Is the Current Surge in Available Homes Fact or Fiction?

Whether you are considering a move or just staying informed about the housing market, having the latest information is crucial. With all the latest headlines you might find yourself wondering, “is the current surge in available homes fact or fiction?” Let us help provide you some insight, follow along for a current update on the supply of homes for sale in your area. Whether you are in the market to buy or sell, the available inventory plays a significant role. Dive into the details below for insights.

The Truth About Today’s Housing Inventory:

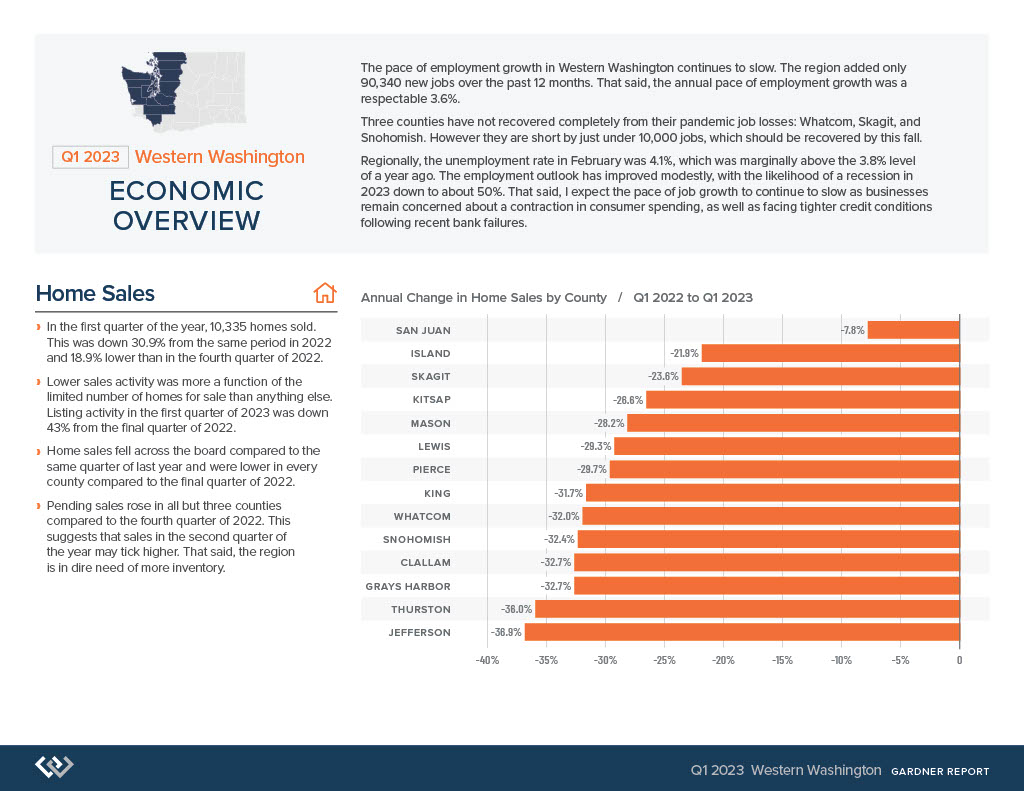

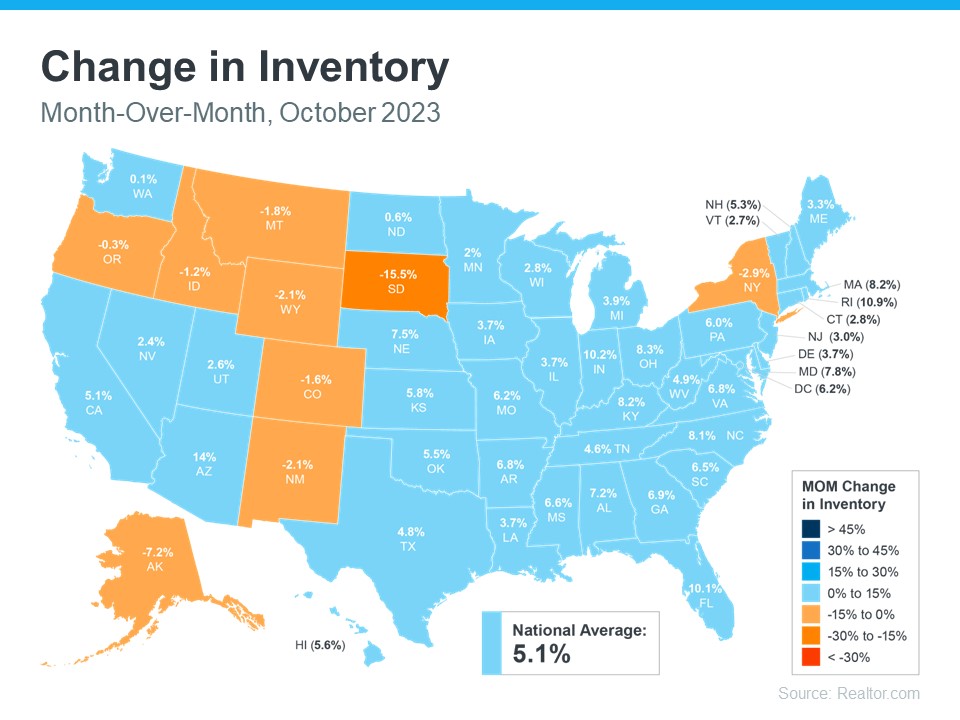

The narrative the past few years has been centered around the scarcity of homes on the market. However, recent national data demonstrates a twist to the story that if your like most might have you questioning the truth. According to Realtor.com, inventory is showing signs of growth month-over-month in numerous regions across the country (highlighted in blue on the map below).

Looking at the map, nationally, the housing supply has increased just over 5% last month alone.

Does This Mean the Days of Limited Housing Inventory is Over?

Many people are wondering if the days of limited housing supply is behind us. This is a fantastic question. The short answer is no. Understanding the full picture here is important. Headlines are stating that inventory is up. The statement is true when compared to the most recent market, but when you look further back, data shows that there are still significantly less homes for sale now than typically listed in a more normal market.

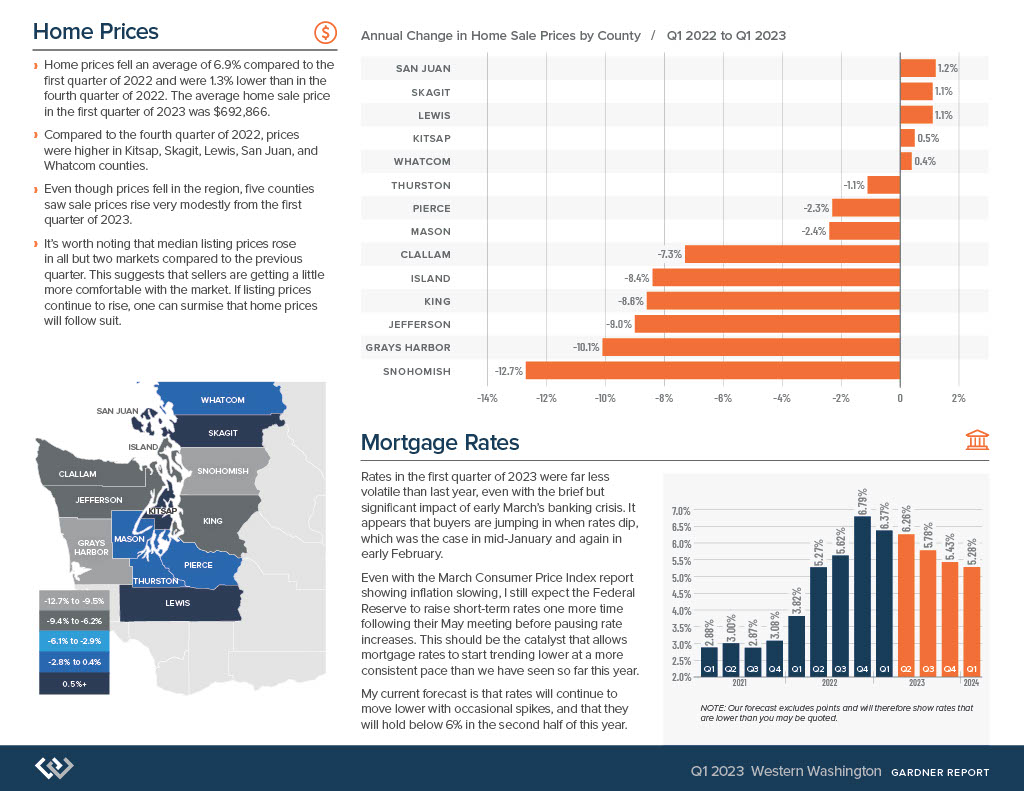

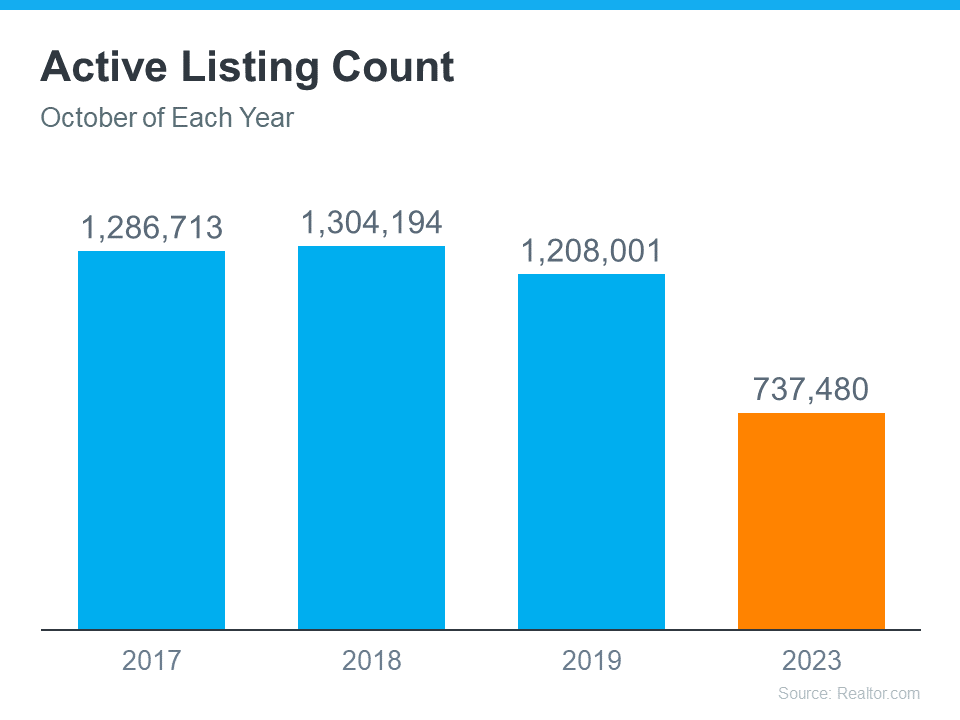

Let’s discuss the graph below.

This graph demonstrates homes listed for sale during the month of October for the three most recent normal years compared to homes listed in the month of October in 2023. As you can see there are significantly less homes listed in 2023 than in that of a normal market. Viewing this helps explain comments like the one ResiClub Analytics, founder, Lance Lambert made where he said, “Housing market inventory is so far below pre-pandemic levels that October’s big jump is still just a drop in the bucket.”

At the end of the day, real estate is hyper-local and changes vastly between locations. It is of the utmost importance, especially in times like these, to look to your trusted real estate agent for clarification of the market as they will help you gain better understanding of the inventory situations in your specific market. Don’t have an agent? Connect with us here.

If You Are Looking to Buy:

You might discover more options than you have in the most recent months. However, it would behoove you to prepare yourself for low inventory. Find yourself a great agent that will share their expertise and strategies that have helped others navigate today’s ongoing low housing.

If You Are Looking to Sell:

Know that you have not missed your window of opportunity to potentially get multiple offers or see your house sell quickly. While inventory has picked up some nationally, overall, it is still low. Having a professional Realtor on your side can help you significantly in understanding the market you are in. A great agent can craft your home a unique marketing plan that meets the requirements of the market to get your home sold.

Regardless of weather you are looking to buy or sell a home, let’s connect so that you are up to date on all of the latest trends that could potentially impact your move.

Extend the Life of Your Herbs

Don’t give up on your gardens just yet!

These 5 alternative approaches will have your herb garden thriving all winter long.

Just because the temperature has changed doesn’t mean your green thumb has to hibernate! You just need to modify your approach to stay gardening throughout the cold season.

Are you ready to start producing flavorful foliage all winter long?

Cold-resistant herbs like chives, mint, oregano, parsley, sage, and thyme tend to withstand the cold better than some of their counterparts such as rosemary. Regardless, any of these can survive when they follow these five steps.

-

Encase your herbs using cold frames or cloche.

Cold frames and cloches protect your herbs from the cold by encasing the entire plant. The enclosure traps the heat rising from the soil, raising the temperature several degrees when it otherwise would be too cold. This can promote further growth of your herbs.

What is a “cold frame” or a “cloche”? A cold frame is a house-shaped frame with glass panels that slope downward in position that capture the most sunlight for the enclosed plant. Cloches tend to be smaller in size and significantly more portable. Traditionally they are glass and bell-shaped. However, their higher price tags have encouraged the DIYers to create their own using cut-off milk jugs or soda bottles to enclose each plant. If you choose the DIY approach, don’t forget to push the edges about an inch or two below the soil to prevent them from blowing away. You can purchase plastic ones here.

-

Cover in mulch or straw.

Like a warm blanket, a thick layer of mulch or straw will allow your herbs to continue growing in the cold season. This approach works best in places that don’t experience extreme cold. When you would like to harvest, simply pull back the mulch or straw blanket, cut the herbs you need, and then return the mulch/straw blanket to its place. Keep in mind your herbs will not produce at the same rate as they did during the warmer seasons. If a small layer of snow falls atop the mulch/straw blanket it will act as additional insulation. When spring returns you can turn the mulch/straw blanket into the soil with little to no waste.

-

Repot your herbs and transport them inside to a greenhouse or sun porch.

If you are growing your herbs in the ground one of the most popular options for keeping them alive and producing is to repot them and move them somewhere warmer. The optimal way to accomplish this is by first trimming them back to about an inch tall making them easy to transport. You can use the trimmings and if there are extra follow step 5. Using a sharp shovel separate them at their bases ensuring that the roots of each one will fit into its container with well-draining planting mix. They will grow back when replanted in the garden in the spring.

-

Grow herbs in your sunny window.

Herbs can add that extra greenery to your kitchen window. Make sure they receive at least six hours of sunlight a day. If not, you can use artificial light to supplement, keeping in mind it takes about 14 hours of artificial light versus the six hours of sunlight per day. Keep your plants in an atmosphere where the temperature ranges between 60 and 70 degrees Fahrenheit. Use a well-draining potting mix and water often.

-

Extend life in a cup of water.

Some plants don’t need soil at all. You can place a cut of basil, mint, sage, oregano, thyme, and green onions in a cup of water on your window sill and they will begin to produce roots and grow new leaves. This is a great way to get extra from your harvest.

Be sure to remove lower leaves to keep them from being submerged in the water.

Keep in mind all plants will do better outside but these ones are a great alternative. Their leaves might be thinner and a tad less flavorful, but they will still be fresh for weeks to come.

If you liked this article, you can find other useful household articles by searching our blogs. Keep reading here.

Knowing When You’re Ready to Buy

Homeownership is a lifestyle choice. Therefore, choosing homeownership isn’t a decision made overnight. The decision often takes careful planning for how the purchase of a home will fit into your life now and in the future. Additionally, the decision will take financial planning for how to pay for the home of your dreams. How will you know if you are ready? Follow along as we explain the fundamentals of preparing for homeownership so that you know when the time is right for you.

When renting…

When renting, you usually don’t have to worry about maintaining the property, making repairs, or remodeling the home. Are you ready to take on those responsibilities as a homeowner? If so, are you ready to be tied down to one place? Renting offers a bit of flexibility because leases are renewed on a regular basis allowing you ease of relocation. As a homeowner you’ll need to spend time and money selling or renting out your home before relocating.

As a renter you never gain any long term savings in the form of home equity. As a homeowner, the longer you are in the home the more equity you can expect to gain. You can get a better idea of why by the explanation in our article, Is It Better to Buy a Home or to Rent One?.

A couple of good questions to ask yourself if you are considering becoming a homeowner are:

If you needed to move in a couple years, would you feel comfortable renting out your home or selling it?

Could it potentially bring in a cash flow?

As a homeowner you are ultimately responsible for paying the mortgage. Are you financially stable enough to not default on your loan?

Most importantly, becoming a homeowner means putting down roots. Are you and your household emotionally ready to make that change and commitment?

If you answered yes to the above questions, you are on your way to homeownership. Let’s dig a little deeper to see if you are financially ready to take the leap:

Do you know how much home you can afford?

There are a lot of factors that play into knowing how much home you can afford. Of course, there is the price of the home, but you must also consider interest rates as they play a significant role in your monthly mortgage payment. For a good demonstration of the effect of interest rates on your monthly mortgage payments check out this article, Rising Mortgage Rates. Furthermore, what many first-time home buyers forget to consider in addition to the down payment and monthly mortgage payments are closing costs, moving expenses, inspection fees, property taxes, and homeowners’ insurance just to name a few. A great agent will connect you with a lender that will walk you through how these will affect your payment and if they pertain to your loan. Don’t have an agent? Connect with us here to get paired with the perfect agent for you. Identifying how much you can afford is not a task to do alone. You must connect with a lender. They will look at your financial position and get you pre-approved for a home.

Are you working to reduce your debt-to-income ratio?

Lenders know that it is not realistic to have no debt. Therefore, lenders are looking to see that you are making progress towards paying down your debt. Demonstrate your plan to get your debt paid off. Your lender can help you determine the best course of action so connect with them sooner rather than later.

Are you prepared for a downpayment?

Lenders recognize 20% down payments as a demonstration of financial stability. 20% down payments decrease the initial risk to the lender and benefits the buyer by not having to pay PMI when they put 20% down. You can read more about those benefits here. However, we know not everyone can afford 20% down, but everyone needs a place to live. Therefore, there are different programs and flexible options that make owning a home attainable even when you do not have funds for a 20% down payment. It is important to talk to your lender to determine which fits your unique needs.

Maybe you already got a pre-approval letter, but you aren’t satisfied with the limits. You have several options. Provide your agent and lender with a clear expectation of your wants and needs. If you aren’t exactly sure what you want, try reading 6 Reasons to Attend Open Houses to solidify your desires. You can use this form to help identify your wants and needs to share with your agent and lender. Once you have a clear list your lender can help create a financial plan to reach your desired goal. Your agent can simultaneously watch the market for homes meeting your criteria and help you understand the dynamics of the local market. Knowing the market can help you understand your purchasing power. Your agent can help you understand the difference between a buyers’ and sellers’ market and help you understand what to expect and how to leverage the market to your advantage.

If you are ready to buy or still unsure, you should begin talking to an agent. If you don’t already have an agent, you are in luck! We have incredible agents and connections with lenders who can guide you through your unique situation and help you know when you are ready to purchase a home. Connect with us here.

State of The Nation’s Housing Explained

Harvard University’s latest edition of The State of the Nation’s Housing has arrived, and Windermere Chief Economist Matthew Gardner is here to break down what the data presented in the report means for the U.S. housing market in 2023 and beyond. Watch this video and if you have further questions you would like to discuss with a local agent call us at 360.675.5953 or connect with us here.

Real Estate 101

Location, location, location:

Costs and Financing:

Types of Real Estate:

When and How to Ask for Help:

Penn Cove Park

Welcome to Penn Cove Park. There is no doubt you will find a home you like here. There is an array of newer and older homes amongst this quiet community on the northern shoreline of Penn Cove off Monroe Landing. The central location between Oak Harbor and Coupeville provides not only more options for educational opportunities but also quick access to all the amenities both cities have to offer.

What sets this neighborhood apart from some of the others you might find on Whidbey Island is that residents not only have access to a private beach, but they also have a boat ramp. During the summer the water is warm enough to swim in because the cove is protected from the strong offshore winds that other water access areas are exposed to, making it likely the warmest beach on Whidbey Island. Not to mention, the incredible views of Penn Cove, gorgeous views of Saratoga Passage and the lovely historic Town of Coupeville. On sunny days you can spot snow covered mountains in the distance and a pod of Orca whales may be playing in the Cove.

One of the major benefits of living here is the short distance to the only Hospital on the island, Whidbey General Hospital. Downtown Coupeville offers quaint restaurants, galleries, shops, and a museum that overlook the cove offering luxurious views making for special trips all year round. Oak Harbor, just north of the neighborhood is home to Naval Air Station Whidbey Island where you will find an array of fast-food restaurants, car washes, and big-name shopping centers. In between the two discover the heart of Whidbey, with family farms like Three Sisters Market, small churches, and one of the very few left in the USA the Blue Fox Drive-in Movies with attractions like arcades, go-carts, and food!

Are you ready to get to know this Whidbey Island neighborhood better? Check it out here.

Have questions? We are happy to help. Connect with us here.

View this post on Instagram

Annual Report 2022

Are you interested in buying or selling, or just wanting to learn more about the market or just Whidbey Island in general? We are here to help! Connect with us here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link