Is the Current Surge in Available Homes Fact or Fiction?

Whether you are considering a move or just staying informed about the housing market, having the latest information is crucial. With all the latest headlines you might find yourself wondering, “is the current surge in available homes fact or fiction?” Let us help provide you some insight, follow along for a current update on the supply of homes for sale in your area. Whether you are in the market to buy or sell, the available inventory plays a significant role. Dive into the details below for insights.

The Truth About Today’s Housing Inventory:

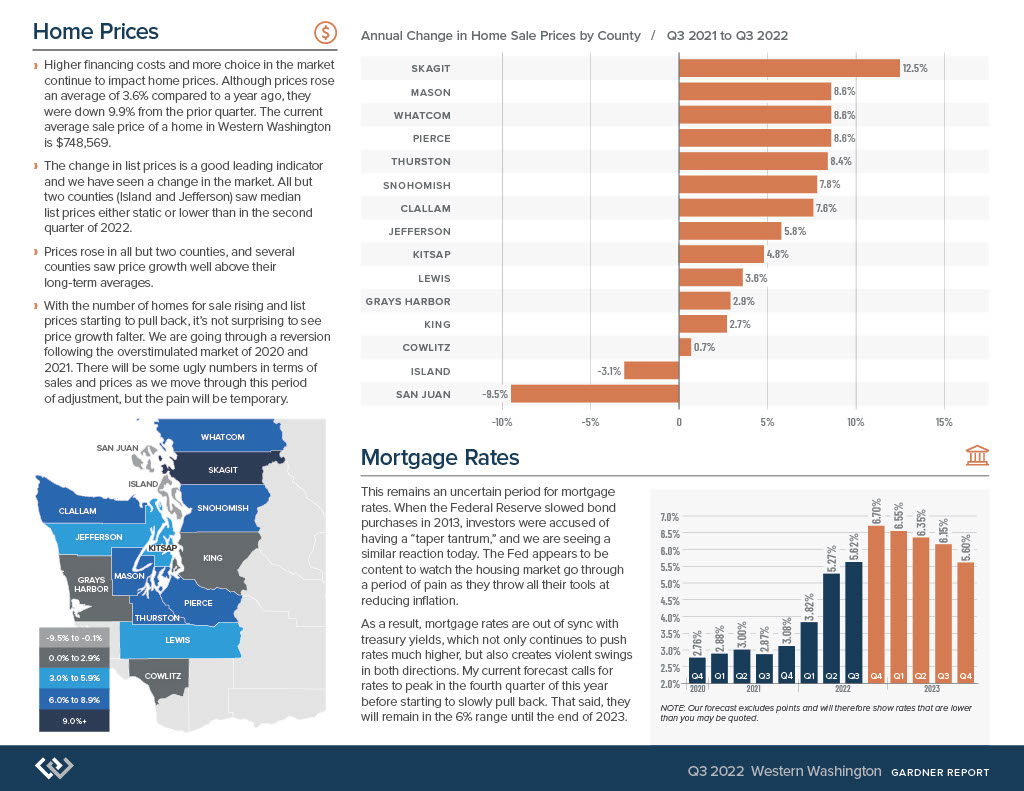

The narrative the past few years has been centered around the scarcity of homes on the market. However, recent national data demonstrates a twist to the story that if your like most might have you questioning the truth. According to Realtor.com, inventory is showing signs of growth month-over-month in numerous regions across the country (highlighted in blue on the map below).

Looking at the map, nationally, the housing supply has increased just over 5% last month alone.

Does This Mean the Days of Limited Housing Inventory is Over?

Many people are wondering if the days of limited housing supply is behind us. This is a fantastic question. The short answer is no. Understanding the full picture here is important. Headlines are stating that inventory is up. The statement is true when compared to the most recent market, but when you look further back, data shows that there are still significantly less homes for sale now than typically listed in a more normal market.

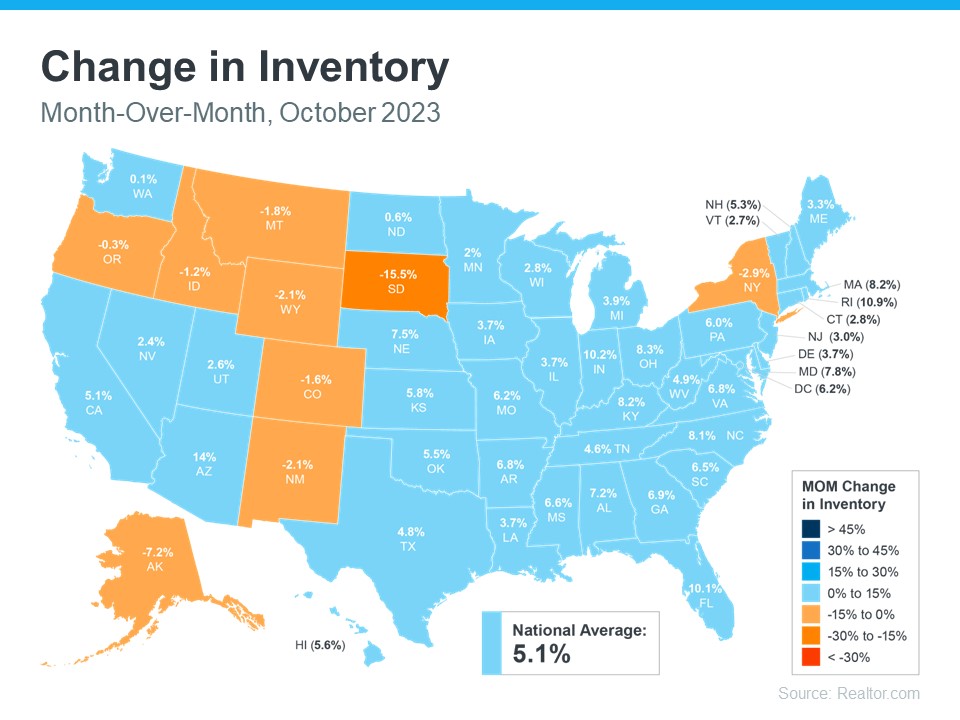

Let’s discuss the graph below.

This graph demonstrates homes listed for sale during the month of October for the three most recent normal years compared to homes listed in the month of October in 2023. As you can see there are significantly less homes listed in 2023 than in that of a normal market. Viewing this helps explain comments like the one ResiClub Analytics, founder, Lance Lambert made where he said, “Housing market inventory is so far below pre-pandemic levels that October’s big jump is still just a drop in the bucket.”

At the end of the day, real estate is hyper-local and changes vastly between locations. It is of the utmost importance, especially in times like these, to look to your trusted real estate agent for clarification of the market as they will help you gain better understanding of the inventory situations in your specific market. Don’t have an agent? Connect with us here.

If You Are Looking to Buy:

You might discover more options than you have in the most recent months. However, it would behoove you to prepare yourself for low inventory. Find yourself a great agent that will share their expertise and strategies that have helped others navigate today’s ongoing low housing.

If You Are Looking to Sell:

Know that you have not missed your window of opportunity to potentially get multiple offers or see your house sell quickly. While inventory has picked up some nationally, overall, it is still low. Having a professional Realtor on your side can help you significantly in understanding the market you are in. A great agent can craft your home a unique marketing plan that meets the requirements of the market to get your home sold.

Regardless of weather you are looking to buy or sell a home, let’s connect so that you are up to date on all of the latest trends that could potentially impact your move.

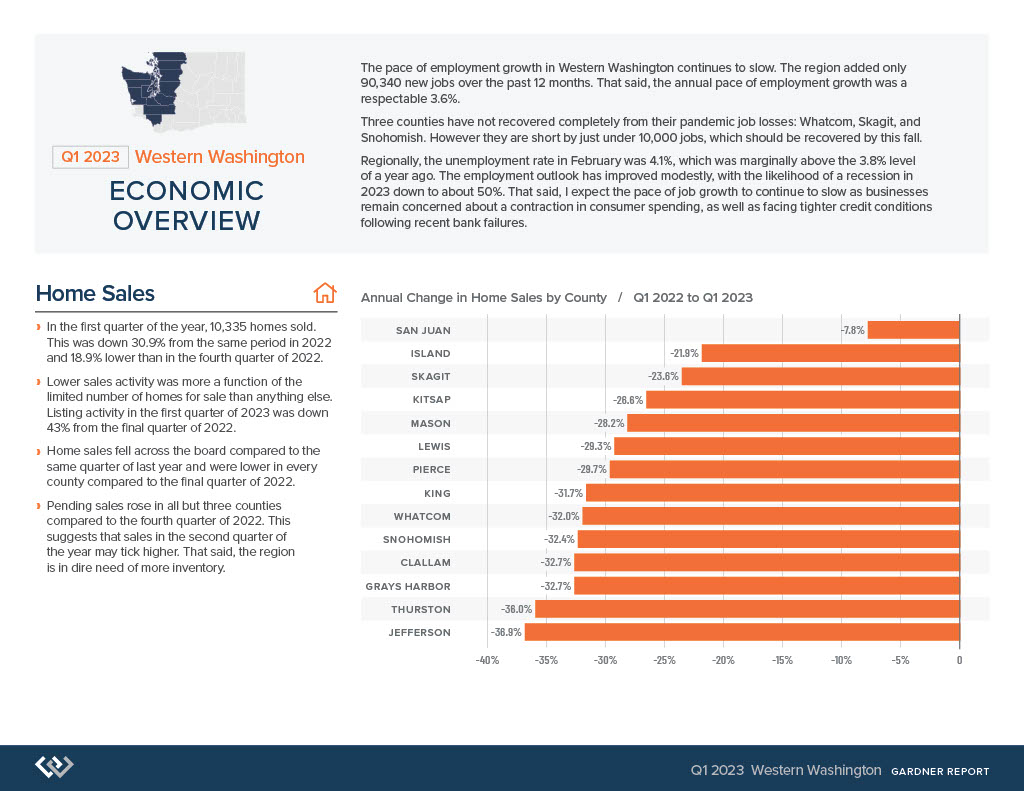

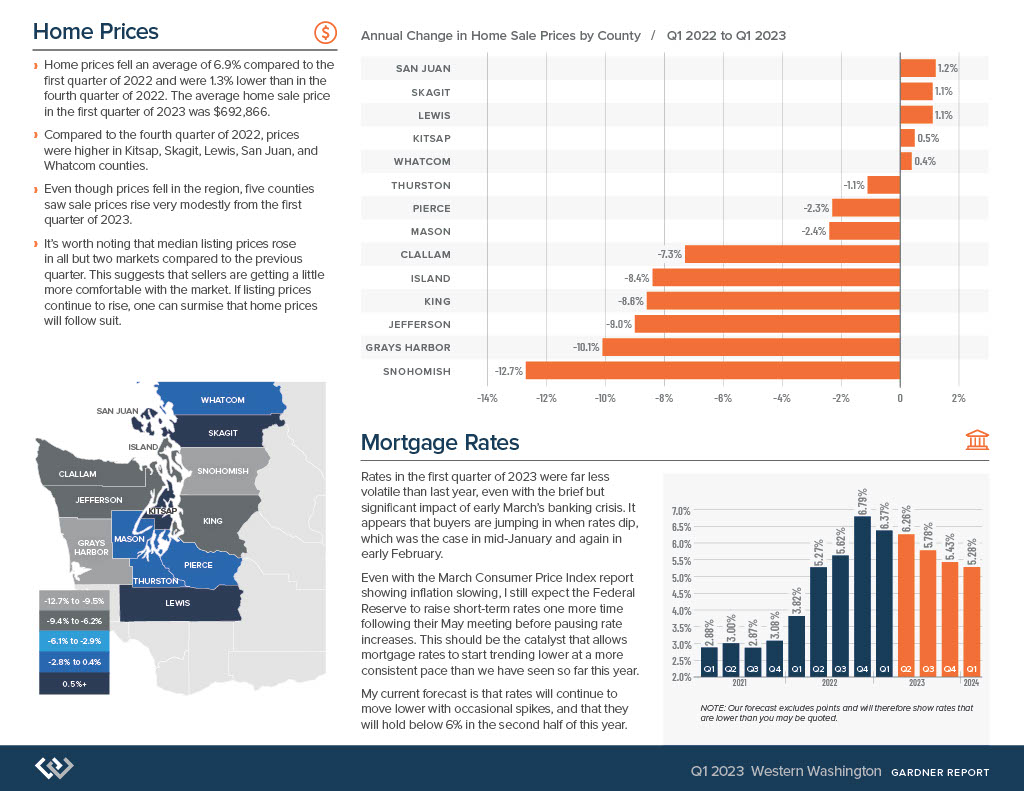

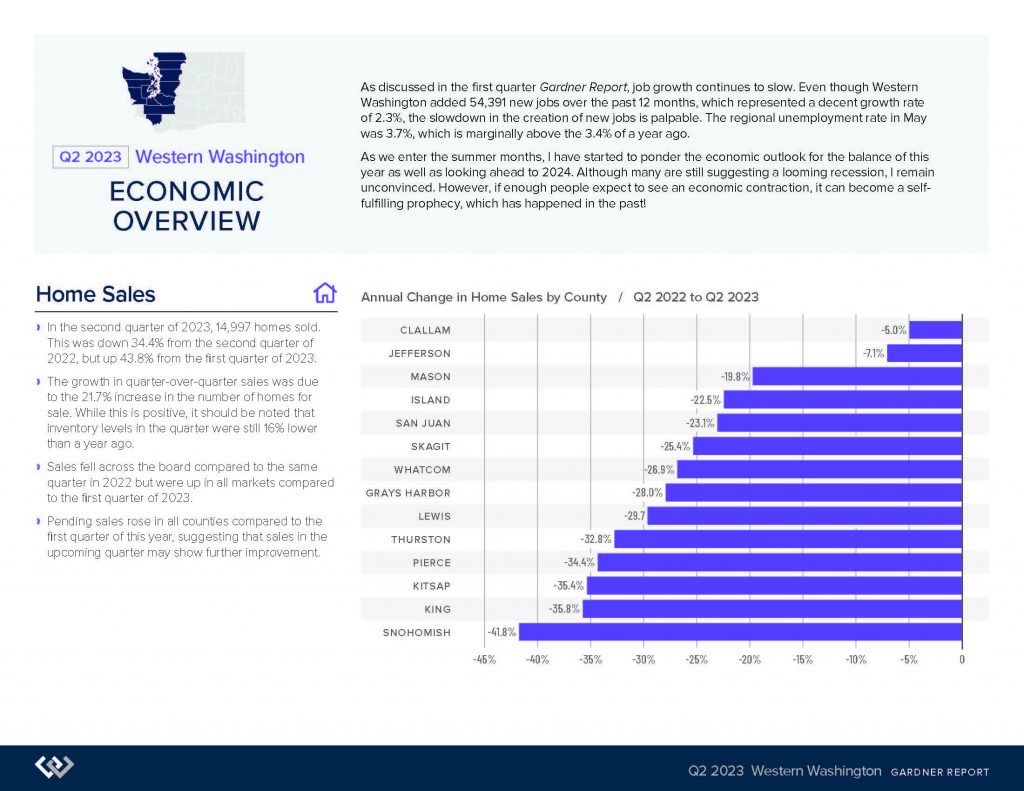

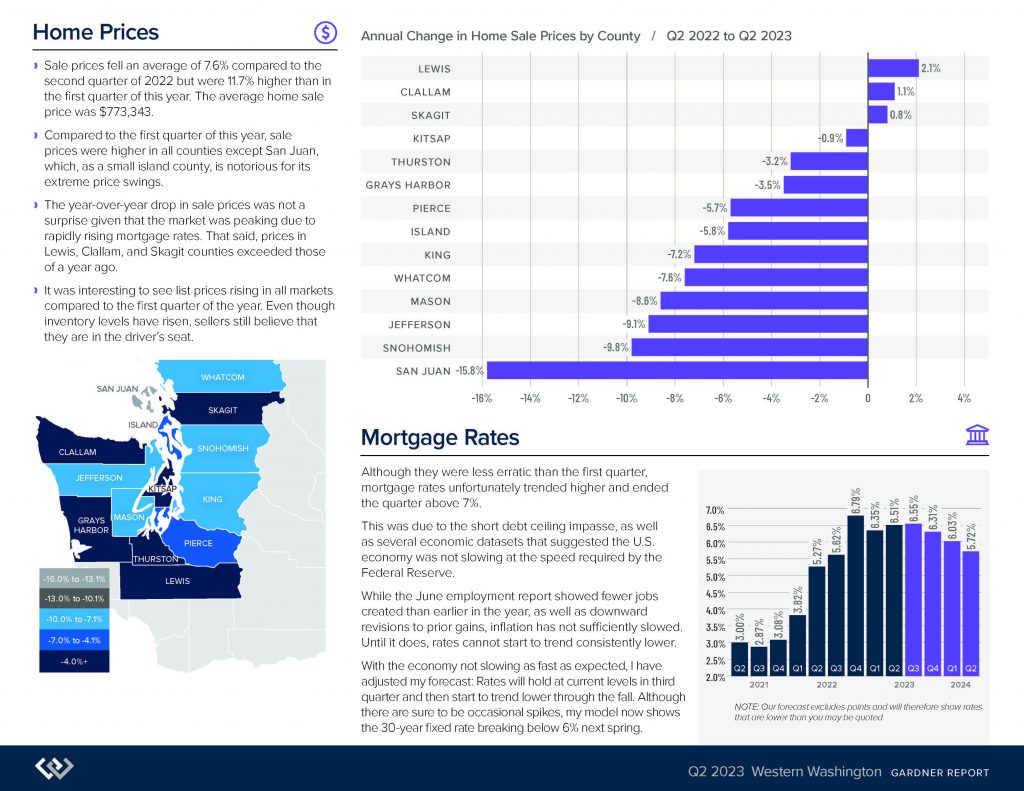

Q2 2023 Gardner Report

If you are interested in discussing this in more detail with an agent connect with us here so we can schedule you an appointment.

State of The Nation’s Housing Explained

Harvard University’s latest edition of The State of the Nation’s Housing has arrived, and Windermere Chief Economist Matthew Gardner is here to break down what the data presented in the report means for the U.S. housing market in 2023 and beyond. Watch this video and if you have further questions you would like to discuss with a local agent call us at 360.675.5953 or connect with us here.

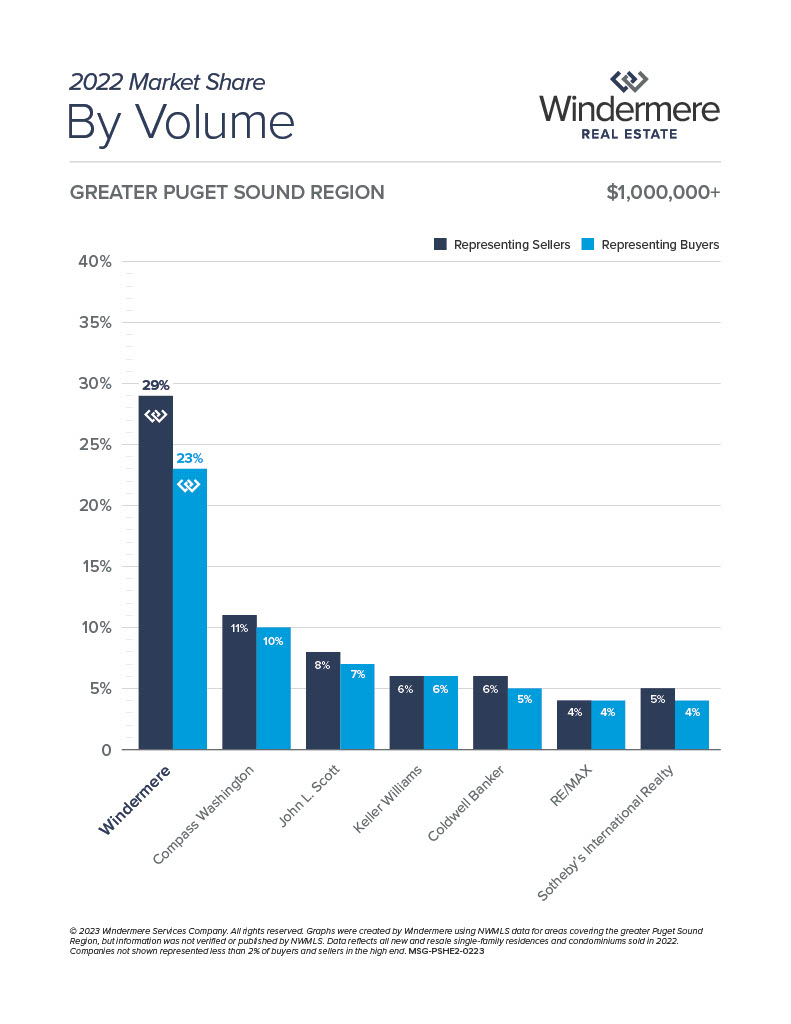

Windermere Produces the Best Luxury Brokers

When it comes to the Pacific Northwest’s real estate market, the name Windermere stands head and shoulders above the rest. With a longstanding reputation for excellence, this brokerage has been a household name for decades, thanks to its unmatched market share across all price points.

But when it comes to the luxury market, Windermere’s reputation really soars. With a keen ear tuned to the needs and desires of their clients and brokers representing the high-end market, Windermere has been able to put in place a series of qualifications, marketing resources, and organizational structures that ensure that their “Premier Properties” receive the exposure and attention they deserve.

Becoming a Windermere Premier Property in a given region is no small feat. Properties must meet certain qualifications and be approved by a local Premier Director, guaranteeing that only the finest, most prestigious homes make the cut. And for those truly exceptional luxury homes that start at a staggering $3 million, Windermere offers the W Collection, a showcase of properties that are not only stunning and unique but also benefit from a separate website and national and international portfolio.

But Windermere’s reputation in the high-end market isn’t just about its exclusive properties. It’s also about the extraordinary level of quality and service that they provide. Windermere’s brokers and staff are known for their unparalleled expertise, professionalism, and attention to detail, ensuring that every aspect of the home buying and selling experience is executed with the utmost care and consideration.

In short, Windermere is more than just a real estate brokerage; it’s a trusted partner in the luxury home market, providing a level of service and expertise that is simply unmatched in the industry. If you’re in the market for a truly exceptional property or looking to sell your luxury home, you won’t find a better partner than Windermere. Connect with a local Windermere broker by clicking here.

If you are interested in becoming a luxury broker on Whidbey Island, email us at KStavros@windermere.com.

Annual Report 2022

Are you interested in buying or selling, or just wanting to learn more about the market or just Whidbey Island in general? We are here to help! Connect with us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link