Minimizing the Stress of Selling Your Home

Minimizing the Stress of Selling Your Home: Navigating the Emotions and the Process

Selling your home is more than just a transaction; it’s the closing of one chapter and the beginning of another. For many homeowners, the process is not only physically demanding but also emotionally overwhelming. After all, you are not parting with just a property, you may be leaving behind a space filled with memories, milestones, and meaningful moments.

While the process of selling a home can be daunting, there are practical steps you can take to minimize the stress and make the experience smoother. Follow along for an approach to selling your home with confidence and clarity, while honoring the memories you have made along the way.

Acknowledge the Emotional Side of Selling

It’s perfectly natural to feel sentimental when preparing to sell your home. Over the years, you’ve celebrated birthdays, holidays, and milestones within those walls. Instead of pushing those feelings aside, acknowledge them. Take a walk through your home and reflect on the positive memories you’ve created.

If it helps, capture a few meaningful photos of your favorite spots in the house or yard. This can give you a sense of closure while also preserving the memories you’ve built.

Start Decluttering Early

One of the most overwhelming parts of selling a home is realizing just how much you’ve accumulated over the years. The earlier you start decluttering, the less stressful the process will be when it’s time to move.

Start small. Tackle one closet or one room at a time. Create piles for items to keep, donate, or discard. Remember, letting go of physical items doesn’t mean letting go of the memories. It simply means making space for new ones in your next chapter.

If you find it difficult to part with certain sentimental items, consider designating a keepsake box for small mementos that carry deep meaning. This allows you to hold on to the most important pieces without feeling overwhelmed by clutter and allows the home to be ready for showings and positions the home to sell for top dollar.

Focus on the Future, Not Just the Past

While it is natural to feel nostalgic, it is also important to shift your focus toward the exciting opportunities ahead. Whether you are downsizing, upsizing, or relocating, think about what your next home will offer. Create a vision board or jot down a list of things you are looking forward to in your new space.

Focusing on the future will help balance the emotions of leaving your current home. Creating a simple reminder that while you are leaving one place behind, you are also entering into something new and exciting.

Lean on Your Real Estate Professional

Selling a home is a major life transition. You shouldn’t have to navigate it alone. Partnering with a trusted real estate agent can ease the burden significantly. Your agent will guide you through the listing, staging, and selling process while also offering valuable perspective and support.

Beyond logistics, your real estate agent can offer insights into market trends, pricing strategies, and negotiating tactics. Their guidance allows you to focus less on the technical details and more on preparing for your next chapter.

The sooner you get your agent involved, the smoother your home-selling process will be. With their market expertise, they’ll assess your home’s value, recommend improvements, and develop a personalized plan to help you achieve the best possible price.

Your agent may suggest professional staging, improving curb appeal, or small upgrades to boost your home’s marketability. Whether you move out or stay during the selling process, your agent will guide you every step of the way to ensure your home shows at its best.

Ready to get started? If you don’t have an agent yet, click here to get connected with one today.

Create a “Moving Game Plan”

The logistical side of moving can quickly become stressful without a plan. Minimize chaos by creating a clear, step-by-step game plan for your move. Start by setting target dates for decluttering, packing, and hiring professional movers, if needed.

Having a clear plan in place allows you to break the process into manageable pieces, reducing last-minute stress and ensuring a smoother transition to your new home.

Get an Inspection & Make a Game Plan for Key Repairs

Conducting a pre-inspection aids you in understanding your home’s condition and helps you prioritize repairs. Some major fixes like a new roof or water heater may be necessary while other cosmetic updates may not be required. Talking with your agent can help you decide what is most important based on current market conditions and buyer expectations and help you with your timeline. If your budget is tight, consider asking your agent about the Windermere Ready program.

Embrace the Journey

Finally, remember that selling your home is not just an ending—it is a beginning. Yes, you are leaving behind a place filled with memories, but you are also opening the door to new adventures, new neighbors, and new experiences.

Take time to appreciate the journey. Pause to reflect on how far you’ve come. Embrace the transition with gratitude.

Final Thoughts

While the process can be emotionally and physically challenging, taking intentional steps to declutter, plan, and lean on your real estate professional can significantly reduce your stress.

As you turn the page and step into your next chapter, remember that home is not defined by four walls, it is defined by the love, memories, and experiences you carry with you.

If you are ready to take the next step connect with us. We are here to help you navigate your journey.

Rising Mortgage Rates

Whether you are thinking about buying or planning to sell, it is critical for you to understand the role mortgage rates play on buyers purchasing power, and sellers listing prices.

But first, some definitions…

Mortgage rates:

the rate of interest charged on a mortgage loan.

Buyers purchasing power:

the amount of home you can afford to buy and is within your financial reach.

Seller’s listing price:

The sales price of a property when put on the market.

How the fluctuation in mortgage rates affect the two:

Buyers:

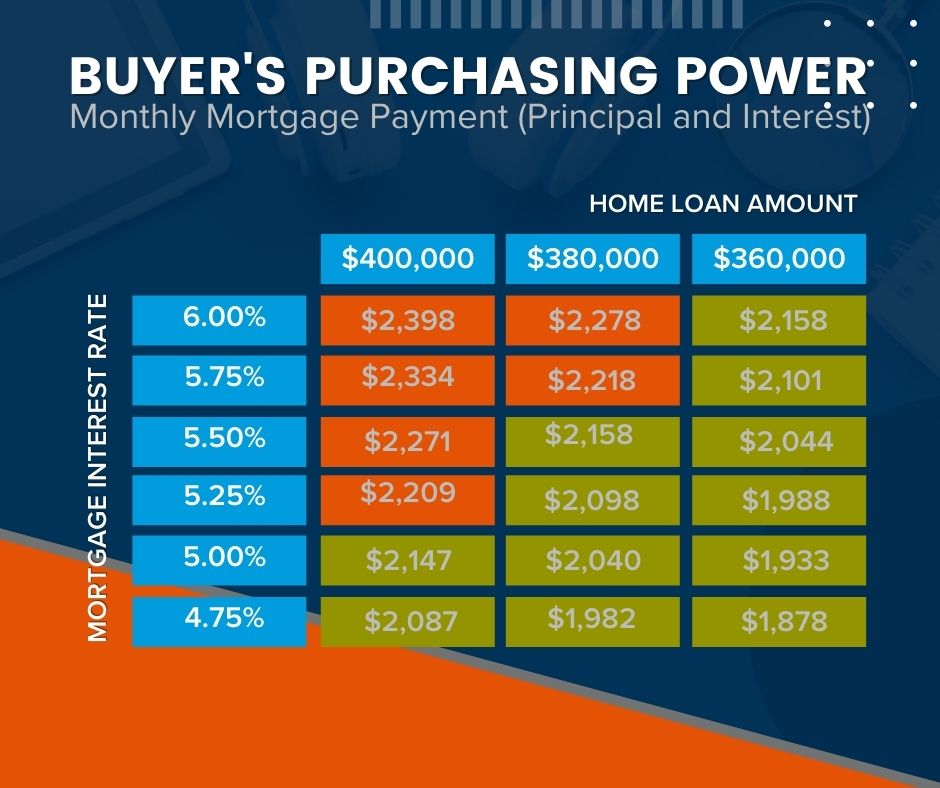

Mortgage rates directly affect the monthly payment buyers make on their home purchase. Even the smallest increases in mortgage rates can significantly impact their purchasing power. Typically speaking, for every 1% increase in mortgage rates buyers lose 10% of their purchasing power. In other words, when rates increase, so do monthly payments forcing many buyers to purchase less expensive homes to make up for the difference in interest and vice versa. With rates currently increasing, buyers need to beware that further mortgage rate increases could potentially limit their future purchasing power. If you are in the process of buying a home, it is of the utmost importance to have a strong plan. Connect with us so we can help you.

Sellers:

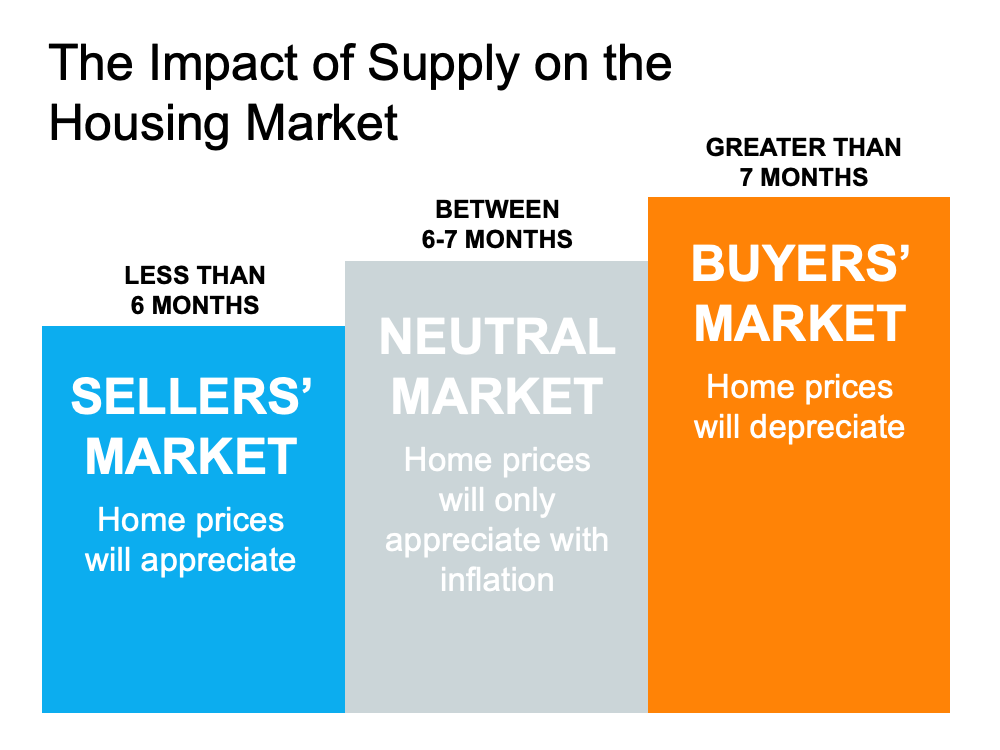

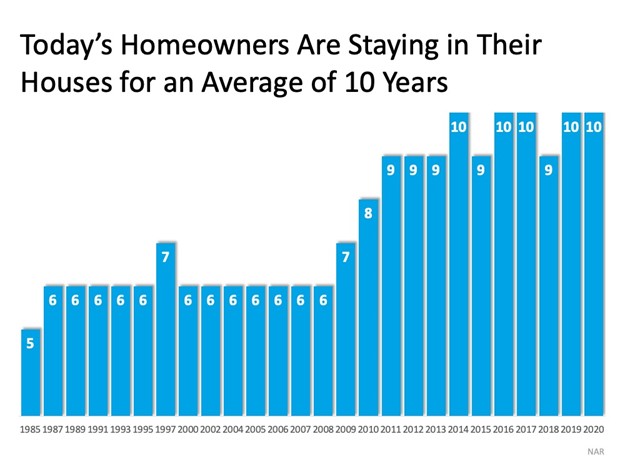

Rising mortgage rates result in a reduced number of overall buyers. With that said, we will likely begin to see the outrageous sales prices begin to decrease. Over the past couple years, we have witnessed a strong sellers’ market coupled with mortgage rates at an all-time low. This gave buyers the ability to purchase more home for low monthly payments. The limited inventory (homes for sale) resulted in wild selling prices. As buyers begin to get priced out of the market and mortgage rates begin to increase it will be of the utmost importance to carefully price your home for the market. You don’t want to risk coming out too high and getting stale or missing the opportunity to maximize interest. Skilled brokers will take into consideration and evaluate numerous factors when pricing expertly. It is not just the condition and location of the home, recent nearby sales, price of similar homes currently on the market but also mortgage rates, buying power, and other local variables. If you are thinking of selling connect with us so we can position your property to stand out in the current market.

Freddie Mac is saying. “History suggests that when rates rise, there is an initial bump in home prices, as many move quickly to buy a home before rates increase further. But after that period, home prices slow. Freddie Mac analysis shows that a 1% increase in mortgage rates results in home price appreciation that is four percentage points lower. For instance, a 1% increase in mortgage rates would change home price growth from 11% to 7%.”

Where we are at today:

Currently, the average 30-year fixed mortgage rate is above 5%. Experts anticipate that mortgage rates will continue to increase in the months ahead. If you are a buyer you have an opportunity to get in ahead of that increase by purchasing now.

Expert tip:

It is critical for you to get preapproved as early as possible to get todays rates locked in and prepare yourself with a plan incase rates are to go up. Additionally, sellers have a unique opportunity to still capitalize on the current situation if they are to list now before more buyers are completely priced out of the market and home prices are still strong. The graph below illustrates how mortgage interest rates drastically impact purchasing power and ultimately reducing the number of buyers bidding on homes in the higher price ranges.

Whether you are considering buying or selling let’s connect so that you have a trusted real estate advisor on your side who can help you strategize to achieve your dream of home ownership.

Before & After – The Importance of Staging

Before & After - The Importance of Staging

It is normal for you to love your home and all of your belongings. However, when it comes time to move, and you are ready to sell, you want your home to be as appealing as possible to as many buyers as possible. To accomplish this you must prepare your home in a way that buyers can envision themselves living there.

The purpose of staging is to make the home speak to everyone else, in a captivating manor. The last thing you want is your personal belongings distracting your buyers from the features of your home that will make it sell.

For example when buyers see:

Piles of papers everywhere it tells them there is not enough storage. Solution: straighten up, get rid of the unnecessary, and create a cleaner more inviting space.

Filled kitchen counters make them think there are not enough cabinets. Solution: Clear off your countertops.

Packed closets lead them to believe the closet is too small. Solution: Do a bit of spring cleaning before photo day get rid of the unnecessary, fold clothes, straighten shoes, and organize your clothes by color on your hangers.

Rooms with a lot of furniture makes them feel cramped and left feeling like there is not enough room. Solution: move furniture into a way that is fitting for each room, perhaps rearranging furniture into other rooms or reducing the amount of furniture altogether.

When your home is clean, clutter-free, and/or staged you are telling potential buyers that you take good care of your home, while simultaneously providing them a clean slate to imagine themselves living there.

81% of Realtors said staging helps buyers visualize the property as a future home, while 46% said it makes prospective buyers more willing to walk through a home they saw online.

Ready to get started?

So, you can either be the "house with the beautiful granite counters and fantastic views" or the "house with the National Geographic collection where the dinning table is supposed to be."

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link