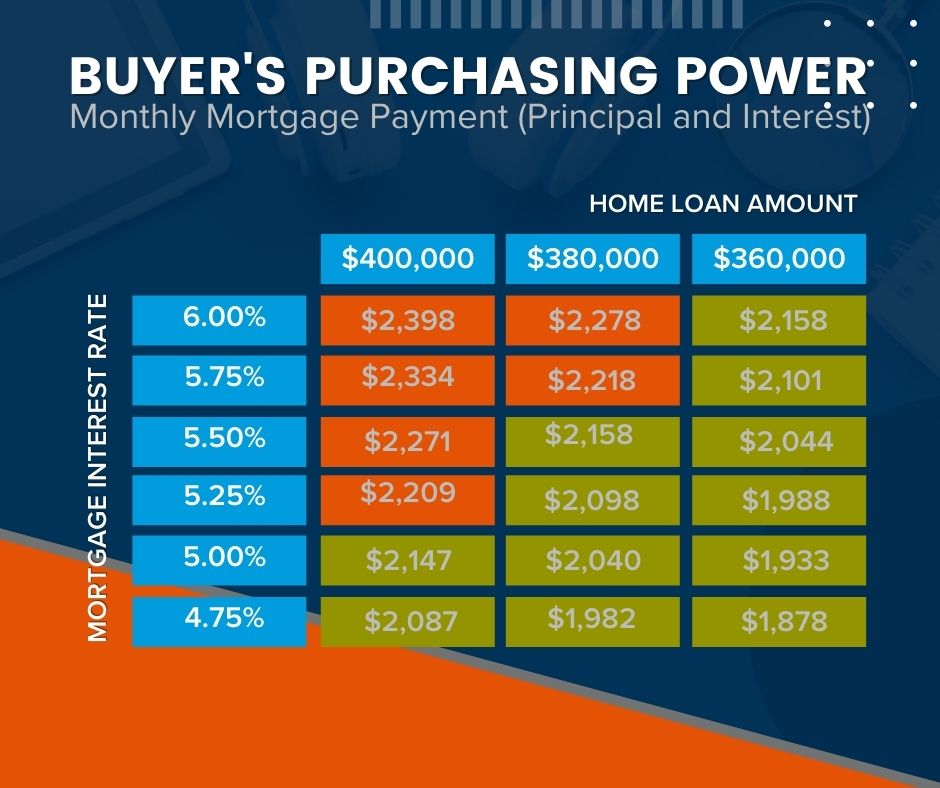

Mortgage rates directly affect the monthly payment buyers make on their home purchase. Even the smallest increases in mortgage rates can significantly impact their purchasing power. Typically speaking, for every 1% increase in mortgage rates buyers lose 10% of their purchasing power. In other words, when rates increase, so do monthly payments forcing many buyers to purchase less expensive homes to make up for the difference in interest and vice versa. With rates currently increasing, buyers need to beware that further mortgage rate increases could potentially limit their future purchasing power. If you are in the process of buying a home, it is of the utmost importance to have a strong plan. Connect with us so we can help you.

Sellers:

Rising mortgage rates result in a reduced number of overall buyers. With that said, we will likely begin to see the outrageous sales prices begin to decrease. Over the past couple years, we have witnessed a strong sellers’ market coupled with mortgage rates at an all-time low. This gave buyers the ability to purchase more home for low monthly payments. The limited inventory (homes for sale) resulted in wild selling prices. As buyers begin to get priced out of the market and mortgage rates begin to increase it will be of the utmost importance to carefully price your home for the market. You don’t want to risk coming out too high and getting stale or missing the opportunity to maximize interest. Skilled brokers will take into consideration and evaluate numerous factors when pricing expertly. It is not just the condition and location of the home, recent nearby sales, price of similar homes currently on the market but also mortgage rates, buying power, and other local variables. If you are thinking of selling connect with us so we can position your property to stand out in the current market.

Freddie Mac is saying. “History suggests that when rates rise, there is an initial bump in home prices, as many move quickly to buy a home before rates increase further. But after that period, home prices slow. Freddie Mac analysis shows that a 1% increase in mortgage rates results in home price appreciation that is four percentage points lower. For instance, a 1% increase in mortgage rates would change home price growth from 11% to 7%.”

Where we are at today:

Currently, the average 30-year fixed mortgage rate is above 5%. Experts anticipate that mortgage rates will continue to increase in the months ahead. If you are a buyer you have an opportunity to get in ahead of that increase by purchasing now.

Expert tip:

It is critical for you to get preapproved as early as possible to get todays rates locked in and prepare yourself with a plan incase rates are to go up. Additionally, sellers have a unique opportunity to still capitalize on the current situation if they are to list now before more buyers are completely priced out of the market and home prices are still strong. The graph below illustrates how mortgage interest rates drastically impact purchasing power and ultimately reducing the number of buyers bidding on homes in the higher price ranges.

Whether you are considering buying or selling let’s connect so that you have a trusted real estate advisor on your side who can help you strategize to achieve your dream of home ownership.

We are NOT in a Housing Bubble: Here’s Why!

Home buyers are beginning to believe we are heading into a housing bubble. It is easy to acknowledge this premonition, as year-after-year home price appreciation has continued to remain in the double digits.

However, we are here to put your mind at ease as this market is very different than it was during the housing crash 15 years ago. Follow along as we explain four fundamental reasons why today's market is nothing like the market was back then.

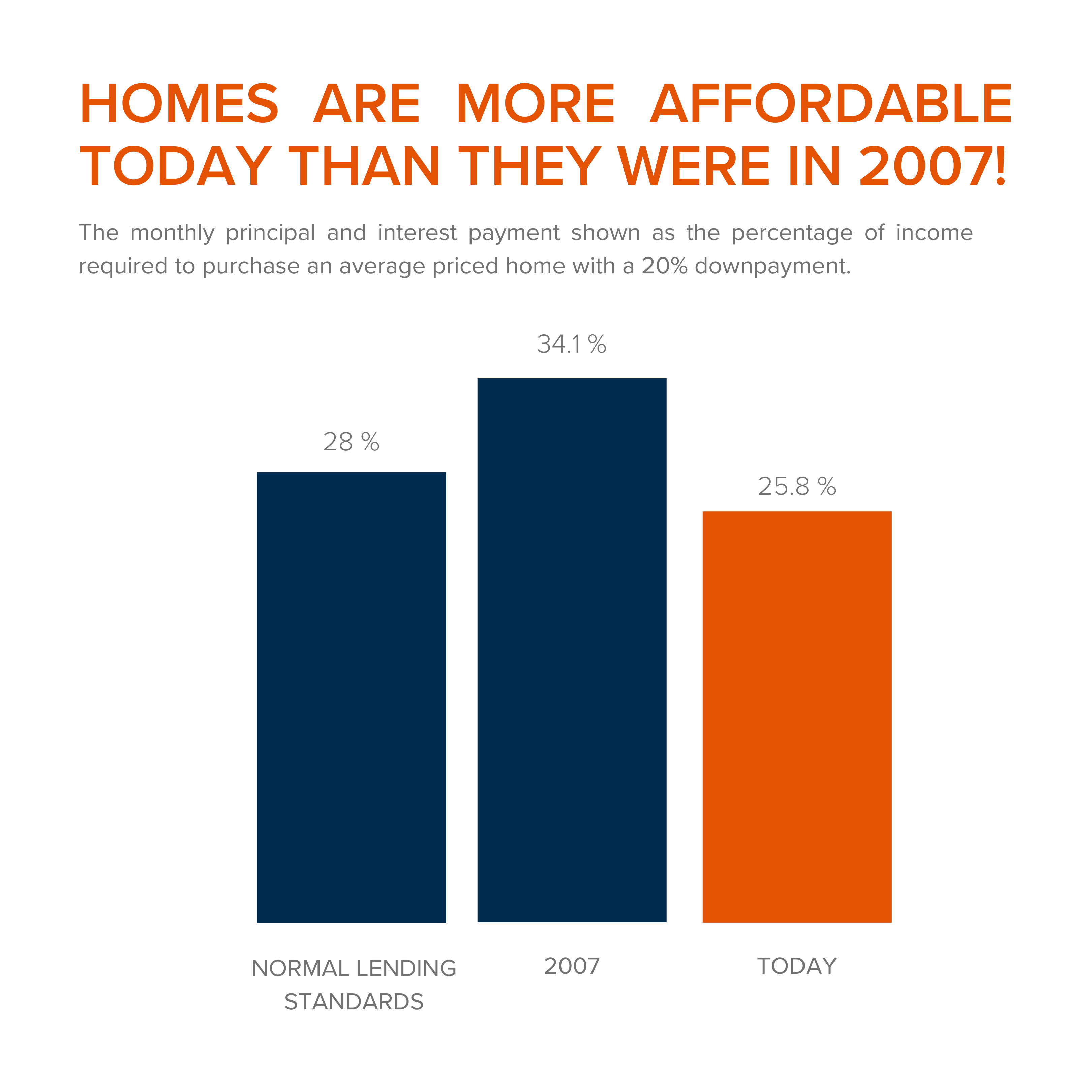

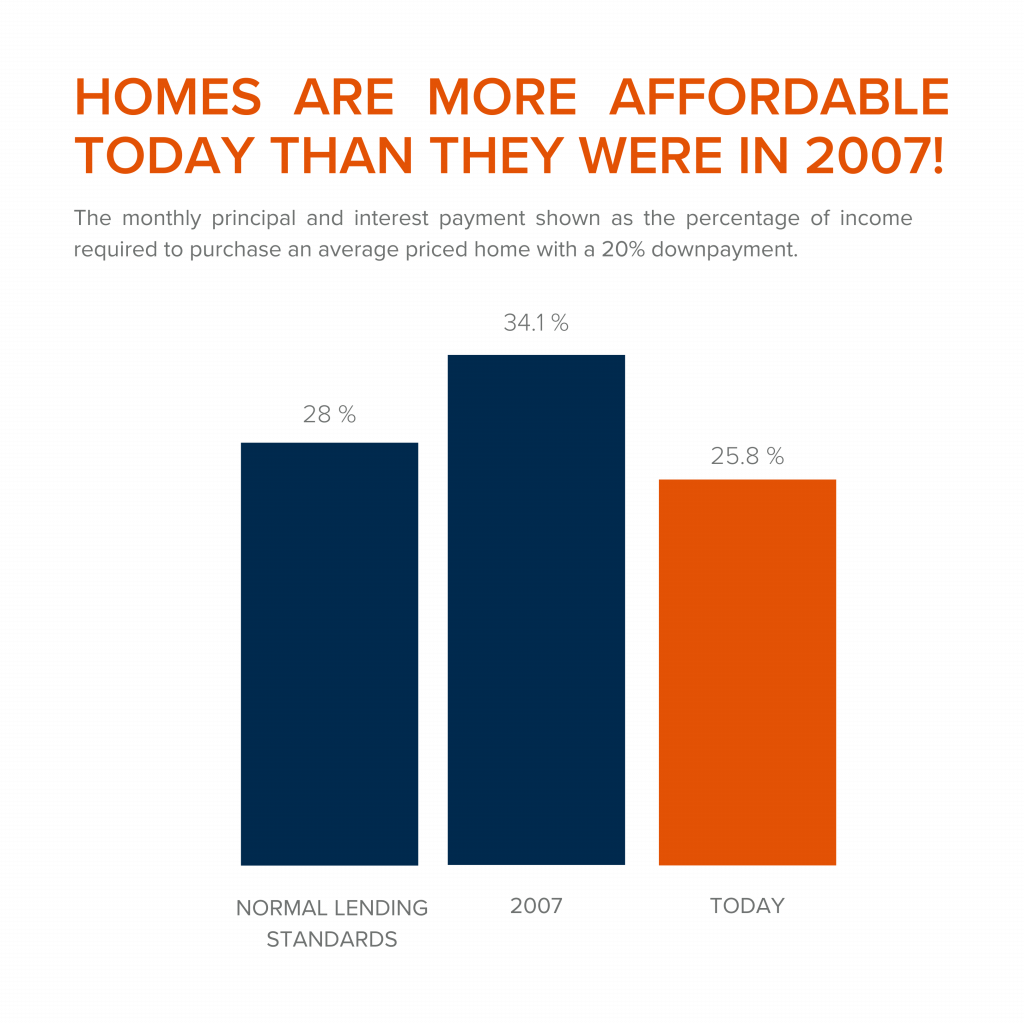

1. Houses Are Affordable Unlike During the Housing Boom

To understand this, one must understand the affordability formula. The affordability formula consists of three parts: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time of purchase. Conventional lending standards suggest a purchaser should spend no more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. While today's home prices are high, wages have increased significantly, and despite the latest spike, mortgage rates are still well below 6%. This means that todays average buyer spends less of their monthly income toward their mortgage payment than buyers did back then.

In the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta speaks to this stating, "The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward."

Undeniably, affordability is not as strong as it was last year, but it is significantly better than it was during the boom. The graph below demonstrates that difference:

How did so many homes sell during the housing boom with such prohibitive costs?

2. Mortgage Standards Were Much More Relaxed During the Boom

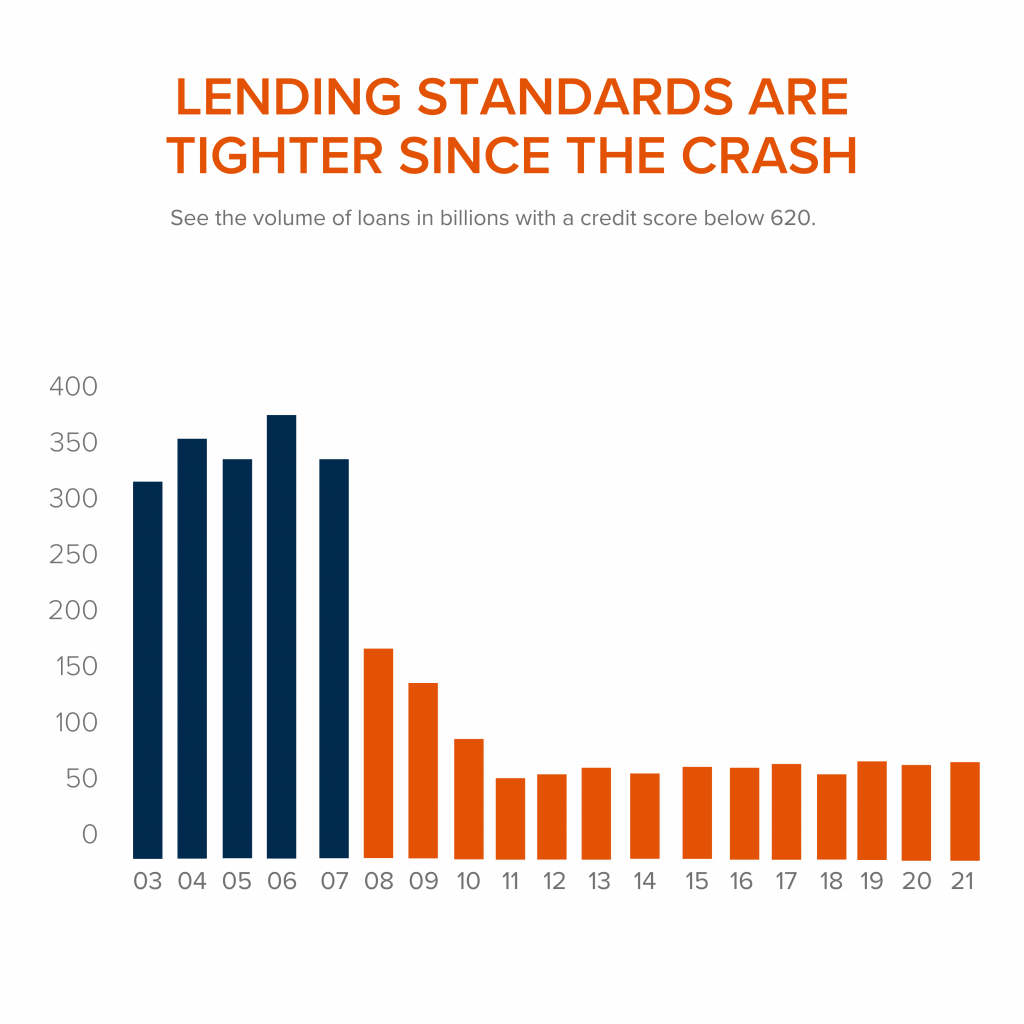

Getting approved for a mortgage loan was significantly more attainable during the housing bubble than it is today. According to credit.org, a credit score between 550-619 is considered poor. They define those with a score below 620, by stating that, "Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk."

While buyers can still qualify for a mortgage with a credit score within that range they are considered riskier borrowers. If you are in that range, read our How Long Does it Take to Save for a Down Payment article here. Below is a graph illustrating the mortgage volume issued to buyers with a credit score less than 620 during the housing boom, in compression to the following 14 years.

Mortgage standards are significantly different than they were last time. Buyers that obtained mortgages during the past decade are better qualified for the loans. Lets look at what that means moving forward.

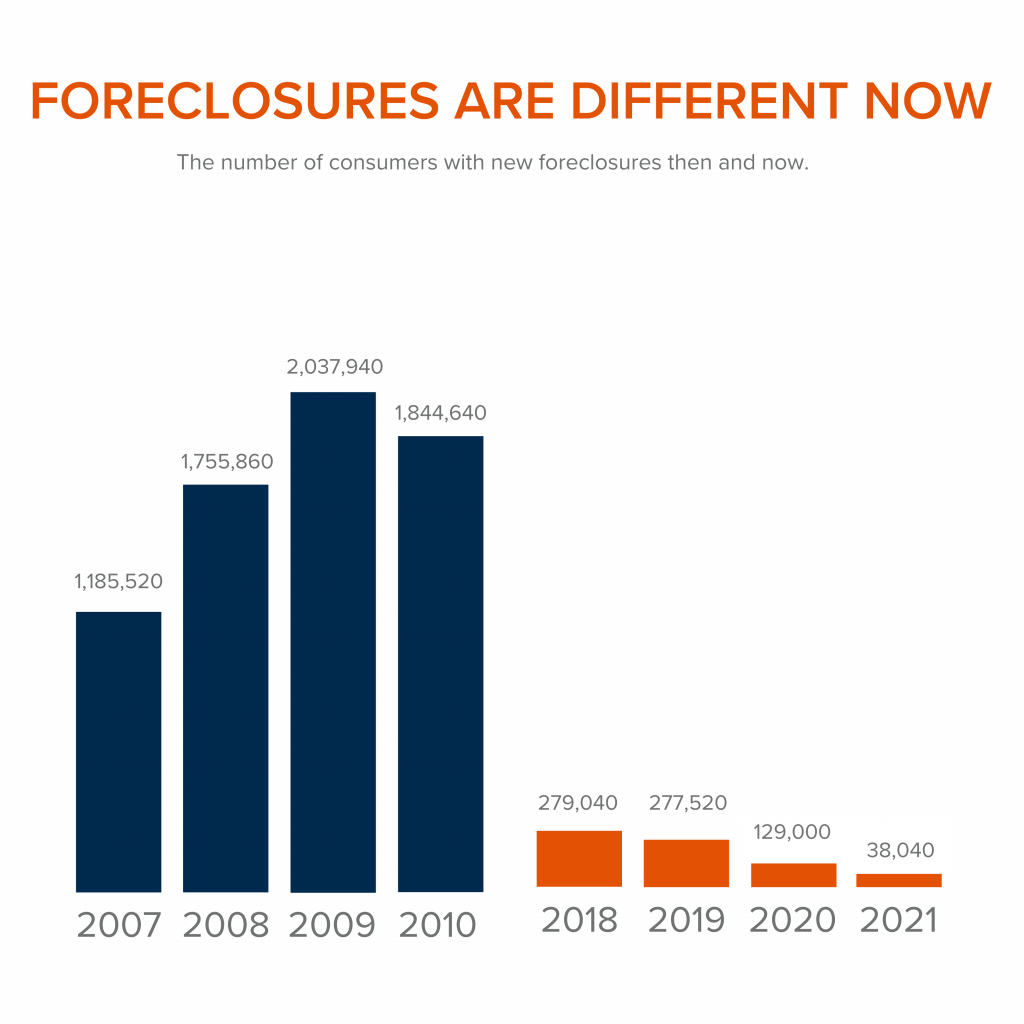

3. Foreclosure Are Completely Different Than They Were During The Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

Undoubtedly the 2020 and 2021 numbers are impacted by the forbearance program, which was created to help homeowners facing uncertainty during the pandemic. Keep in mind, there are less than 800,000 homeowners remaining in the program today, and the majority of those will be able to work out a repayment plan with their banks.

Rick Sharga, Executive Vice President of RealtyTrac, explains, "The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure' narrative was incorrect."

Why are there significantly less foreclosures seen today? Well, homeowners today are equity rich. They are not tapped out.

During the build-up to the housing bubble, some homeowners were using their homes as personal ATM machines. We saw a plethora of people withdrawing their equity the moment it was built up. When home values began to fall, many homeowners found themselves in a negative equity situation where the amount they owed on their mortgage had surpassed the value of their home. Many were faced with the decision of walking away from their homes. When that happened it led to a rash of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of comparable homes in the area.

Homeowners, have since learned their lessons. Prices have risen nicely over the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like they had previously, as indicated by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now standing at $300,000. What happened last time will not happen today.

As the latest Homeowner Equity Insights report from CoreLogic explains, "Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they've also enabled many to continue building their wealth."

There will be nowhere near the same number of foreclosures as we seen during the crash. What does that mean for the housing market today?

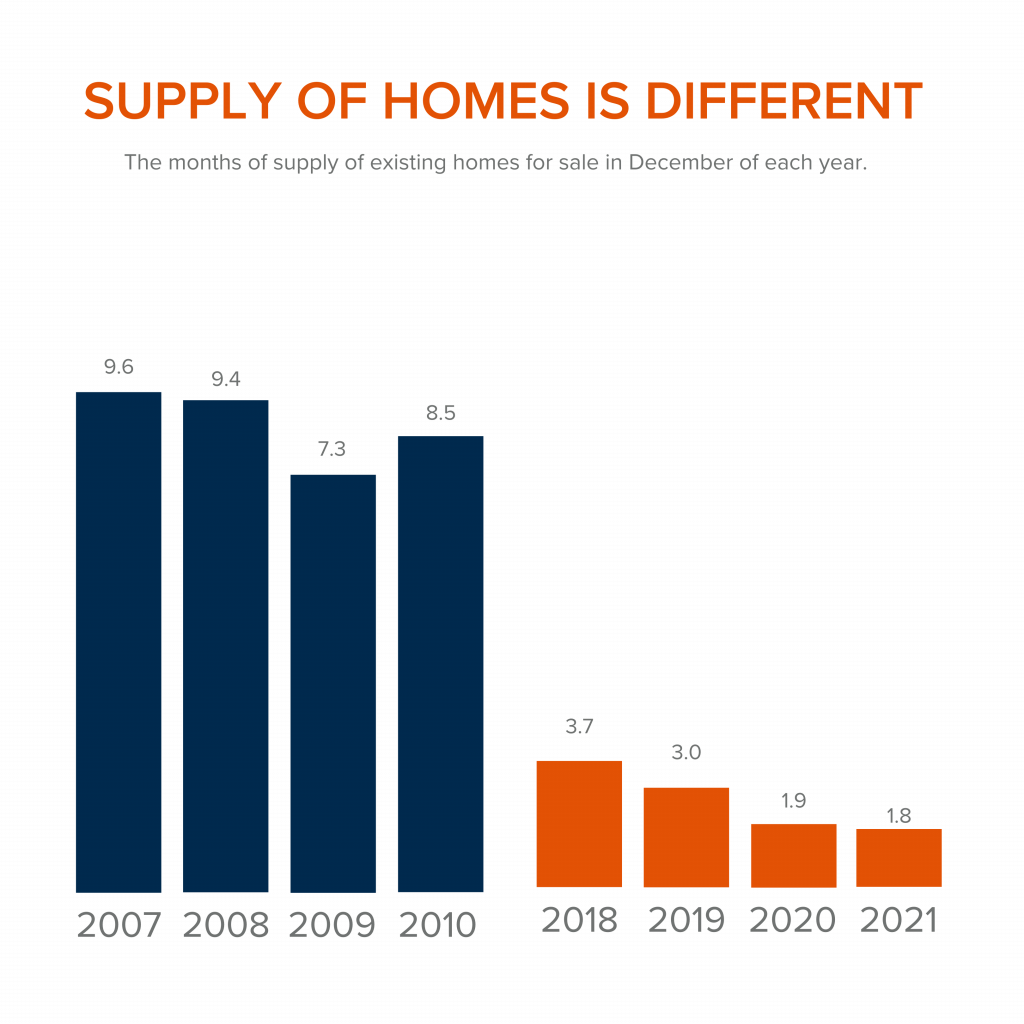

4. There is Not a Surplus of Homes on the Market – We Have a Shortage

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. The following graph demonstrates, the surplus of homes for sale between 2007 to 2010 (many of which were short sales and foreclosures). That caused prices to tumble. Today, there is a shortage of inventory, which is creating the increasing home values we are witnessing today.

Inventory is drastically different in comparison to last time. Prices are rising because there is a healthy demand for homeownership while at the same time there is a shortage of homes for sale.

At the end of the day,

if you are worried that we are making the same mistakes that led to the housing crash, the graphs above show data and insights to help alleviate your concerns. If you are considering buying or selling and would like to dive deeper into this subject we would be happy to schedule a consult with you. Call us today at 360.675.5953.

Is the Oak Harbor Housing Market Getting Squishy?

Written by: Kristen Stavros

16 September 2021

There is a general feeling amongst brokers that the Oak Harbor market has softened up just a bit. As Branch Manager and Co-owner of Windermere Whidbey Island I pay close attention to what my brokers are seeing and feeling out there in the market. When I begin to sense a theme I go to the numbers to see if they are telling the same story.

I’ll be really curious to see how these numbers change when we can add September data to them but I’m seeing the teensiest sign that there may be some easing.

For the first time all year, we’ve seen a dip in closed sales in August.

At the same time, new listings continue to rise every month.

Average days on market has plateaued.

Does this mean buyers can start getting homes for less $$$?

The answer is emphatically, NO. As you can see from the graphs below prices continue to climb, inventory is still at a record low, and homes are still moving off the market incredibly fast. This just means that instead of being up against 10 other buyers you now may be up against just 2-3 other qualified buyers. Instead of great homes going for up to 10-20% over list price, the good ones may just end up 5-8% over list. The pressure on buyers is still decidedly strong but the dial has been turned down ever so slightly.

Average Price Per Square Foot.

Months’ Supply of Homes (based on closed sales).

Average Days on Market.

Sellers still have a fantastic advantage in this market but things are changing weekly so we are encouraging sellers to not get too greedy or assured because doing so may mean you overprice the market, lose the opportunity to garner multiple offers out of the gate, and ultimately make less profit on your home.

Working with a smart and sophisticated listing agent has never been more important in the previous 3 years than it is RIGHT NOW. You need someone who is really going to take their time analyzing the market against your specific home before giving you pricing advice. Call us today to be connected with a market pricing expert!

This analysis focuses just on the Oak Harbor market but we have the same analysis going on for all of Whidbey Island! If you are interested in knowing more about any aspect of Whidbey Island real estate let us know and we are happy to share.

What would a million dollars buy you in today’s market?

What would a million dollars buy you in today’s market?

Has the thought ever crossed your mind, “if I had a million dollars, what would I do with it?” What about if you had a million dollars to spend on just your house? What would it look like? What kind of area would you like to live in? What would a million dollars even get you these days? Just for fun, we want to show you just what a million-ish dollar home looks like in this current market in three very different places – Whidbey Island, Sequim, and Seattle!

Let’s start right here at home on Whidbey Island!

-

1585 West Beach Rd, Oak Harbor – “Island Retreat”

Not far from the hustle and bustle of town, but far enough away to enjoy the calm, cool breeze of the Puget Sound is a real Island Retreat. Listed for $1,050,000, this home combines the simplicity of nature with a modern flare. Here you can enjoy your very private beachfront views from your living room, kitchen, bedroom or deck. Take a walk with Fido down the beach, relax with a steamy cup of coffee on your patio, enjoy views of the Olympic mountains, and soak in a romantic sunset with your special someone right from your own backyard. Now doesn’t that sound heavenly?

-

8260 Coho Way, Clinton – “Island Paradise”

Clinton is known for breathtaking homes with stunning views, and this Island Paradise doesn’t disappoint. For $1,598,000 you can call this little piece of paradise your own! Stay warm and cozy by your stone fireplace, and still enjoy a colorful sunset from your large living room windows. Soak in your very own jetted tub, entertain guests from your wrap deck with built in BBQ, play catch with the kids in your spacious yard, or cook a family favorite in your generously sized kitchen. You won’t ever want to leave home!

Moving on to Sequim, and a totally different housing market…

-

110 Flying Cloud, Sequim – “The Heavenly Abode”

This home may not have you literally flying on clouds, but you will feel like you found a little piece of heaven! At $1,178,950, this heavenly abode boasts a modern and chic atmosphere, custom features and finishes, generously sized rooms, and breathtaking views. Lose yourself in your favorite novel while sitting in your very own library, immerse yourself in views of the Straight of Juan de Fuca and the Cascade Mountains while you soak in your oversized master bathtub, sip a glass of wine and breathe in fresh mountain air on your patio, work on a project in your walkout basement, or work from home in your spacious office. Who knew a little piece of heaven landed right here in Washington?

-

342 Schoolhouse Point Lane, Sequim – “Waterfront Mansion”

A waterfront mansion is what comes to mind when looking at this two-story home with waterfront views. Listed at $1,385,000 this home not only provides you with ample space for your family, but also a separate guest house! Your fenced in yard is perfect for the kids and dog to play, a heated shop with boat and RV storage will give you all the space you need for those projects you’ve been longing to do, host Sunday brunch on your patio overlooking Sequim Bay, snooze in your favorite armchair in your reading nook with large windows and beautiful views, keep an array of plants in your greenhouse year round, or soak up some sun on your private beach area. You’ll find a little bit of everything on this paradise property.

We’ve seen Whidbey Island and Sequim, but what does a million dollars in Seattle look like?

-

1758 NW 62nd St, Seattle – “The Tetris House”

It may not seem like much, but this Seattle home is modern and way more technologically up-to-date than Tetris. “The Tetris House” is listed at $1,084,900 and its modern flair makes for a unique appearance inside and out. Entertain guests with a home-cooked meal created in your gourmet kitchen, turn your lights on and off with the sound of your voice, read a book in the sun on your rooftop deck, relax sore muscles in your oversized shower, unwind at the end of the day with dinner in front of your fireplace, or go for a short drive to enjoy downtown Seattle nightlife. This stylish, and smart home will be the envy of all your friends.

-

7748 32nd Ave NE, Seattle – “A Modern Oasis”

So new that you can still enjoy that new house smell! This Modern Oasis offers comfort and style in the heart of Seattle. For $1,550,000 you can be the first to occupy this home. Sit and enjoy the sound of rain on your covered patio, host family movie night in your spacious living room and lay out an array of snacks on your extra long kitchen island, relax in your master bath soaking tub, build a fort with the kids in your fenced in yard, and worry no more about dirt being tracked inside thanks to your conveniently located mud room off the front door. This home is a blank slate for your imagination to run with and make your very own!

Can you imagine yourself living in one of these unique homes? Maybe you aren’t in the million-dollar market for your next home, it can still be fun to daydream a little!

You might also like:

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link