Nervous About Getting Approved For a Home Loan?

Are you nervous about getting approved for a home loan?

Don’t be! Staying informed about what to expect and what you should and should not do will help ease some of that worry. We are here to help you. Follow these simple DOs and DON’Ts and they will help you avoid hiccups during the approval of your home loan.

Dos:

- Continue to your current rent or mortgage payments on time.

- Stay up to date on all existing accounts (even if you are paying them off).

- Continue to work for your same employer.

- Continue to use the same insurance company.

- Continue living at your current residence.

- Continue to use your credit cards as normal.

- Call your trusted lender if you have any questions.

Don’ts:

- Make any major purchases like cars, boats, furniture, jewelry ect.

- Apply for a new line of credit (credit card or loan) even if you are pre-approved.

- Open a new credit card.

- Transfer any balances from one account to another.

- Pay off any collections or accounts without first checking with your trusted lender.

- Close any credit card accounts.

- Change bank accounts or banks.

- Max out or overcharge your current credit cards.

- Consolidate your debts into fewer accounts.

- Take out a new loan.

- Start any home improvement projects.

- Finance any elective medical procedures.

- Open new cell phone accounts.

- Create a new fitness membership at a gym or club.

If you run into any unique situation that leaves you questioning whether you should proceed it is in your best interest to connect with your lender and ask before you make any decisions. Your lender can help you determine what is right for you in your unique situation to achieve your financial goals.

If you do not have a lender of your own or would like to discuss buying or selling a home, please do not hesitate to connect with us so that we can help you.

Email us at WhidbeyCommunications@windermere.com or call us at 360.675.5953

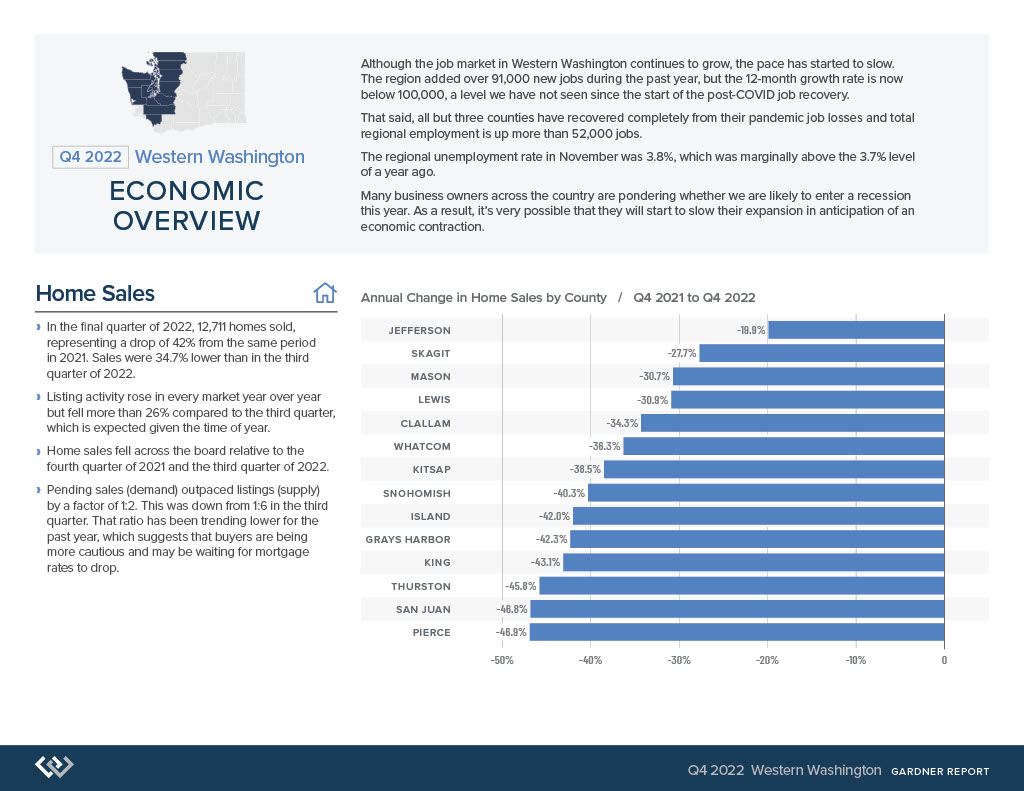

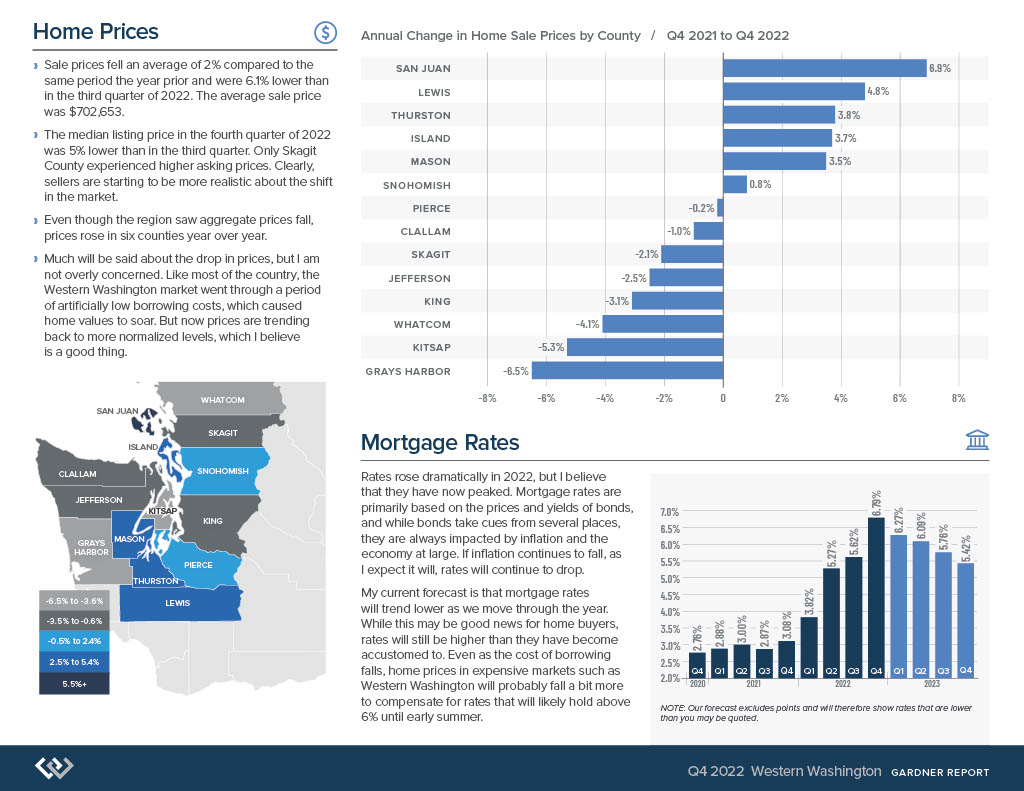

Drop in Mortgage Rates, What that Means for You

Mortgage rates rise and fall in response to varying inflation. If 7% was too high for you, it is likely now a better time to connect with your lender to see if the current rates better align with your monthly housing allowance goals, as mortgage rates have begun to decline. Keeping an eye on inflation will offer you a strong indicator to where mortgage rates will go.

While there is no comparison to the rates offered at the beginning of 2022 there is hope that they will ease a bit from the dramatic climb.

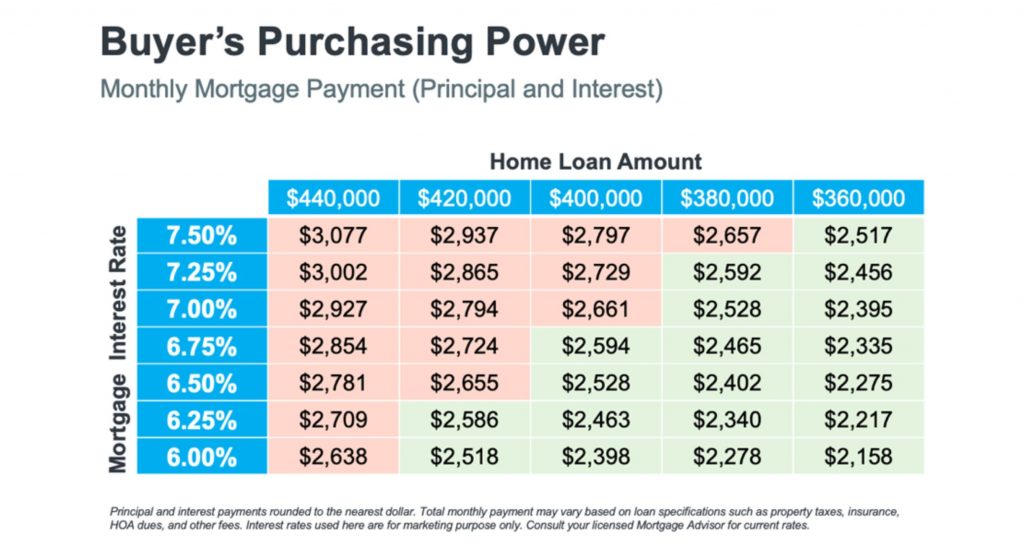

Buyers Purchasing Power

If you are considering buying, this decline in mortgage rates means an increase in your purchasing power. For example, let’s assume you want to buy a $400,000 home with a monthly payment between $2,500 and $2,600. Consider the chart below to see how your purchasing power changes as mortgage rates move up and down. The red demonstrates payments above your desired threshold while the green represents payments within and below your desired price range.

This is a small example of how a little quarter-point change in mortgage rates can significantly impact your monthly mortgage payment. It is of the utmost importance to work with a trusted real estate professional and lender who follow the market and understand the projected mortgage rates for the days, months, and year ahead,

If you are considering buying and do not have a trusted real estate broker already on your side, connect with us and we will pair you with a broker that will meet your needs.

A Different Approach to Developing Wealth

Mynd recently released their 2022 Consumer Insights Report that demonstrates how millennials and Gen Z’s have taken a different approach to developing wealth than previous generations.

For example, while 9% of Baby Boomers are contemplating the idea of investing in rental properties over 43% of Millennials and Gen Zs are choosing to remain in their current living environments and invest in rental properties elsewhere to build their wealth.

BUT IS IT WORKING?

This strategy is becoming increasingly popular. It allows the investor to remain living without disruption to their lifestyle in a place they may not be able to afford to purchase a home of their own. Instead of uprooting their lives and relocating elsewhere to attain the dream of homeownership the investor achieves homeownership by purchasing a home in a more affordable location with the intention of renting it out.

With no disruption to their life, they become a homeowner and investors at the same time. Their purchase not only creates monthly passive income for their pocketbooks but also builds equity over time – ultimately increasing their overall net worth.

They can later choose to continue to rent out the home, sell for an increased price, or move into the home if or when they want or need to.

READY TO EXPLORE THIS APPROACH?

If you would like to explore this idea further connect with us so we can help you build your wealth through real estate.

VA Home loans help Veterans Reach The American Dream

VA Home loans help veterans reach the American dream.

If you or a loved one has served in the military this article is meant for you.

It is important for you to not only know that there are Veterans Affairs (VA) home loans available to you, but also understand the program, its purpose, and the benefits available to you at its fullest.

Follow along as we break it down into bite-size pieces so that you can be best prepared for the purchase of your own home.

UNDERSTAND THE PROGRAM

Veteran Affairs home loans provide millions of veterans the ability to purchase their own homes. They have been providing these types of loans over the past 78 years.

To be eligible for a VA home loan one must be an active service member, a veteran, or an eligible surviving spouse.

UNDERSTAND ITS PURPOSE

The U.S. Department of Veterans Affairs wants to say thank you for serving by making homeownership a real possibility for those who have dedicated their lives to serving our country. They have made it their mission to serve you by providing home loan guarantee benefits in addition to other housing-related programs that assist you in buying, building, repairing, retaining, or adapting a home for your own personal use.

UNDERSTAND THE BENEFITS

Some of the major benefits of using a VA home loan is that most eligible borrowers can purchase the home with NO DOWN PAYMENT! That means you don’t have to save up to buy your own home and you are not penalized for not having a down payment. Typically, most other loans that have down payments below 20% require what is called Private Mortgage Insurance often referred to as PMI. This is an additional monthly fee tacked onto the mortgage that can be removed once you’ve reached 20% of the mortgage. How does this benefit you? You have an overall reduced monthly cost. In addition, VA loans offer competitive terms and mortgage interest rates.

The Executive Director of the Department of Veterans Affairs Loan Guaranty Service, John Bell, recently described the strength of the program by saying:

“It provides early ownership for many people that would not have that opportunity to begin with. Since there’s no down payment, it allows people to hold their wealth and it gives them the ability to have long-term financial security by being able to own a house and let that equity grow.”

Our veterans sacrifice so much during their service to our nation. One way we thank them is to ensure they have the best information about the benefits of VA home loans. Thank you for your service. If you are considering using your VA home loan and wish to speak with an agent, please connect with us here or email us at Whidbeycommunications@windermere.com.

When Rents Rise, You Pay More But You Don’t Get More

When rents rise, you pay more but you don’t get more.

Interest rates might be rising, but so is rent! As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“There is no doubt that these higher rates hurt housing affordability. Nevertheless, apart from borrowing costs, rents additionally rose at their highest pace in nearly four decades.” So, which is right for you? Buying a house or renting? If you are finding yourself in a place where you are struggling to determine which is the right decision here’s some food for thought.

RENT CONTINUES TO RISE

Rent has continually risen significantly for decades with no end in sight. It is no coincidence that as costs rise rents do too. In fact, 72% of landlords intend on raising the rent on at least one of their properties within the next year. Could that be you? Have you ever stopped to think that when rents rise, you pay more, but you don’t get more? Not only can you make money in the long run by buying a home but buying a home can prevent you from getting trapped in the cycle of continually rising rent.

When you become a homeowner, you have the opportunity to lock in your monthly payment for 15 to 30 years without it increasing as rent does. Be sure to discuss the advantages of the different types of loan options you qualify for with your Mortgage Lender (don’t have one? You can find one here). This is where homeownership pays off. Not only does your monthly payment remain low as rents around you increase creating a shield of protection from inflation but you also gain equity as your home value increases, and your loan amount decreases with each additional payment producing significantly more equity in your home each month.

ON THE FLIP SIDE

On the flip side, you need to consider the maintenance and upkeep costs of owning your own home. There is no calling the landlord when things break down or wear out and depending on the age and condition of the home you could be looking at paying a big lump sum in the future. Beyond cosmetics maintenance, you will also need to consider the cost of replacing things like your hot water heater, furnace, or even the roof over time.

Homeownership is not the right decision for everyone but consulting with an experienced Windermere broker to help weigh through all the considerations is something we love to help with, and it doesn’t cost you anything. In the meantime check out this article to dig deeper into whether or not buying or renting is better for you. Don’t have your own Windermere agent yet? Connect with us here.

Back to School: Realtors Edition

If you aren’t a real estate broker you probably don’t know that September doesn’t just initiate back to school for our kids but as an industry, this is the beginning of conference season! This just means that Fall and Winter tend to be slower seasons and provide the best time for busy brokers to grab a block of hours or even a block of days to spend sharpening their skills. Great brokers are committed to being lifelong learners. They keep up with the ever-changing market, lending options, negotiating tactics, marketing techniques for properties, and the list goes on.

If you are a broker…

You may be looking for some great opportunities that are coming up in the next few months. We have collected a few that we think will be really worth your time. Take a peek and please let us know if we missed one of your favorites because we would love to add it to our list.

New Forms are coming SOON! Please take advantage of educational opportunities to study and familiarize yourself with the changes.

You can take one of the many virtual classes the NWMLS is offering here

Oct. 14, 9-3pm in Oak Harbor! Fair Housing Class, 6 clock hours

Ninja Installation Tacoma Dec 5-8 (Brokerage pays for 1st timers)! $1,100 Thinking about joining our team? Connect with us.

Conference Opportunities:

Windermere Homecoming! $350 (plus accommodation and travel) Sept. 29-30

Inman Connect NYC Jan 24-26 $900

Denise Lones Prosperity Strategy California Nov 9-11, only 50 people! $3,500 w/ accommodation

NAR Conference Orlando Nov 11-13 $450

In addition to these great learning opportunities our brokerage brings in an expert speaker 2-3 times on topics from septic systems to negotiation tactics, from topics as unique as forestry management to ones that are pretty applicable on an island like shoreline processes and bluff stabilization. If you’d like to attend one of these trainings let us know! We’d love for you to be our guest in learning because the better we can serve our clients in this industry the better!

Lagoon Point

Lagoon Point is one of just three canal communities on Whidbey Island where you can dock your boat right in front of your home. This rare style of a planned community used to be a large salt marsh before developers pushed earth around, dredged, and carved out a canal from Puget Sound down to finger canals lined with floating docks and gangways connecting them to backyards. You can find this centrally located neighborhood on the coveted west side of Whidbey Island on the southern edge of Greenbank.

Boating Community:

Although only a small percentage of Lagoon Point community homes have docks in their backyards, most all partake in the gorgeous water views. Many of the homes are perched up the hill where they can enjoy heightened and expansive views while others surround the large lagoon (Lagoon Lake) on the north side. No one can argue that this is a very boating centric community. In fact, one of the very best boat launches can be found here and is only available to homeowners. An added benefit is that there is ample space to store your truck and trailer while you are out enjoying the sound.

Keep in Mind:

The only tricky bit with this canal community is that mother nature keeps trying to close off the mouth of the canal that leads to the Puget Sound. With that said, it is of the utmost importance to have an intimate understanding of how the spit is currently formed and at what depth tide you can safely navigate your vessel through it. Luckily, it is a very active neighborhood. One member has even provided drone footage of the opening on his You Tube channel so you can familiarize yourself! https://www.youtube.com/channel/UCXwDdeNtdeZWUnSFtfQ2Gaw

Only Bridge on Whidbey:

Lagoon Point likes to boast that it has the only bridge on Whidbey Island. Confused huh? Let us explain. There is a very serious bridge that connects the two sections of the lower part of the community that has both ends firmly planted on Whidbey where the Deception Pass Bridge obviously has one side on an entirely different island. Ha! If you can debunk this we would love to hear. Send us an email here: whidbeycommunications@windermere.com.

Check it Out:

For those just wanting to check out the community you can easily take a drive around. There is a narrow section of beach that is a public beach at the end of Salmon Street. Keep in mind it is privately owned tidelands on either side. One of the best depictions of this can be found in the gallery section of the communities very informative website https://lagoonpoint.com/gallery/.

Close to Everything:

Being central on the island, positions the community only a couple of miles from South Whidbey State Park, less than 4 miles from Greenbank Farms, and less than 10 miles from downtown Freeland. Living in Lagoon Point offers you a plethora of opportunities to take a gorgeous hike or do your grocery shopping!

Considerations:

One consideration when investing in a canal community is that maintaining such infrastructure as a jetty, bulk heads, canals, 2 boat launches, and even a bridge can be expensive and hard work. A homeowner in this community needs to be prepared to invest in their upkeep and appreciate the work the volunteers on the board and committees take on. For instance, the new bridge installed in 2017 took 4 years and 100’s of thousands of dollars. The last time they dredged it took almost a decade and just under 1 million dollars.

View this post on Instagram

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link