Navigating Washington’s Agency Agreements Changes

You may have heard real estate laws are changing in Washington State. While navigating Washington’s agency agreement changes it’s important to note that it’s not uncommon for laws to change as industries evolve. In 2019 the rules requiring that buyer broker compensation be offered to list a property was eliminated. For transparency purposes, in 2019 another law made the buyer broker compensation offered in the listing viewable to the public. In 2022 laws were implemented that made the offer of buyer broker compensation separate and distinct from the offer to the seller’s broker. That same year, our Northwest Multiple Listing Service started including the amount of buyer broker compensation in the purchase and sale agreement so there is complete transparency within the transaction.

Other great changes that help the buyers and sellers is a revision of the agency law pamphlet. It is now more easily read and understood (taking it from 8 complicated pages to 4) and there is a requirement to sign a contract with buyers. Now buyers truly chose who is representing them and it doesn’t just happen randomly. Our brokers have been studying extensively not only the new laws but how to best implement them and prepare their clients to understand how the changes in the laws will affect them. Follow along as we walk you through navigating Washington’s agency agreement changes with an overview of the changes, how it impacts buyers and sellers, and offer you further resources for more information.

Overview of the New Laws:

Prior to January 1, 2024 Washington State law only required brokers representing sellers to enter into a brokerage agreement. Starting January 1, 2024 Chapter 18.86 RCW mandates brokers representing buyers in a residential transaction enter into a written brokerage service agreement as soon as reasonably possible. Washington is the first state to implement this type of legislation. This contractual arrangement encompasses key provisions such as the duration of the partnership, exclusivity terms, and the agreed-upon compensation rate. The purpose of the change is to ensure that buyers understand the scope of the representation, how much it will cost, and how the costs are paid prior to agents providing any real estate services.

Impact on Buyers:

There are a couple of changes that buyers should expect to see. The first is that they will be asked to commit to a Buyers broker early on. It’s going to behoove buyers to take their selection of the broker they work with much more seriously. Buyers will now be presented with an agency agreement prior to their agents providing any services. This might feel a bit off-putting to commit so soon, but Windermere brokers have never forced clients to work with them and are using an agreement that gives buyers control to end the agency relationship at any time. Be sure to read the agreement carefully and identify what the procedures are for canceling the buyer-broker agreement. Great Agents often provide you with a cancelation document or instructions upfront so that you can rest assured that you will not be stuck if their services don’t meet your expectations.

Impact on Sellers:

For the most part, sellers are not significantly impacted by the new changes. The only significant change that sellers can expect to see is that agents may offer a Seller Brokerage Service Agreement earlier than in the past. The new listing agreement allows for signing up to 90 days in advance of going on the market.

Overall, the changes are positive. They are put in place to protect consumers, which we are all about! By law, every client is to receive the Agency Law Pamphlet. The buyer or seller should take time to read it and understand it prior to signing any agreement. If you find yourself with more questions than answers, don’t hesitate to ask questions or seek guidance. If an agent does not currently represent you and you are seeking quality representation, connect with us. We can give you a few names of excellent brokers to interview. It is important to stay informed about these changes to ensure a smooth real estate transaction.

If you would like to discuss this in greater detail, please do not hesitate to connect with us.

Rising Mortgage Rates

Whether you are thinking about buying or planning to sell, it is critical for you to understand the role mortgage rates play on buyers purchasing power, and sellers listing prices.

But first, some definitions…

Mortgage rates:

the rate of interest charged on a mortgage loan.

Buyers purchasing power:

the amount of home you can afford to buy and is within your financial reach.

Seller’s listing price:

The sales price of a property when put on the market.

How the fluctuation in mortgage rates affect the two:

Buyers:

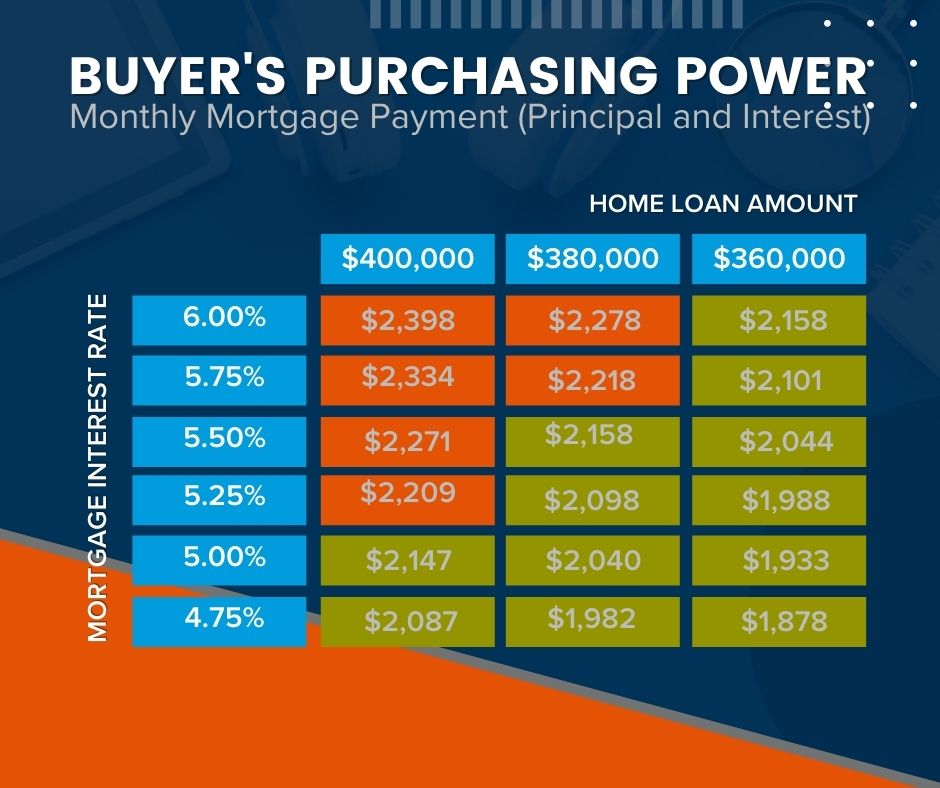

Mortgage rates directly affect the monthly payment buyers make on their home purchase. Even the smallest increases in mortgage rates can significantly impact their purchasing power. Typically speaking, for every 1% increase in mortgage rates buyers lose 10% of their purchasing power. In other words, when rates increase, so do monthly payments forcing many buyers to purchase less expensive homes to make up for the difference in interest and vice versa. With rates currently increasing, buyers need to beware that further mortgage rate increases could potentially limit their future purchasing power. If you are in the process of buying a home, it is of the utmost importance to have a strong plan. Connect with us so we can help you.

Sellers:

Rising mortgage rates result in a reduced number of overall buyers. With that said, we will likely begin to see the outrageous sales prices begin to decrease. Over the past couple years, we have witnessed a strong sellers’ market coupled with mortgage rates at an all-time low. This gave buyers the ability to purchase more home for low monthly payments. The limited inventory (homes for sale) resulted in wild selling prices. As buyers begin to get priced out of the market and mortgage rates begin to increase it will be of the utmost importance to carefully price your home for the market. You don’t want to risk coming out too high and getting stale or missing the opportunity to maximize interest. Skilled brokers will take into consideration and evaluate numerous factors when pricing expertly. It is not just the condition and location of the home, recent nearby sales, price of similar homes currently on the market but also mortgage rates, buying power, and other local variables. If you are thinking of selling connect with us so we can position your property to stand out in the current market.

Freddie Mac is saying. “History suggests that when rates rise, there is an initial bump in home prices, as many move quickly to buy a home before rates increase further. But after that period, home prices slow. Freddie Mac analysis shows that a 1% increase in mortgage rates results in home price appreciation that is four percentage points lower. For instance, a 1% increase in mortgage rates would change home price growth from 11% to 7%.”

Where we are at today:

Currently, the average 30-year fixed mortgage rate is above 5%. Experts anticipate that mortgage rates will continue to increase in the months ahead. If you are a buyer you have an opportunity to get in ahead of that increase by purchasing now.

Expert tip:

It is critical for you to get preapproved as early as possible to get todays rates locked in and prepare yourself with a plan incase rates are to go up. Additionally, sellers have a unique opportunity to still capitalize on the current situation if they are to list now before more buyers are completely priced out of the market and home prices are still strong. The graph below illustrates how mortgage interest rates drastically impact purchasing power and ultimately reducing the number of buyers bidding on homes in the higher price ranges.

Whether you are considering buying or selling let’s connect so that you have a trusted real estate advisor on your side who can help you strategize to achieve your dream of home ownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link