Utilize That Tax Refund to Benefit Your Future Self

While every tax refund is different, if you received a refund this year, it’s likely that it is larger than in years past. On April 15th CNET shared that:

“The average refund size is up by 4.6%, from $2,878 for 2023’s tax season through April 7, to $3,011 for this season through April 5.”

There is a good chance that your tax refund not only was larger, but it also may have hit your bank account by now. If you haven’t spent it already, keep reading for a couple ways you could leverage it with real estate.

First and foremost, purchasing real estate is like investing in yourself. Each payment you make towards your mortgage lowers your debt and increases your equity. Combine this increase of equity with the historical average home price increase of 5% per year, and it becomes clear that homeownership can be a powerful wealth-building strategy. Over time, not only do you build equity through mortgage payments, but your home also typically appreciates in value. Each payment further enhances your overall financial position. Can we agree that spending a little extra now on a mortgage of our own to pay out a greater return in the future could be worth it? If you are open to this idea of wealth building let’s discuss how you could utilize that tax refund to benefit your future self.

Saving for a Down Payment

One of the greatest obstacles for attaining home ownership is saving enough for a down payment. Your tax refund might just be the boost in income you needed to make homeownership a reality. Lucky for you the 20% down payment requirements of the past are long gone. However, there are benefits when you do put down 20% check them out here. Today, lenders have options as low as 3% down. If you are a military Veteran there are 0% down VA Loans. Learn more about them here. Check with your lender to see what you qualify for and if these loan types will benefit your home goals. If you are not currently working with a lender connect with us and we can help you locate a few.

Pay Closing Costs

Closing costs are the fees and expenses incurred when finalizing a real estate transaction. They typically range between 2% and 5% of the total purchase price of the home. These costs encompass various expenses, such as loan origination fees, appraisal fees, title insurance, and property taxes. Considering these expenses, directing your tax refund toward covering closing costs can help alleviate the financial burden at the time of closing.

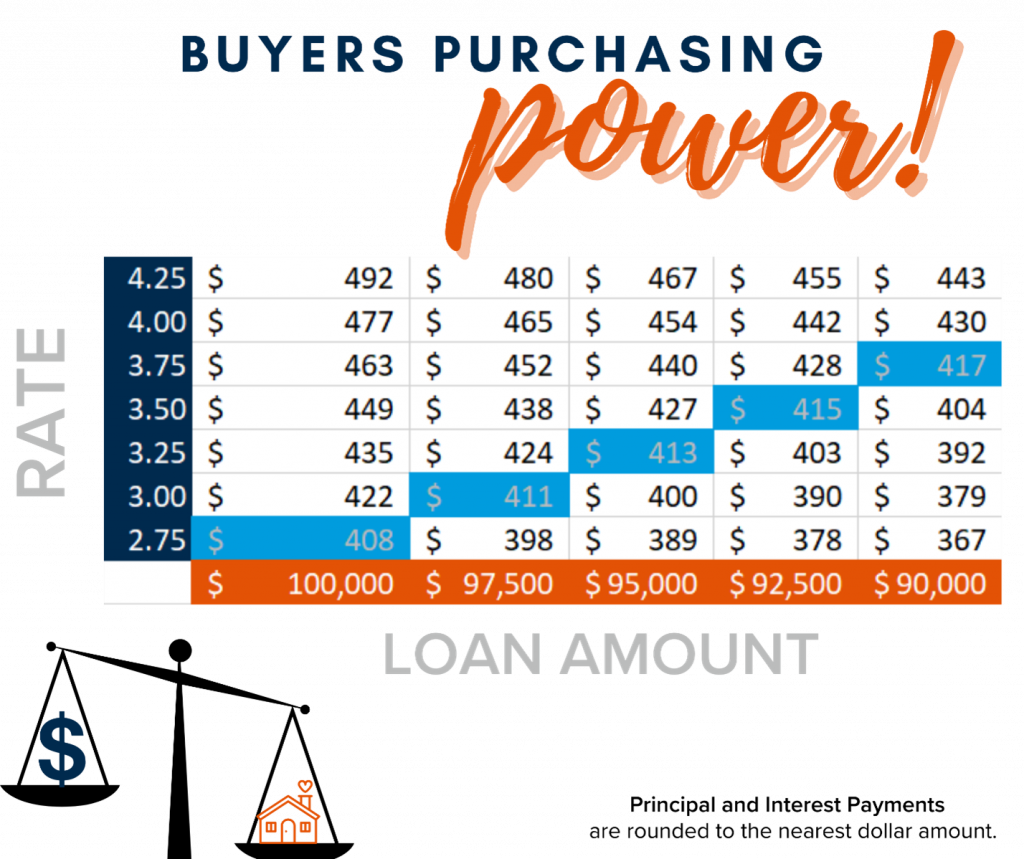

Reduce Your Mortgage Rates by Purchasing Points

If rates today mean affordability is tight, consider talking to your lender about reducing your mortgage rates by purchasing points. You could use your tax refund to buy down your interest rate. Talk to your lender to see if you qualify and if this option is right for your homeownership goals.

Make Extra Payment Towards Your Mortgage and Reduce Overall Interest

Another alternative, if your loan allows for it, is to make additional payments towards your mortgage loan. Each additional payment reduces your total pay off amount. Your payment remains the same, it just means with each additional payment your mortgage will get paid off sooner. Check with your lender, but depending on your loan type, if you pay it off earlier your total interest paid is less than it would have been if you made regular payments.

Whether you are ready to buy now, or in the future, connecting with a trusted real estate professional that understands the process and your options to ensure that you are ready to buy is of the utmost importance. If you are not currently working with a Realtor, connect with us today. We can help you utilize that tax refund to benefit your future self.

Back to School: Realtors Edition

If you aren’t a real estate broker you probably don’t know that September doesn’t just initiate back to school for our kids but as an industry, this is the beginning of conference season! This just means that Fall and Winter tend to be slower seasons and provide the best time for busy brokers to grab a block of hours or even a block of days to spend sharpening their skills. Great brokers are committed to being lifelong learners. They keep up with the ever-changing market, lending options, negotiating tactics, marketing techniques for properties, and the list goes on.

If you are a broker…

You may be looking for some great opportunities that are coming up in the next few months. We have collected a few that we think will be really worth your time. Take a peek and please let us know if we missed one of your favorites because we would love to add it to our list.

New Forms are coming SOON! Please take advantage of educational opportunities to study and familiarize yourself with the changes.

You can take one of the many virtual classes the NWMLS is offering here

Oct. 14, 9-3pm in Oak Harbor! Fair Housing Class, 6 clock hours

Ninja Installation Tacoma Dec 5-8 (Brokerage pays for 1st timers)! $1,100 Thinking about joining our team? Connect with us.

Conference Opportunities:

Windermere Homecoming! $350 (plus accommodation and travel) Sept. 29-30

Inman Connect NYC Jan 24-26 $900

Denise Lones Prosperity Strategy California Nov 9-11, only 50 people! $3,500 w/ accommodation

NAR Conference Orlando Nov 11-13 $450

In addition to these great learning opportunities our brokerage brings in an expert speaker 2-3 times on topics from septic systems to negotiation tactics, from topics as unique as forestry management to ones that are pretty applicable on an island like shoreline processes and bluff stabilization. If you’d like to attend one of these trainings let us know! We’d love for you to be our guest in learning because the better we can serve our clients in this industry the better!

The Whidbey Island Guide and Neighborhood Deep Dive!

When you are preparing to move to a new location or to buy a home for the first time, you are likely eager to learn literally EVERYTHING from the home buying process to everything about the area and what it has to offer when you arrive.

Whether from pure excitement or overwhelming nerves you are likely to find yourself up well past your typical bedtime researching things like:

What cool things are nearby?

Which neighborhoods you can afford.

What those neighborhoods are like.

If you can imagine yourself living there.

Where the best spots are for a cup of coffee.

and probably… where the most iconic location for a picture that might make you Instagram famous might be.

Luckily for you, some real estate brokers are obsessed with this same level of need-to-know. There are a handful of brokers who have created incredibly in-depth online guides to their area. Many go as far as to include information on individual little neighborhoods that will make your search and transition that much easier.

Where it all started:

We were inspired by Marguerite Martin to go all out on neighborhoods and provide rich local content just as she has with her page Move to Tacoma.

It brings us great pleasure to announce that here at Windermere Whidbey Island, we recently unveiled our very own Neighborhood Guide. We couldn’t be more excited to share it with you! Our first release takes a deep dive into 26 neighborhoods from Oak Harbor to Greenbank. We will continue expanding over time. Each page includes written descriptions, images of the homes and neighborhood features, quotes from neighbors, a map with key attractions nearby, median sales price, links to active, pending, and sold homes, commute times to schools and nearby hospitals, and blog posts on a whole suite of topics related to that neighborhood.

Looking for more?

If you are looking for more lifestyle information, check out our umbrella page The Whidbey Island Guide. The guide offers local events, links to government and public sites/resources, collections of articles on things like hiking, restaurants, and so much more.

Remember, these pages represent just the tip of the iceberg on what our brokers know about living on Whidbey Island. If all this information just leads to more questions give us a call! If you have suggestions on information, you wish we would add please tell us, we are all ears.

Connect with us:

Connect with us and expand your search by following us on Instagram at @Windermere_Whidbey_Island where you can find reels on the various neighborhoods of Whidbey.

View this post on Instagram

If Facebook is more your thing you can find us here!

Is it better to buy a home or to rent one?

Is it better to buy a home or to rent one? This discussion has been happening for decades. Supporters of buying claim you are making an investment, which can significantly increase in value every year you live in the home. Additionally, if/when you decide to rent out your home your renters are essentially paying for your mortgage if you still owe. When you no longer have a mortgage, you are will have positive cash flow every month.

Opposingly, advocates of renting argue that the additional costs that accompany owning a home, such as taxes, interest payments, maintenance, unexpected repairs, ect. can add up rather quickly. They point out that there is no guarantee that those expenses will be regained when it comes time to sell the home. Rather than investing in a home, it might be behooving of you to consider investing your savings in stocks, bonds, and other financial securities that pose less risk.

Recently, we have seen mortgage rates at all-time lows. This means that getting a mortgage is relatively cheap, raising the question, ‘Is it really worth it to keep renting?’

Regardless, whether interest rates remain low or not, the question of whether it is better to rent or buy will always exist. This is because the answer has a lot more to do with each person’s specific situation. We have compiled a few considerations for you to make to help you decide.

What is the real estate situation in the cities you are considering?

Reports are released every quarter stating the average national sales price for a home, and the average monthly payment for a U.S. rental. These reports are typically based on an average of all the cities in the U.S. What you really must consider is these same numbers for the local area you are considering.

Take a close look at the local sales and rental markets. You will notice some cities fall significantly below the national average, while others are well above it. When comparing housing costs, remember to base your assessment on what is currently happening in your city and neighborhood, not the nationwide averages. If you need help, don’t hesitate to reach out to one of our specialists by emailing us at WhidbeyCommunications@Windermere.com or finding your agent here.

How long will you live in the home?

If you do not plan to live in the home for at least five years, speaking finically, renting is likely your answer. This is because the upfront costs are spread out over many years throughout the mortgage loan. That means, the longer you plan to live in the home the better it is to buy as opposed to renting. Therefore, if you are ready to settle down for 7 to 10 years buying is likely the right option for you. During that time, it is highly likely that any home you purchase will appreciate.

Aim for a low mortgage rate.

Do not forget about the cost of your loan or the interest you will be paying your lender. When determining your mortgage rate, a lender will review your financial situation. Your rate is based on a combination of how much money you have saved, your credit score, your work history, and other factors. Be sure to talk to a loan officer well before you start looking for a home to help you prepare to get the best rate possible. You can find a local one here. Being pre-approved for a mortgage not only helps you determine your price range but also helps strengthen your offer when it comes time to compete for your new home.

Should you pay more than you are required to?

It can be beneficial to get a lower monthly payment than you can afford so that you can pay a little more than the minimum payment each month.

For example, if you can pay extra towards your monthly mortgage bill you can end up knocking years off the overall life of the lone. Let’s take a closer look. If you can pay $300 more per month towards your 30-year, $300,000 loan, you end up taking eight years off the life of the loan. You reduce your final bill by more than $63,000. That is savings you would never see if you rented. Additionally, every time you make that extra payment your equity in the home also increases.

Does the home need repair or improvements?

Buying a fixer-upper might get you a deal on a house, but it depends on the amount of repairs the home needs and your ability to fix it that determines whether it is a good buy or not. For example, if the money you spend on the repairs are higher than your gains when it comes time to sell it is not a good buy. Of course, there are other things to take into consideration like, how long will you live in the home and what will your satisfaction level be living in a possibly unfinished home for a significant amount of time?

There are opportunities where you can work with your mortgage lender for a repair loan. This can help you get that lot you want, and help you pay for the repairs. Be sure to ask your lender.

However, if you can only afford a home that demands major improvements, and you don’t have the skills to do much of the work yourself, it’s probably better to rent. You want to like where you live and feel satisfied with your home. If you cannot afford the repairs upfront your satisfaction with your new home will dwindle over time and you will become dissatisfied.

Do you have an alternative way to invest?

A home purchase can be an easy way to invest under the right circumstance. You can create significant savings while living in your home. But for others renting an apartment and investing savings in stocks, bonds, and other financial securities is better for their circumstances.

Speaking with a financial advisor about your specific financial situation can help. A financial advisor can break down what you need to do to get the best return on your investments. They can also see the big picture for your unique situation when it comes to your money.

Can you rent out a portion of the home?

Is there an opportunity to maximize your investment and let it work to your advantage? If you buy a house that includes a rental (extra bedroom, mother-in-law unit, studio, etc.) you could be the landlord instead of paying the landlord. With the additional income, you could pay off the mortgage sooner, saving you big bucks in the end while also contributing money to your savings. Of course, this means you would need to be willing to share part of your home with a tenant and take on the responsibilities of being a landlord or work closely with a professional property manager to help you.

Time to make your decision.

For more help making sense of your findings, analyzing other factors, and help looking at home options contact one of our experienced Windermere Real Estate agents by clicking here.

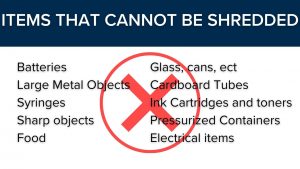

The Importance of Shredding

During or after the purchase or sale of a home you find a lot of paperwork that may have sensitive personal information. What do you do with all of that paperwork?! Throwing it in the trash could mean it falling in the wrong hands and used against you. The safest way to deal with old documents is to shred them. Below we go over what should and should not be shredded and why it’s important to protect your personal and sensitive information from falling into the wrong hands.

To help you, Windermere Real Estate/Whidbey Island is co-hosting a free Shred-it event on October 9th, 2021 and you are invited! Check out the details here!

Types of documents you should shred:

- Tax returns

- Photo IDs

- Bank Statements

- Voided Checks

- Employee Pay Stubs

- Credit Card information

- Copies of sale receipts

- Documents containing sensitive information such as names, addresses, phone numbers or emails

- Employee records

Top reasons you should shred:

- Prevent identity theft: In 2012, about 16.6 million U.S. residents over the age of 16 were victims of at least one identity theft incident according to the Bureau of Justice Statistics.

- Protecting your family, friends, and customers is the law: It is important that you take the extra steps to protect the people around you and shred sensitive information if you must write it down. Businesses that fail to abide by regulations protecting their customers’ personal and secure information are at risk of being fined for mishandling customers’ information.

- Protect your employees: Employees have a right to privacy and if you are throwing away documents you are not taking the necessary steps to protect their privacy or identity. Shredding is always the safest way to go.

- Space saved: by shredding all the unnecessary papers cluttering your office or your home you will create more room and less clutter ultimately you will feel more at ease and satisfied with your space.

If you’re wondering how long you need to keep ahold of different types of documents there are lots of different opinions but we liked the simplicity of this guidance https://www.suzeorman.com/resources/record-keeping

We are all in, for you! What that means is we believe that as realtors we can make a positive impact in our community and in the lives of the people around us. We do this not only by helping people purchase their homes but by staying active in our community and educating where needed. One thing we feel strongly about is protecting those people. Throughout the buying and selling process clients are guided through what kind of links are ok to accept, warned of scammers, and taught how to not fall prey to people trying to take advantage of them.

If you liked this blog you might also like:

Matthew Gardner Presentation: 2021

On March 31, 2021, we hosted a live virtual event where we invited Matthew Gardener Windermere’s leading economist, to present an economic review and Forecast for our local Whidbey Island real estate market.

You may be asking yourself, “who is Matthew Gardner or why should I listen to what he has to say?”

Why We Trust Matthew and Think You Should Too

Matthew Gardner is the Chief Economist for Windermere Real Estate, the second-largest regional real estate company in the nation. Matthew specializes in residential market analysis, commercial/industrial market analysis, financial analysis, land use, and regional economics. He is the former Principal of Gardner Economics and has over 30 years of professional experience both in the U.S. and U.K. You may have also run across his articles on the popular Inman.com.

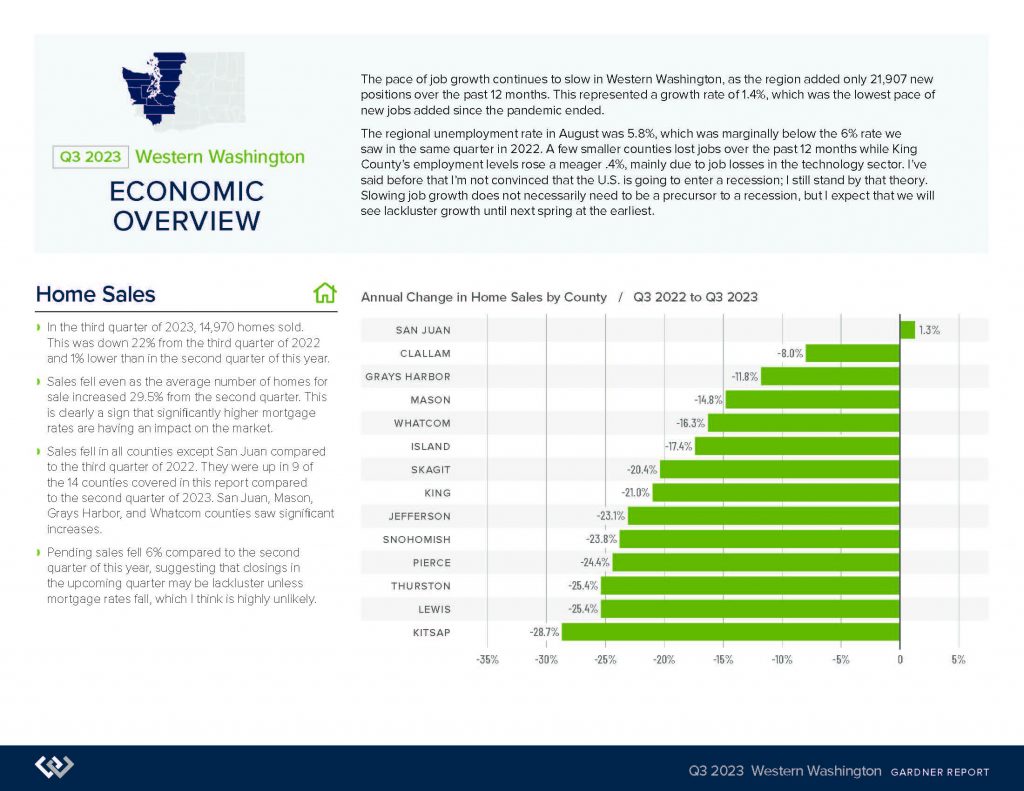

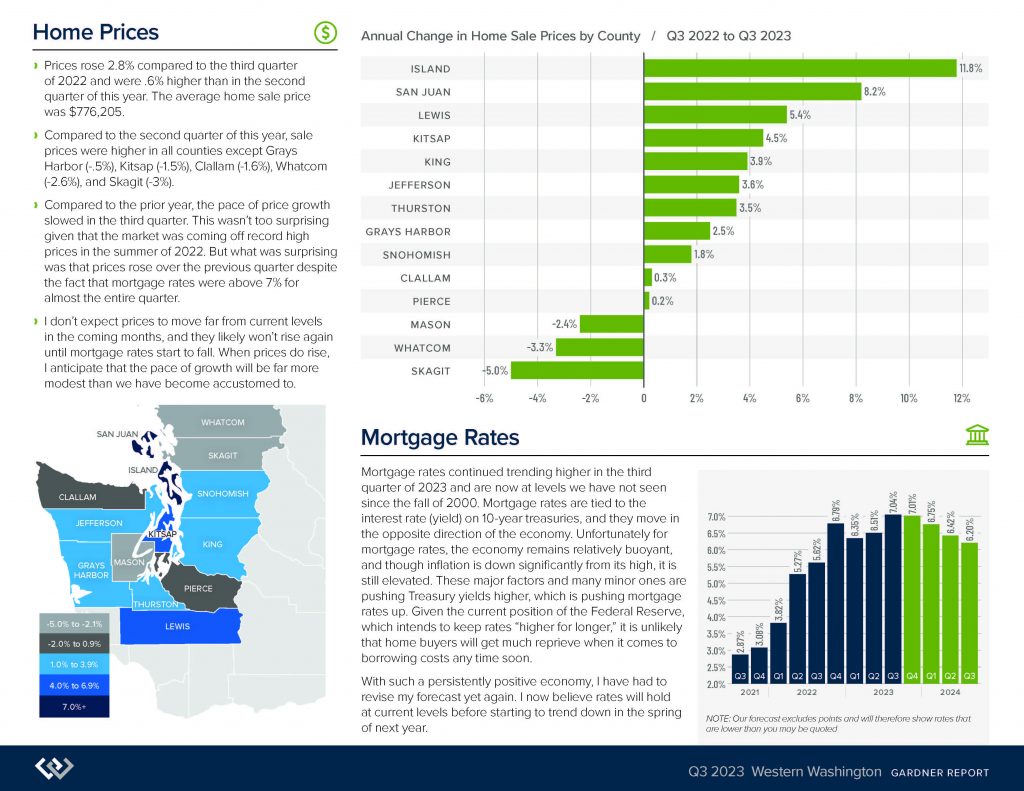

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. This includes publishing THE GARDNER REPORT each quarter, which highlights market conditions in regions throughout the Western U.S. Inside each region’s report, you’ll find forecasts based on the latest real estate data, including regional home sales, average home-price information, days on market, and other indicators to determine whether it is a buyer’s or seller’s market. Matthews Western Washington Quarter Reports can be found here.

We were lucky enough to get him to do a specialized analysis of our local market just for you. If you missed it live, you can watch the full recording below as well as take a closer look at his slide deck by requesting to have it sent to your email.

As always if you have any questions reach out to your Windermere Agent. Don’t have one? Email us today at WhidbeyCommunications@Windermere.com and we will get you connected with the perfect agent for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link