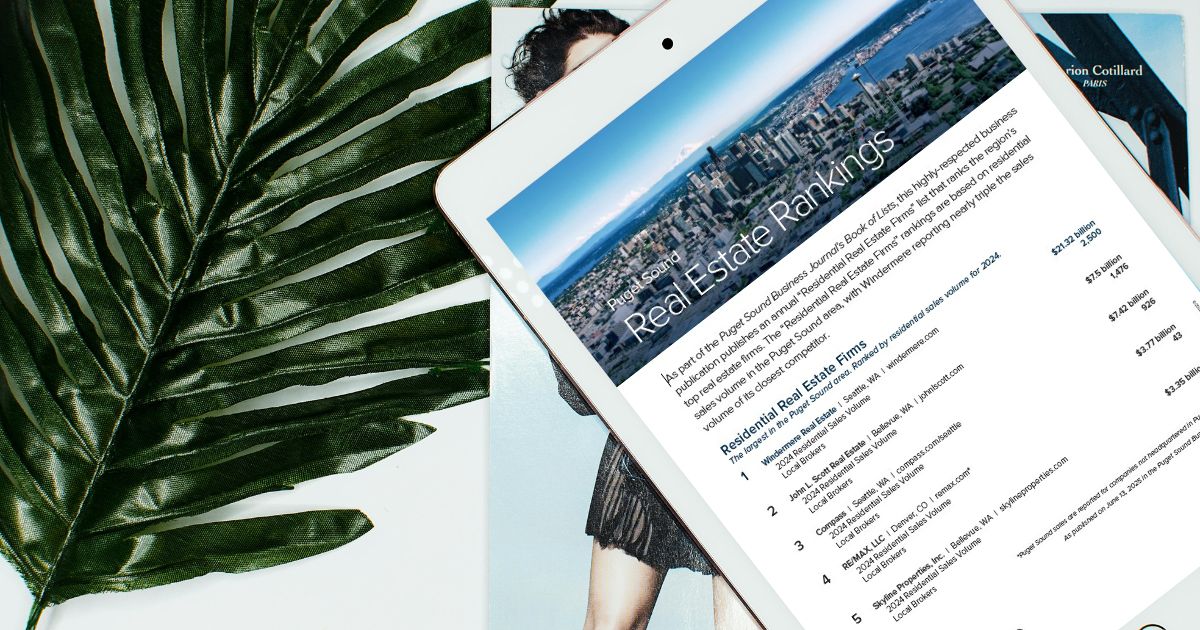

Real Estate Ranking in Puget Sound

The Puget Sound Business Journal released real estate rankings that truly made us proud to be part of Windermere (check them out here). Windermere has been a long standing leader of market leadership in the Puget Sound area and this report confirms that has not changed. The report claims Windermere Puget Sound did $21.32 billion in residential sales volume in 2024, surpassing the closest competitor by nearly a threefold. The report demonstrates how Windermere Real Estate continues to assert its position as the foremost residential real estate firm in the Puget Sound region.

The history:

The Puget Sound Business Journal inaugurated its list of top residential real estate companies in 1986. Windermere has maintained the No. 1 ranking every single year. This nearly four-decade tenure spotlights not only Windermere’s market share but its sustained organizational resilience, strategic adaptability, and strong community presence. We are proud to be a part of the success.

Factor of Success:

Several factors contribute to Windermere’s enduring success. First, its expansive network across the Pacific Northwest supports unparalleled market coverage and client reach. Second, the emphasis on agent education, technological integration, and customer-centered service has strengthened its professional reputation and operational efficiency. Finally, Windermere’s deep-rooted commitment to community engagement. The Windermere Foundation, funded in part by a portion of every home sold sets Windermere apart as both a market leader and a socially responsible organization. As Windermere offices and agents in the Puget Sound, we couldn’t be more proud.

Here is a snip-it into what our Oak Harbor and Coupeville offices have been doing in our communities recently:

What it all means:

Windermere’s continued ability to maintain leadership at such scale suggests a robust alignment between regional market demands and Windermere’s business model. Housing markets across the Puget Sound area evolve in response to demographic shifts, economic pressures, and ongoing development patterns. Windermere’s legacy of leadership positions it uniquely to shape the future trajectory of real estate services in the region.

In sum, Windermere’s top ranking is not merely a reflection of annual sales. Windermere’s top ranking is a testament to nearly forty years of consistent excellence, strategic foresight, and unwavering commitment to all of the communities served. We are grateful for your continued trust in our services and look forward to continuing to serve you for years to come.

If you are looking to making a move in your future please reach out. We would love to help you. If you wish to have a copy of this document mailed or emailed to you please email us at whidbeycommunications@windermere.com.

Fall Garden & Yard Prep

Fall Garden & Yard Prep: Setting Your Home Up for Success

Early fall warm weather days often tempt us to keep our gardens going just a little longer, but late September through October is the prime time to prepare your yard for the colder months ahead. Think of it as “winterizing” your home’s curb appeal—a little work now means a smoother, fresher start come spring.

Just like a home needs the right foundation to thrive, your garden and landscape need a strong send-off before winter arrives. Here are a few smart (and surprisingly simple) steps every homeowner should take:

1. Say Goodbye to Summer Veggies

As much as we want those last tomatoes to ripen on the vine, it’s time to let go. Pull spent veggies like tomatoes, peppers, and cucumbers, and add them to your compost. Still have green tomatoes? Don’t toss them! You can ripen them indoors by placing them in a paper bag or box.

2. Care for Perennials

Healthy perennials can be left standing; they’ll catch snow and add some winter charm. However, if there are any plants that show disease, they should be removed now to prevent problems next year.

3. Hydrate Before Hibernate

Trees, shrubs, perennials, and even lawns benefit from a good soak before the freeze. A well-watered root system means a healthier comeback in spring.

4. Empty Containers

Ceramic, terra cotta, and clay pots don’t do well in freezing temps. Clean, dry, and store them to prevent cracking.

5. Clean & Store Tools

Wash your garden tools, sharpen blades, and lightly oil metal surfaces to keep rust away. Your future self will thank you when spring planting rolls around. If you accidently left one out and it now has some rust, esteemed Minnesota gardener and writer Mary Lahr Schier has a tip for you. Discover her secret in her article by clicking here.

6. Manage the Leaves

A light layer of chopped leaves can be good mulch, but too many leaves left on your lawn may cause snow mold and damage your grass. Rake or mulch as needed. Keep aside some leaves to use as mulch after the soil freezes.

Why It Matters for Homeowners

Not only does fall yard prep make spring easier, but it also protects your landscaping investment, boosts curb appeal, and helps your home shine year-round. Whether you are thinking of selling next season or just want to love the home you are in, small steps now add long-term value.

So, grab your rake, pull on your cozy sweater, and show your home a little autumn TLC—it’ll pay off in more ways than one!

If you are thinking about selling next season now is the best time to connect with a realtor to help guide you every step of the way, feel free to connect with us. Find our contact details here.

Minimizing the Stress of Selling Your Home

Minimizing the Stress of Selling Your Home: Navigating the Emotions and the Process

Selling your home is more than just a transaction; it’s the closing of one chapter and the beginning of another. For many homeowners, the process is not only physically demanding but also emotionally overwhelming. After all, you are not parting with just a property, you may be leaving behind a space filled with memories, milestones, and meaningful moments.

While the process of selling a home can be daunting, there are practical steps you can take to minimize the stress and make the experience smoother. Follow along for an approach to selling your home with confidence and clarity, while honoring the memories you have made along the way.

Acknowledge the Emotional Side of Selling

It’s perfectly natural to feel sentimental when preparing to sell your home. Over the years, you’ve celebrated birthdays, holidays, and milestones within those walls. Instead of pushing those feelings aside, acknowledge them. Take a walk through your home and reflect on the positive memories you’ve created.

If it helps, capture a few meaningful photos of your favorite spots in the house or yard. This can give you a sense of closure while also preserving the memories you’ve built.

Start Decluttering Early

One of the most overwhelming parts of selling a home is realizing just how much you’ve accumulated over the years. The earlier you start decluttering, the less stressful the process will be when it’s time to move.

Start small. Tackle one closet or one room at a time. Create piles for items to keep, donate, or discard. Remember, letting go of physical items doesn’t mean letting go of the memories. It simply means making space for new ones in your next chapter.

If you find it difficult to part with certain sentimental items, consider designating a keepsake box for small mementos that carry deep meaning. This allows you to hold on to the most important pieces without feeling overwhelmed by clutter and allows the home to be ready for showings and positions the home to sell for top dollar.

Focus on the Future, Not Just the Past

While it is natural to feel nostalgic, it is also important to shift your focus toward the exciting opportunities ahead. Whether you are downsizing, upsizing, or relocating, think about what your next home will offer. Create a vision board or jot down a list of things you are looking forward to in your new space.

Focusing on the future will help balance the emotions of leaving your current home. Creating a simple reminder that while you are leaving one place behind, you are also entering into something new and exciting.

Lean on Your Real Estate Professional

Selling a home is a major life transition. You shouldn’t have to navigate it alone. Partnering with a trusted real estate agent can ease the burden significantly. Your agent will guide you through the listing, staging, and selling process while also offering valuable perspective and support.

Beyond logistics, your real estate agent can offer insights into market trends, pricing strategies, and negotiating tactics. Their guidance allows you to focus less on the technical details and more on preparing for your next chapter.

The sooner you get your agent involved, the smoother your home-selling process will be. With their market expertise, they’ll assess your home’s value, recommend improvements, and develop a personalized plan to help you achieve the best possible price.

Your agent may suggest professional staging, improving curb appeal, or small upgrades to boost your home’s marketability. Whether you move out or stay during the selling process, your agent will guide you every step of the way to ensure your home shows at its best.

Ready to get started? If you don’t have an agent yet, click here to get connected with one today.

Create a “Moving Game Plan”

The logistical side of moving can quickly become stressful without a plan. Minimize chaos by creating a clear, step-by-step game plan for your move. Start by setting target dates for decluttering, packing, and hiring professional movers, if needed.

Having a clear plan in place allows you to break the process into manageable pieces, reducing last-minute stress and ensuring a smoother transition to your new home.

Get an Inspection & Make a Game Plan for Key Repairs

Conducting a pre-inspection aids you in understanding your home’s condition and helps you prioritize repairs. Some major fixes like a new roof or water heater may be necessary while other cosmetic updates may not be required. Talking with your agent can help you decide what is most important based on current market conditions and buyer expectations and help you with your timeline. If your budget is tight, consider asking your agent about the Windermere Ready program.

Embrace the Journey

Finally, remember that selling your home is not just an ending—it is a beginning. Yes, you are leaving behind a place filled with memories, but you are also opening the door to new adventures, new neighbors, and new experiences.

Take time to appreciate the journey. Pause to reflect on how far you’ve come. Embrace the transition with gratitude.

Final Thoughts

While the process can be emotionally and physically challenging, taking intentional steps to declutter, plan, and lean on your real estate professional can significantly reduce your stress.

As you turn the page and step into your next chapter, remember that home is not defined by four walls, it is defined by the love, memories, and experiences you carry with you.

If you are ready to take the next step connect with us. We are here to help you navigate your journey.

Understanding Property Assessments and Taxes in Island County

At Windermere Whidbey Island, we are committed to providing our clients with valuable insights and information about the real estate market on Whidbey Island, Washington. One topic that frequently comes up in discussions with our clients is how property assessments and taxes work in Island County. To help clarify this complex process, we recently had a presentation by Jason Joiner from People’s Bank, who previously served as the Deputy Assessor at Island County. His expertise has equipped us with the knowledge to better serve our clients, and we are excited to share these insights with you so that you can have an understanding of property assessments and taxes in Island County.

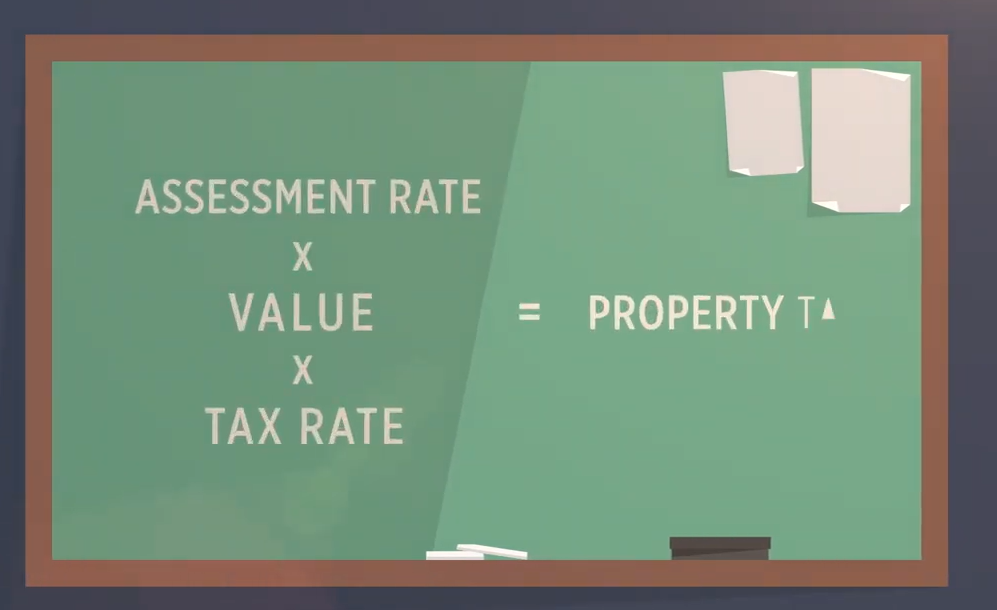

The Basics of Property Assessments and Taxes

In Washington State, property taxes are determined through a budget-based system rather than a rate-based system. Understanding this distinction is crucial for comprehending how property taxes are calculated in Island County. In a budget-based system, the county sets its annual budget, and property owners contribute a portion of that budget based on the assessed value of their property. This means that the total property tax collected is determined by the budget, not the property tax rate.

For a more detailed explanation, we recommend watching this YouTube video that breaks down the basics of property assessments and their connection to taxes.

Lid Lifts and Property Tax Increases

Washington State law restricts property tax increases to 1% per year. However, it is sometimes necessary to raise the baseline beyond this limit to keep up with rising costs and inflation. This process is known as a “lid lift,” which requires voter approval. Essentially, voters may be asked every few years to approve a lid lift to ensure the county can continue to meet its budgetary needs without falling behind due to inflation.

Property Tax Rates in Island County

One of the benefits of living in Island County is our relatively low property tax rates compared to other areas in the state. This advantage is significant for property owners and is an important consideration for those looking to move to the area.

The Assessment Process

Island County is divided into six appraisal areas. Each year, county assessors are required to physically inspect one of these areas. The remaining areas are adjusted based on a conservative market-based increase. This method, known as the “catch up method,” means that property owners will typically see a more noticeable increase in their property value during the year their area is physically inspected.

This approach ensures that property values remain accurate and reflect any significant changes in the market or the property itself. However, it also means that property owners should be prepared for potential fluctuations in their assessed value from year to year.

Preparing for Potential Property Tax Increases

When purchasing a property, it is essential to budget for potential property tax increases, especially if the purchase price is significantly higher than the current assessed value. A good rule of thumb is to budget about 1% of the purchase price for property taxes. This conservative estimate helps ensure that buyers are not caught off guard by a substantial tax increase after their purchase.

The Role of Permits in Property Assessments

The Island County Planning Department provides a list of permits to the assessor’s office, which uses this information to adjust assessed values as needed. For example, a permit for a hot water heater replacement might not affect the assessed value, but a permit for a new kitchen would likely lead to an upward adjustment.

It is important to note that assessors conducting physical inspections are not reporting unpermitted improvements to the planning department. This means that while unpermitted improvements may eventually be discovered and assessed, the assessors themselves do not report these findings.

Appealing Your Property Assessment

If you disagree with your property assessment, you have the right to appeal. When you receive your assessment notice in June, you have 30 days from the date on the letter to file an appeal with the Board of Equalization. The instructions for filing an appeal are provided on the back of the notice. This process allows property owners to present their case and potentially receive a revised assessment.

Understanding the Workload of Assessors

It is worth noting that private sector appraisers typically charge around $800 per appraisal, while the Island County Assessor’s office receives about $23 per assessment. Despite this significant difference in compensation, the public often expects the same level of service and accuracy from county assessors. This disparity highlights the challenges faced by public sector assessors in maintaining high standards of service with limited resources.

Final Thoughts

Understanding the intricacies of property assessments and taxes in Island County can be daunting, but it is an essential aspect of property ownership. By familiarizing yourself with the process, you can better navigate your financial responsibilities and make informed decisions about your property investments.

At Windermere Whidbey Island, we are dedicated to guiding and educating our clients on all aspects of property ownership. Whether you are considering buying a new home, appealing your property assessment, or simply want to learn more about how property taxes work, we are here to help. Please feel free to reach out with any questions or concerns you may have. Let’s work together to make your real estate journey as smooth and informed as possible.

Windermere Whidbey Island is here to assist you every step of the way. If you are not currently working with a realtor and would like to, connect with us here.

Utilize That Tax Refund to Benefit Your Future Self

While every tax refund is different, if you received a refund this year, it’s likely that it is larger than in years past. On April 15th CNET shared that:

“The average refund size is up by 4.6%, from $2,878 for 2023’s tax season through April 7, to $3,011 for this season through April 5.”

There is a good chance that your tax refund not only was larger, but it also may have hit your bank account by now. If you haven’t spent it already, keep reading for a couple ways you could leverage it with real estate.

First and foremost, purchasing real estate is like investing in yourself. Each payment you make towards your mortgage lowers your debt and increases your equity. Combine this increase of equity with the historical average home price increase of 5% per year, and it becomes clear that homeownership can be a powerful wealth-building strategy. Over time, not only do you build equity through mortgage payments, but your home also typically appreciates in value. Each payment further enhances your overall financial position. Can we agree that spending a little extra now on a mortgage of our own to pay out a greater return in the future could be worth it? If you are open to this idea of wealth building let’s discuss how you could utilize that tax refund to benefit your future self.

Saving for a Down Payment

One of the greatest obstacles for attaining home ownership is saving enough for a down payment. Your tax refund might just be the boost in income you needed to make homeownership a reality. Lucky for you the 20% down payment requirements of the past are long gone. However, there are benefits when you do put down 20% check them out here. Today, lenders have options as low as 3% down. If you are a military Veteran there are 0% down VA Loans. Learn more about them here. Check with your lender to see what you qualify for and if these loan types will benefit your home goals. If you are not currently working with a lender connect with us and we can help you locate a few.

Pay Closing Costs

Closing costs are the fees and expenses incurred when finalizing a real estate transaction. They typically range between 2% and 5% of the total purchase price of the home. These costs encompass various expenses, such as loan origination fees, appraisal fees, title insurance, and property taxes. Considering these expenses, directing your tax refund toward covering closing costs can help alleviate the financial burden at the time of closing.

Reduce Your Mortgage Rates by Purchasing Points

If rates today mean affordability is tight, consider talking to your lender about reducing your mortgage rates by purchasing points. You could use your tax refund to buy down your interest rate. Talk to your lender to see if you qualify and if this option is right for your homeownership goals.

Make Extra Payment Towards Your Mortgage and Reduce Overall Interest

Another alternative, if your loan allows for it, is to make additional payments towards your mortgage loan. Each additional payment reduces your total pay off amount. Your payment remains the same, it just means with each additional payment your mortgage will get paid off sooner. Check with your lender, but depending on your loan type, if you pay it off earlier your total interest paid is less than it would have been if you made regular payments.

Whether you are ready to buy now, or in the future, connecting with a trusted real estate professional that understands the process and your options to ensure that you are ready to buy is of the utmost importance. If you are not currently working with a Realtor, connect with us today. We can help you utilize that tax refund to benefit your future self.

Spring Cleaning

Spring cleaning has long been a cherished tradition embraced by households worldwide. Stemming from a practical need to freshen up living spaces after the long winter months, this annual ritual has evolved into a symbol of renewal and rejuvenation. Beyond simply tidying up, spring cleaning holds significant importance for both physical and mental well-being. By clearing out clutter, dust, and grime accumulated over the winter, we create a cleaner and healthier environment for ourselves and our families. Moreover, the act of spring cleaning can have positive effects on our mindset, providing a sense of accomplishment, satisfaction, and a renewed energy to tackle new challenges. Embracing this tradition allows us to start the new season on a clean slate, fostering a sense of optimism and positivity as we welcome the warmer days ahead.

Follow along for a comprehensive spring cleaning checklist to help you tackle every corner of your home:

Declutter and Donate

- Make your home more inviting by decluttering. Go through each room and declutter by getting rid of items you no longer need or use.

- Donate, sell, or discard items that are no longer serving a purpose for you. Consign your items at places like My Sisters Closet, or host a yard sale and feel a sense of accomplishment when you can fund something new. Whatever you find yourself still left with donate to a local thrift store. Island Thrift, WAIF Thrift Shop , and Treasure Island-Antique and Thrift are just a few of the many options on Whidbey Island.

Dust

- Open your windows and breathe a breath of fresh air.

- Dust all surfaces, including shelves, countertops, furniture, and electronics.

- Don’t forget to dust ceiling fans, light fixtures, and vents.

Clean Windows

- Spring brings so much outside beauty. Make sure you can enjoy it all with sparkling windows.

- Wash windows inside and out, including the window frames and sills. If your window has weeping holes, be sure to make sure they are not clogged so that excess water can drain properly.

- If cleaning your windows is out of reach there are companies like A Clean Streak or Oh Say Can You See that can help.

- Clean blinds, curtains, or drapes according to manufacturer’s instructions.

Vacuum and Clean Floors

- Vacuum carpets and area rugs thoroughly.

- Sweep and mop hard floors, paying special attention to corners and baseboards.

Deep Clean Kitchen and Restrooms

- Clean and disinfect countertops, cabinets, and drawers, all bathroom surfaces, including sinks, toilets, and tubs/showers.

- Clean appliances inside and out, including the refrigerator, oven, microwave, and dishwasher.

- Degrease stove hood and filter.

- Scrub tile grout and remove any mold or mildew.

Organize Closets and Cabinets

- Out with the old and in with the new… or maybe just move the sweaters to the back (we are still in the PNW and occasionally will still need those sweaters), but break out the vibrant tank tops it is spring already!

- Declutter and organize closets and cabinets, donating or discarding items as needed.

- Use storage bins or baskets to keep items organized and easily accessible.

Freshen up Bedding

- Launder bedding, including sheets, pillowcases, and duvet covers.

- To increase the life of your mattress, rotate and flip it for even wear.

Clean Upholstery and Furniture

- Vacuum upholstery and cushions to remove dust and debris. Make sure you get behind and underneath.

- Spot clean stains and spills on furniture.

Tidy Outdoor Spaces

- Sweep or pressure wash outdoor patios, decks, and walkways.

- Clean outdoor furniture and cushions.

- Trim bushes, trees, and clean up garden beds.

Inspect and Maintain

- Ensure your families safety every season.

- Check smoke detectors and carbon monoxide detectors, replacing batteries as needed.

- Test and clean ceiling fans.

- Schedule routine maintenance for HVAC systems, plumbing, and electrical systems.

Final Touches

- Brings some of the outside in.

- Add finishing touches such as fresh flowers or plants to bring life into your space.

- Sit back, relax, and enjoy your freshly cleaned and organized home!

Spring cleaning isn’t just about tidying up—it’s also an essential part of home maintenance and preparation for the warmer months ahead. For homeowners, it’s an opportunity to refresh their living spaces and ensure that their property is in top condition. Beyond the aesthetic benefits, a thorough spring cleaning can enhance the value of a home by improving its curb appeal and overall appeal to potential buyers. By decluttering, organizing, and performing deep cleaning tasks, homeowners can showcase their property’s full potential and make a positive impression on prospective buyers. Additionally, addressing maintenance issues early can help prevent costly repairs down the line and contribute to the long-term health and durability of the home. So, as spring approaches, embrace the tradition of spring cleaning as a valuable investment in both your home and your well-being.

If you are considering selling this Spring, connect with us.

To help get you motivated listen to our Spring Cleaning Playlist Here.

Retirement in your future?

If retirement is in your near future, or perhaps you are already there (congratulations) you may find yourself wondering if staying in your home is still a good fit. When you live in a home for an extended period, it is normal for your needs to change as you progress through life’s milestones. You may find that your home is too big for the needs of this next chapter. Perhaps you have always had a dream destination in mind, whether to visit or to live or maybe you just want to be closer to family. Selling your home may just be the key to moving onto something that fits your life better.

Regardless of your why, understanding your options and the market can help you make the best next decision. We cannot stress enough that no one size fits all and suggest discussing your unique situation with a trusted Realtor. If you are not currently working with a realtor, connect with us. We will help find you the perfect match through a series of specific questions.

Follow along as we discuss why you might be in an advantageous position if you ARE considering a move and thinking about retirement.

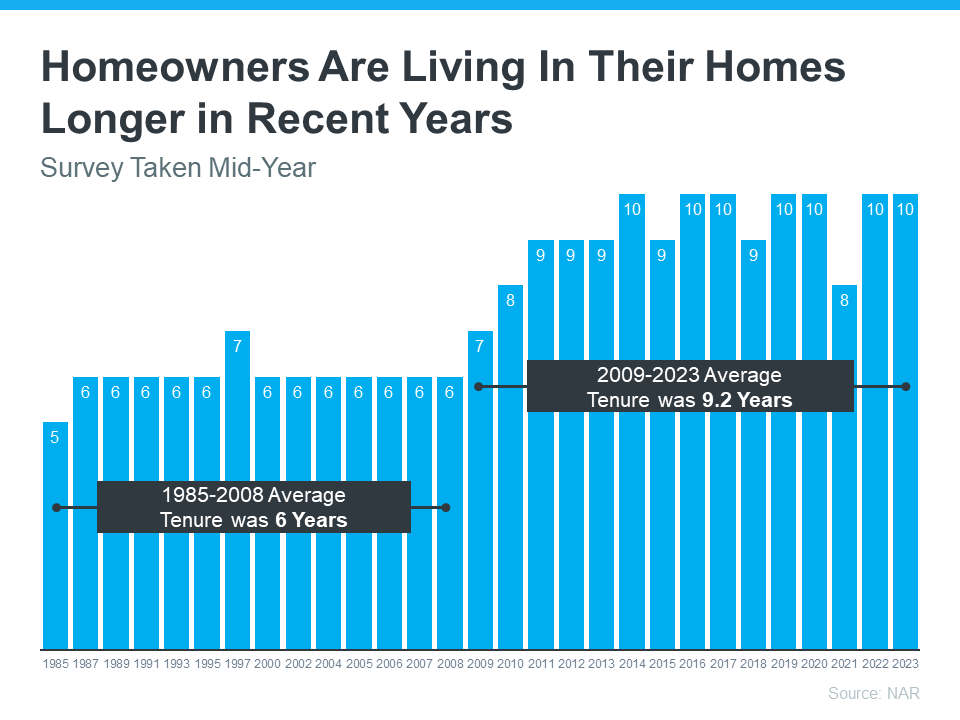

Consideration 1: How long have you owned your home?

Today, people are living in their homes longer than they ever have in the past. The longer you live in the home the more likely that you are in a better position to sell. Let’s look at a few factors. The National Association of Realtors (NAR) shared that homeowners owned their homes for an average of six years between 1985 and 2008 whereas homeowners have been staying in their homes for an average of 9.2 years since 2009. See the graph below.

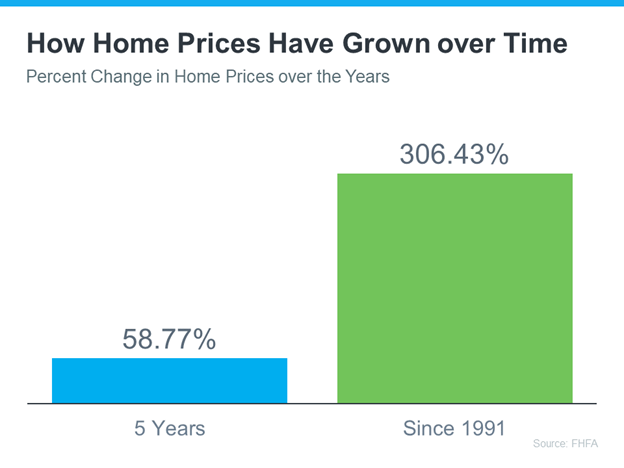

If you are like most homeowners today, you have been in your home for well over 5 years. If this is the case, it is an indicator that a move may be in your favor. Typically speaking, you have built significant equity after just 5 years in your home due to home price appreciation. The Federal Housing Finance Agency (FHFA) demonstrates this in their graph below.

If you have lived in your home for over 5 years, you might just be sitting on a large sum of money that could make your dreams a reality. The recent market has helped homeowners increase their equity by nearly 60% in the past 5 years. Those who have owned their homes since 1991 have experienced their home triple in value since they purchased it back in 1991.

Consideration 2: The Market

Currently, we are experiencing a sellers’ market. Home price appreciation is stable. There is a lack of inventory and a prediction that mortgage rates will decline. We have already begun to see the decline in rates. As rates drop, homeownership becomes an attainable option again for those looking to buy. If you are not currently working with an agent and would like to discuss a strategic plan, connect with us here.

Whether you wish to downsize, move to the destination of your dreams, have the funds to go on the vacation of a lifetime, or move closer to the ones you love, the equity in your home can help get you there.

No matter what your home goals are, a trusted realtor can help you discover the best options to get you there. They can help you sell your current home and get you into the that is right for life today.

Retirement in your future? Let’s connect and explore your options.

Navigating Washington’s Agency Agreements Changes

You may have heard real estate laws are changing in Washington State. While navigating Washington’s agency agreement changes it’s important to note that it’s not uncommon for laws to change as industries evolve. In 2019 the rules requiring that buyer broker compensation be offered to list a property was eliminated. For transparency purposes, in 2019 another law made the buyer broker compensation offered in the listing viewable to the public. In 2022 laws were implemented that made the offer of buyer broker compensation separate and distinct from the offer to the seller’s broker. That same year, our Northwest Multiple Listing Service started including the amount of buyer broker compensation in the purchase and sale agreement so there is complete transparency within the transaction.

Other great changes that help the buyers and sellers is a revision of the agency law pamphlet. It is now more easily read and understood (taking it from 8 complicated pages to 4) and there is a requirement to sign a contract with buyers. Now buyers truly chose who is representing them and it doesn’t just happen randomly. Our brokers have been studying extensively not only the new laws but how to best implement them and prepare their clients to understand how the changes in the laws will affect them. Follow along as we walk you through navigating Washington’s agency agreement changes with an overview of the changes, how it impacts buyers and sellers, and offer you further resources for more information.

Overview of the New Laws:

Prior to January 1, 2024 Washington State law only required brokers representing sellers to enter into a brokerage agreement. Starting January 1, 2024 Chapter 18.86 RCW mandates brokers representing buyers in a residential transaction enter into a written brokerage service agreement as soon as reasonably possible. Washington is the first state to implement this type of legislation. This contractual arrangement encompasses key provisions such as the duration of the partnership, exclusivity terms, and the agreed-upon compensation rate. The purpose of the change is to ensure that buyers understand the scope of the representation, how much it will cost, and how the costs are paid prior to agents providing any real estate services.

Impact on Buyers:

There are a couple of changes that buyers should expect to see. The first is that they will be asked to commit to a Buyers broker early on. It’s going to behoove buyers to take their selection of the broker they work with much more seriously. Buyers will now be presented with an agency agreement prior to their agents providing any services. This might feel a bit off-putting to commit so soon, but Windermere brokers have never forced clients to work with them and are using an agreement that gives buyers control to end the agency relationship at any time. Be sure to read the agreement carefully and identify what the procedures are for canceling the buyer-broker agreement. Great Agents often provide you with a cancelation document or instructions upfront so that you can rest assured that you will not be stuck if their services don’t meet your expectations.

Impact on Sellers:

For the most part, sellers are not significantly impacted by the new changes. The only significant change that sellers can expect to see is that agents may offer a Seller Brokerage Service Agreement earlier than in the past. The new listing agreement allows for signing up to 90 days in advance of going on the market.

Overall, the changes are positive. They are put in place to protect consumers, which we are all about! By law, every client is to receive the Agency Law Pamphlet. The buyer or seller should take time to read it and understand it prior to signing any agreement. If you find yourself with more questions than answers, don’t hesitate to ask questions or seek guidance. If an agent does not currently represent you and you are seeking quality representation, connect with us. We can give you a few names of excellent brokers to interview. It is important to stay informed about these changes to ensure a smooth real estate transaction.

If you would like to discuss this in greater detail, please do not hesitate to connect with us.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link