Spruce up your Space this Spring

With spring upon us and gardening on the top of our minds lets discuss 5 simple landscaping ideas to spruce up your space this spring before you rush out and use your 20% off plants at Mailliards Landing Nursery coupon during the month of April. Don’t have one but want one? Request yours here!

- Do you have a side yard that doesn’t get much sun? You probably find yourself feeling defeated when you are constantly left with patchy grass intermingled with mud when you were shooting for a lush green lawn. This is a sight for sore eyes, but this defeated feeling can be instantly cured with landscaping material such as pea gravel, sand, or steppingstones. A smooth, full look in this type of area is appealing to the eye and can give your yard a polished look that is not only simple to create but is also easy to maintain. Pro tip! Spruce it up with some potted seasonal flowers to brighten the space when you feel necessary.

- Determine your yards focal point. This is typically one big item. It can be a tree, a shrub, or a hardscape item like an arch, bench, or sculpture. Perhaps your yard already has one? If so, work with it to enhance eyes towards that focal point. If you don’t have one, Mailliards has a plethora of plants, shrubs and hardscape ideas to get your yard from 0 to 100 in no time!

- Create a flower bed. When choosing plants, lean on the expertise of garden store staff (they typically have a plethora of knowledge in this area). Then experiment with plants that work well in that location based on the level of sun, shade, and soil quality.

- PRO TIP: Choose native plants! These are plants that grow naturally in your area, are economical, and super easy to care for because they flourish with little to no help and are still enjoyable to look at.

- Add fresh mulch to flower and garden beds. Keep in mind that dark new mulch not only protects your plants, but it prevents weed growth and creates a fresh clean look for your yard.

Let your creativity flow. Post a picture to your social when you are done and tag us in it. We would love to see your finished product!

Instagram: @windermere_whidbey_island

Facebook: @WindermereWhidbeyIsland

If you are considering buying or selling and would like to dive deeper into this subject, we would be happy to schedule a consult with you at your home to show you even more low-cost tips and tricks for maximizing your sale price! Call us today at 360.675.5953 or email us at whidbeycommunications@windermere.com.

If you liked this article you might also like: Best ways to increase curb appeal for under $100 this Spring.

The Whidbey Island Guide and Neighborhood Deep Dive!

When you are preparing to move to a new location or to buy a home for the first time, you are likely eager to learn literally EVERYTHING from the home buying process to everything about the area and what it has to offer when you arrive.

Whether from pure excitement or overwhelming nerves you are likely to find yourself up well past your typical bedtime researching things like:

What cool things are nearby?

Which neighborhoods you can afford.

What those neighborhoods are like.

If you can imagine yourself living there.

Where the best spots are for a cup of coffee.

and probably… where the most iconic location for a picture that might make you Instagram famous might be.

Luckily for you, some real estate brokers are obsessed with this same level of need-to-know. There are a handful of brokers who have created incredibly in-depth online guides to their area. Many go as far as to include information on individual little neighborhoods that will make your search and transition that much easier.

Where it all started:

We were inspired by Marguerite Martin to go all out on neighborhoods and provide rich local content just as she has with her page Move to Tacoma.

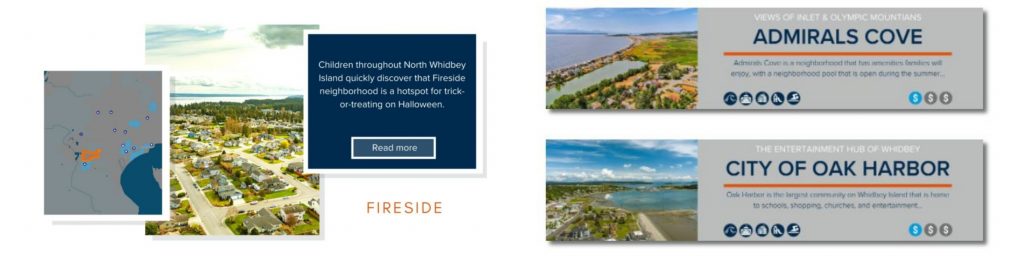

It brings us great pleasure to announce that here at Windermere Whidbey Island, we recently unveiled our very own Neighborhood Guide. We couldn’t be more excited to share it with you! Our first release takes a deep dive into 26 neighborhoods from Oak Harbor to Greenbank. We will continue expanding over time. Each page includes written descriptions, images of the homes and neighborhood features, quotes from neighbors, a map with key attractions nearby, median sales price, links to active, pending, and sold homes, commute times to schools and nearby hospitals, and blog posts on a whole suite of topics related to that neighborhood.

Looking for more?

If you are looking for more lifestyle information, check out our umbrella page The Whidbey Island Guide. The guide offers local events, links to government and public sites/resources, collections of articles on things like hiking, restaurants, and so much more.

Remember, these pages represent just the tip of the iceberg on what our brokers know about living on Whidbey Island. If all this information just leads to more questions give us a call! If you have suggestions on information, you wish we would add please tell us, we are all ears.

Connect with us:

Connect with us and expand your search by following us on Instagram at @Windermere_Whidbey_Island where you can find reels on the various neighborhoods of Whidbey.

View this post on Instagram

If Facebook is more your thing you can find us here!

Best ways to increase curb appeal for under $100 this spring

Even in the hottest seller’s market Whidbey Island has ever seen, it’s obvious that curb appeal is still fetching top dollar. In fact, now more than ever a phenomenal home that is attractively presented is able to create such a stir that buyers are battling over who will get it. If you are selling soon don’t skimp on the power of curb appeal, the return on a small investment of time, elbow grease, and new plants will never be higher! We’ve prepared a list of 6 ways to increase your curb appeal and sell for top dollar. Don’t leave anything on the table in this market!

Perhaps you are not planning to sell… these tips will help you fall in love with your space that much more without breaking the bank. So, keep reading.

1. Mailliard’s Landing Nursery plants!

A manicured lawn, established trees, shrubs, and plants are all obvious ways to increase your home’s curb appeal but adding some seasonal flowers for a pop of color or replacing anything that’s looking a little scraggly and old is the all-important icing on the cake!

During the month of April, Windermere Whidbey Island partners with Mailliard’s Landing Nursery to offer you 20% off your purchase of plants when you present our Mailliard’s offer card. Don’t have this card but want one? Email us your address and let us know you want the Mailliards card and we will pop it in the mail for you. Eager to get it sooner? Just stop by our office and pick one up.

*Expert-tip: start small with a few fast-growing trees like these top picks!

Crape Myrtle

Emerald Green Arborvitae

Prairie Crabapple

Dawn Redwood

Paper Birch

Sargent Cherry

Leyland Cypress

In addition to being fast-growing these trees need little maintenance, just water them regularly and fertilize them in the spring and fall. Doing so will not only increase your home’s curb appeal but will also, increase your property value, reduce your utility bill, improve air quality, and even reduce your stress.

2. Paint the front door!

Give your entrance a huge boost with a fresh new look. A gallon of exterior paint costs roughly $35 – $50 dollars and is an instant way to make your home stand out! It is ok to go bold here just be careful to make sure it accentuates the rest of your home.

Before you start, ensure that the door is properly prepped for painting to get the best results that will last for years to come.

We love before and after pics of front door refreshes! When you’re finished post a pic to your social and tag us so we can see what you’ve done!

Instagram: @windermere_whidbey_island

Facebook: @WindermereWhidbeyIsland

3. Pressure wash!

Cleaning out not just the front entrance but a quick wash for the entire house to make it look fresh and well cared for. This includes your driveway, walkways, fences, gutters, siding, garage doors, and patio furniture. Living in the Pacific Northwest means mold, moss, and just general organic growth can cover most surfaces. What may be almost imperceptible to the naked eye will still look freshened up with a good scrub. If you don’t have a pressure washer you can rent one here. Don’t forget to always start on the lowest pressure to prevent damage to your surfaces. *Pro-tip: move from top to bottom and out towards the street.

4. Define your yard’s entry.

If your walkway starts at the street, make it a grand entrance to make your guests feel welcomed and invited. A good way to create this feeling is by decorating your entrance with planters, a fence, pavers, gravel, or solar path lighting. Remember to request your 20% off at Mailliard’s Landing Nursery card so you can get plants to fill the planter boxes.

5. Replace your mailbox

If your mailbox is old, dented, or rusty and a little cleaning doesn’t do the trick, purchase a new one some of them are as little as $20! If you are moving the placement, make sure you are following regulations. You can find them here at the United States Post Office website.

6. Clean or update your house numbers and lighting

Do something chic with your house number. Make sure the numbers are visible from the street and that they add to the appeal of your home. Get creative, put them on planters by your new grand entrance or add a succulent planter box at your front door and display your number across the front. Let your creativity flow. Post a picture to your social when you are done and tag us in it. We would love to see your finished product!

Instagram: @windermere_whidbey_island

Facebook: @WindermereWhidbeyIsland

If you are considering buying or selling and would like to dive deeper into this subject we would be happy to schedule a consult with you at your home to show you even more low-cost tricks and tips for maximizing your sale price! Call us today at 360.675.5953.

We are NOT in a Housing Bubble: Here’s Why!

Home buyers are beginning to believe we are heading into a housing bubble. It is easy to acknowledge this premonition, as year-after-year home price appreciation has continued to remain in the double digits.

However, we are here to put your mind at ease as this market is very different than it was during the housing crash 15 years ago. Follow along as we explain four fundamental reasons why today's market is nothing like the market was back then.

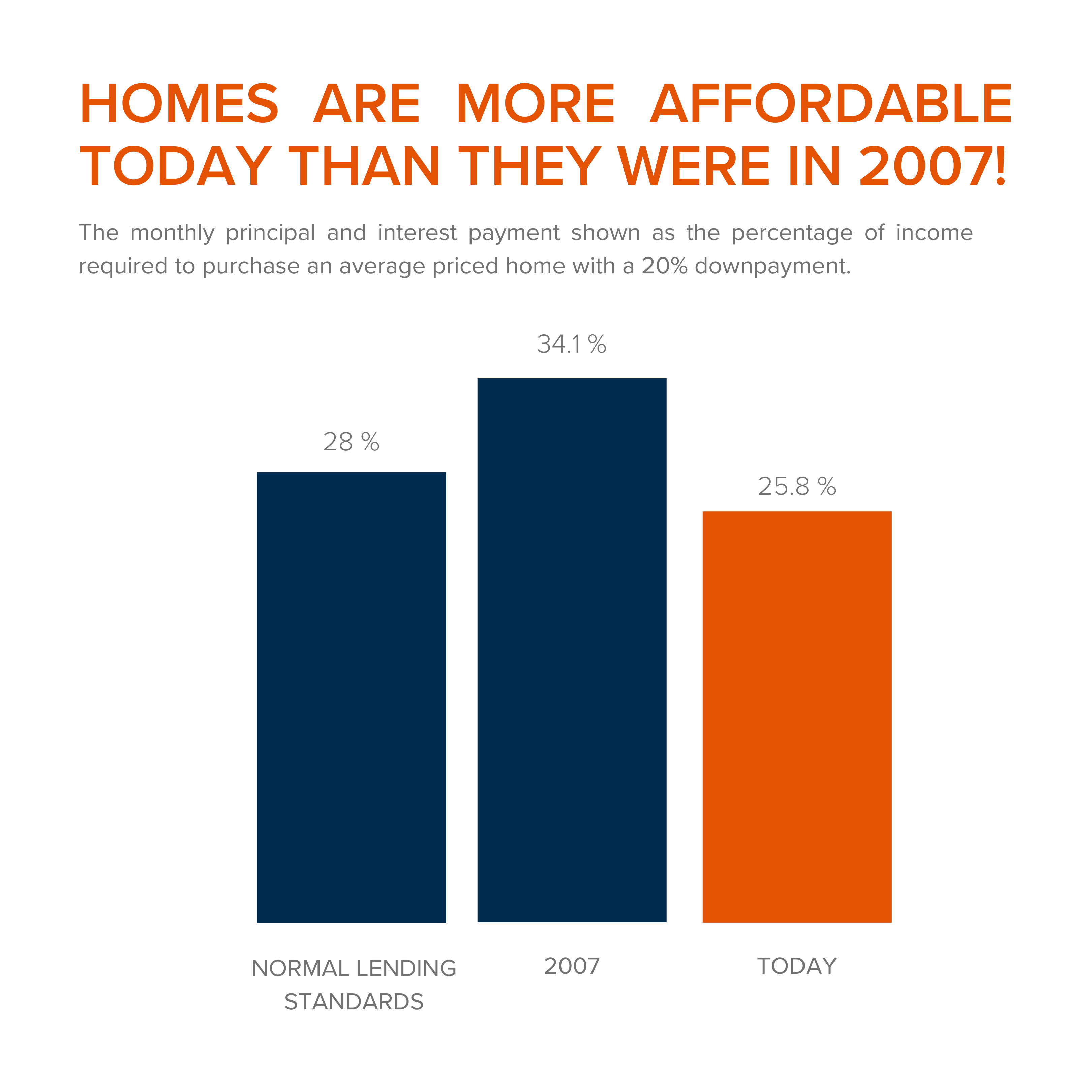

1. Houses Are Affordable Unlike During the Housing Boom

To understand this, one must understand the affordability formula. The affordability formula consists of three parts: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time of purchase. Conventional lending standards suggest a purchaser should spend no more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. While today's home prices are high, wages have increased significantly, and despite the latest spike, mortgage rates are still well below 6%. This means that todays average buyer spends less of their monthly income toward their mortgage payment than buyers did back then.

In the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta speaks to this stating, "The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward."

Undeniably, affordability is not as strong as it was last year, but it is significantly better than it was during the boom. The graph below demonstrates that difference:

How did so many homes sell during the housing boom with such prohibitive costs?

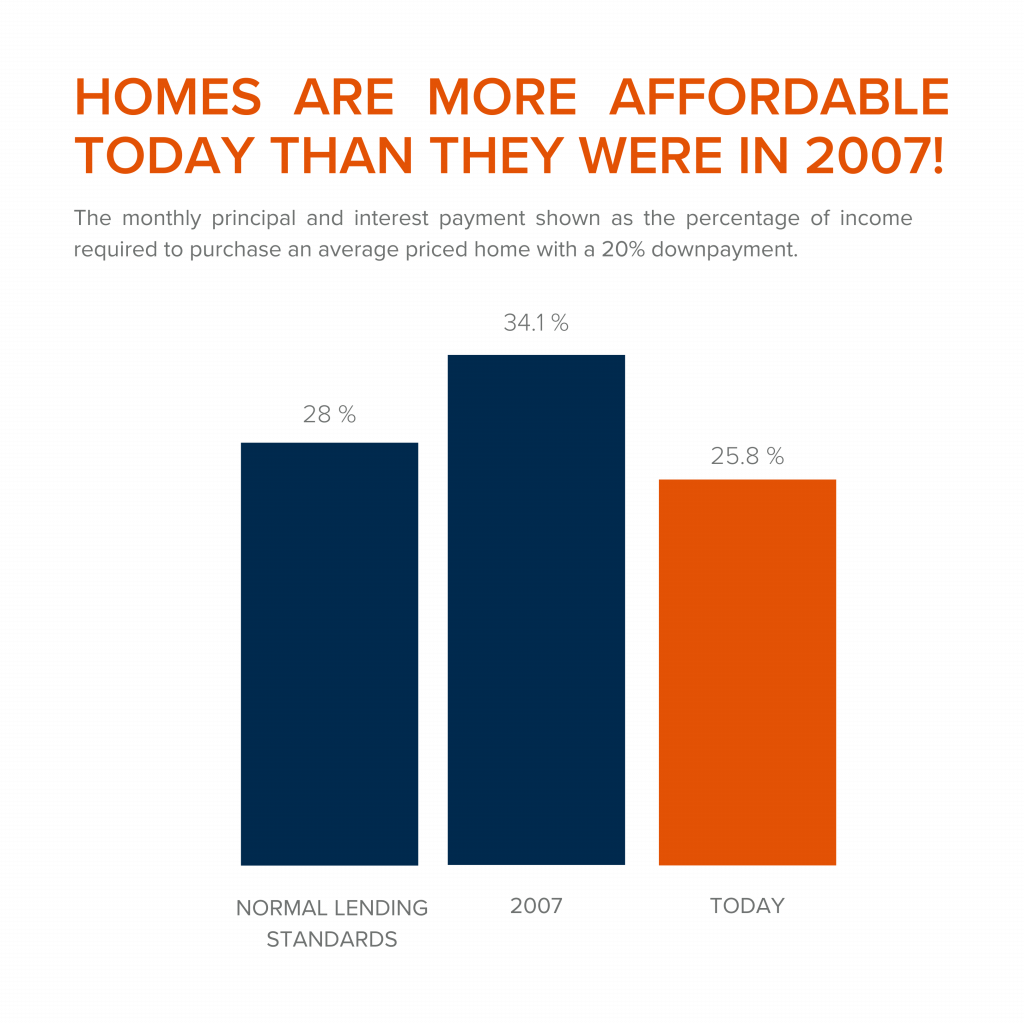

2. Mortgage Standards Were Much More Relaxed During the Boom

Getting approved for a mortgage loan was significantly more attainable during the housing bubble than it is today. According to credit.org, a credit score between 550-619 is considered poor. They define those with a score below 620, by stating that, "Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk."

While buyers can still qualify for a mortgage with a credit score within that range they are considered riskier borrowers. If you are in that range, read our How Long Does it Take to Save for a Down Payment article here. Below is a graph illustrating the mortgage volume issued to buyers with a credit score less than 620 during the housing boom, in compression to the following 14 years.

Mortgage standards are significantly different than they were last time. Buyers that obtained mortgages during the past decade are better qualified for the loans. Lets look at what that means moving forward.

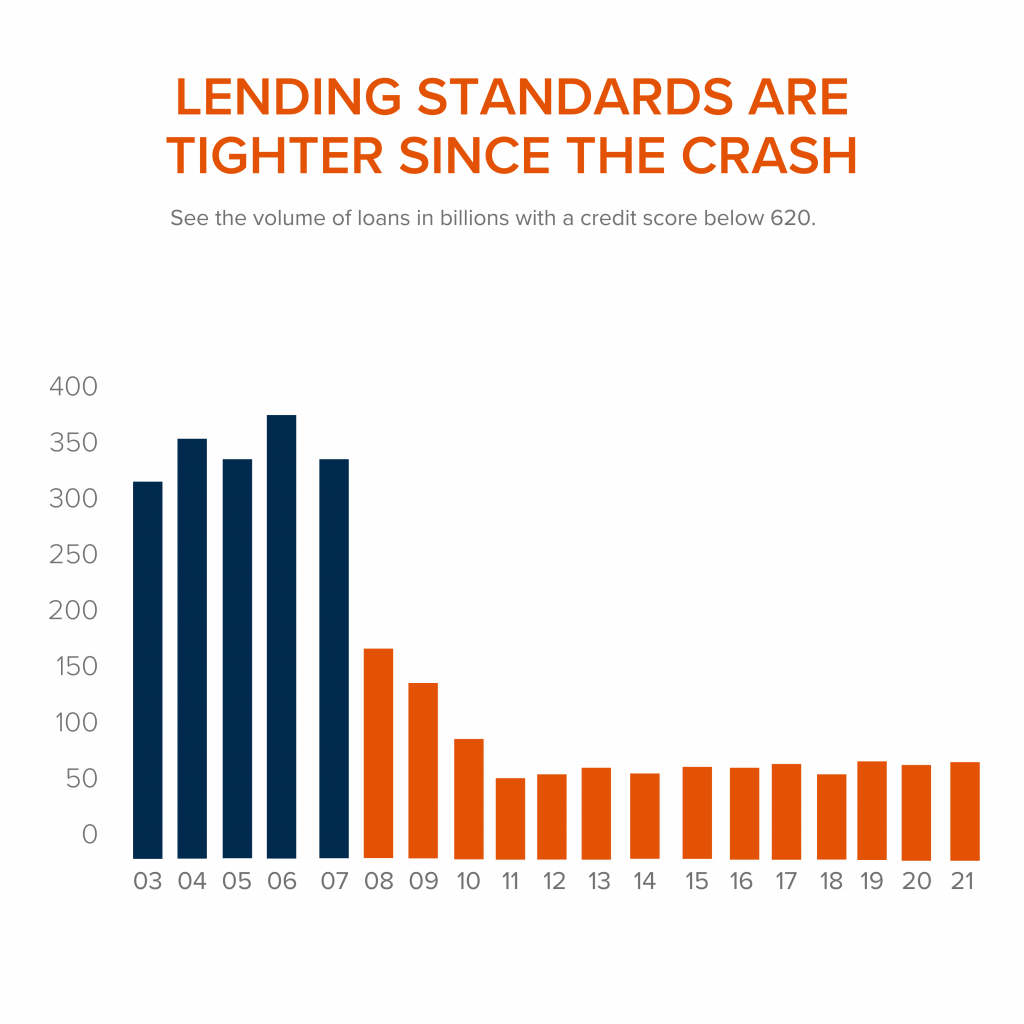

3. Foreclosure Are Completely Different Than They Were During The Crash

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

Undoubtedly the 2020 and 2021 numbers are impacted by the forbearance program, which was created to help homeowners facing uncertainty during the pandemic. Keep in mind, there are less than 800,000 homeowners remaining in the program today, and the majority of those will be able to work out a repayment plan with their banks.

Rick Sharga, Executive Vice President of RealtyTrac, explains, "The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure' narrative was incorrect."

Why are there significantly less foreclosures seen today? Well, homeowners today are equity rich. They are not tapped out.

During the build-up to the housing bubble, some homeowners were using their homes as personal ATM machines. We saw a plethora of people withdrawing their equity the moment it was built up. When home values began to fall, many homeowners found themselves in a negative equity situation where the amount they owed on their mortgage had surpassed the value of their home. Many were faced with the decision of walking away from their homes. When that happened it led to a rash of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of comparable homes in the area.

Homeowners, have since learned their lessons. Prices have risen nicely over the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like they had previously, as indicated by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now standing at $300,000. What happened last time will not happen today.

As the latest Homeowner Equity Insights report from CoreLogic explains, "Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they've also enabled many to continue building their wealth."

There will be nowhere near the same number of foreclosures as we seen during the crash. What does that mean for the housing market today?

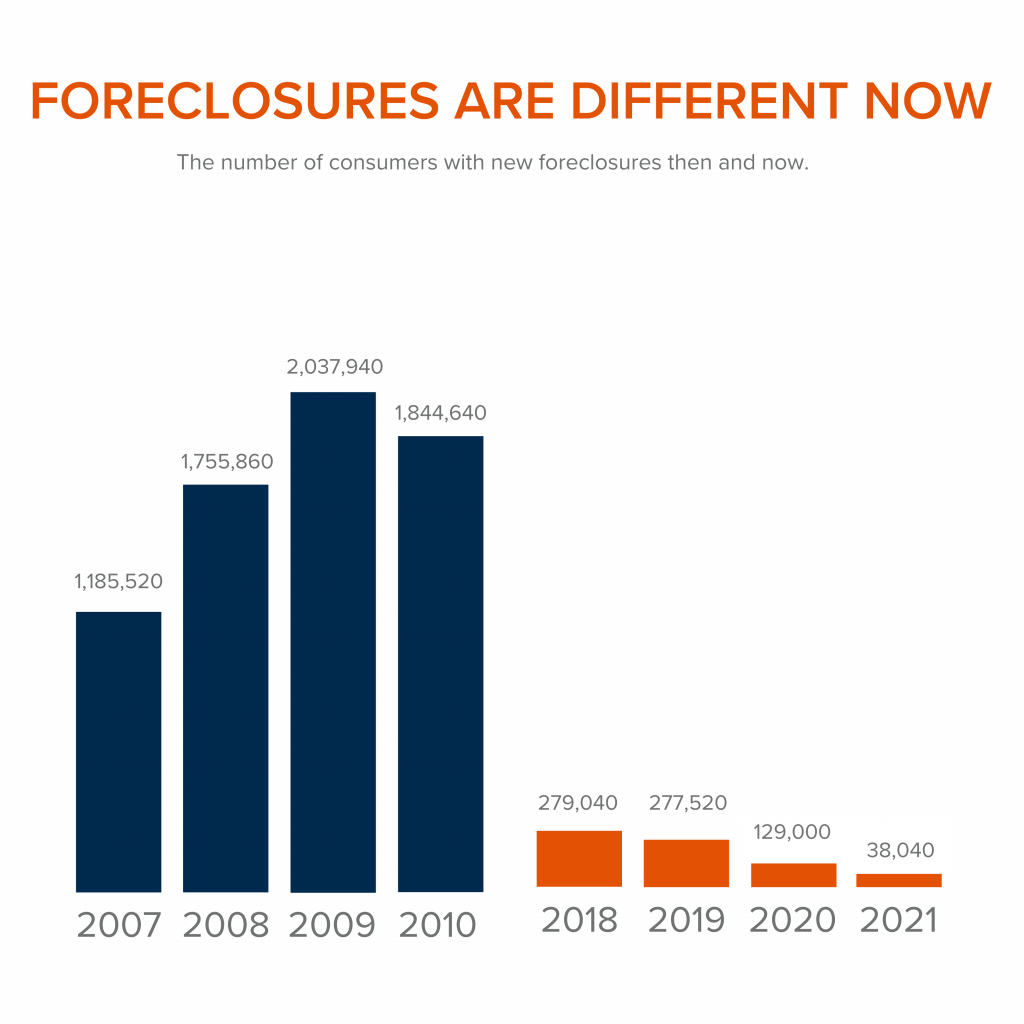

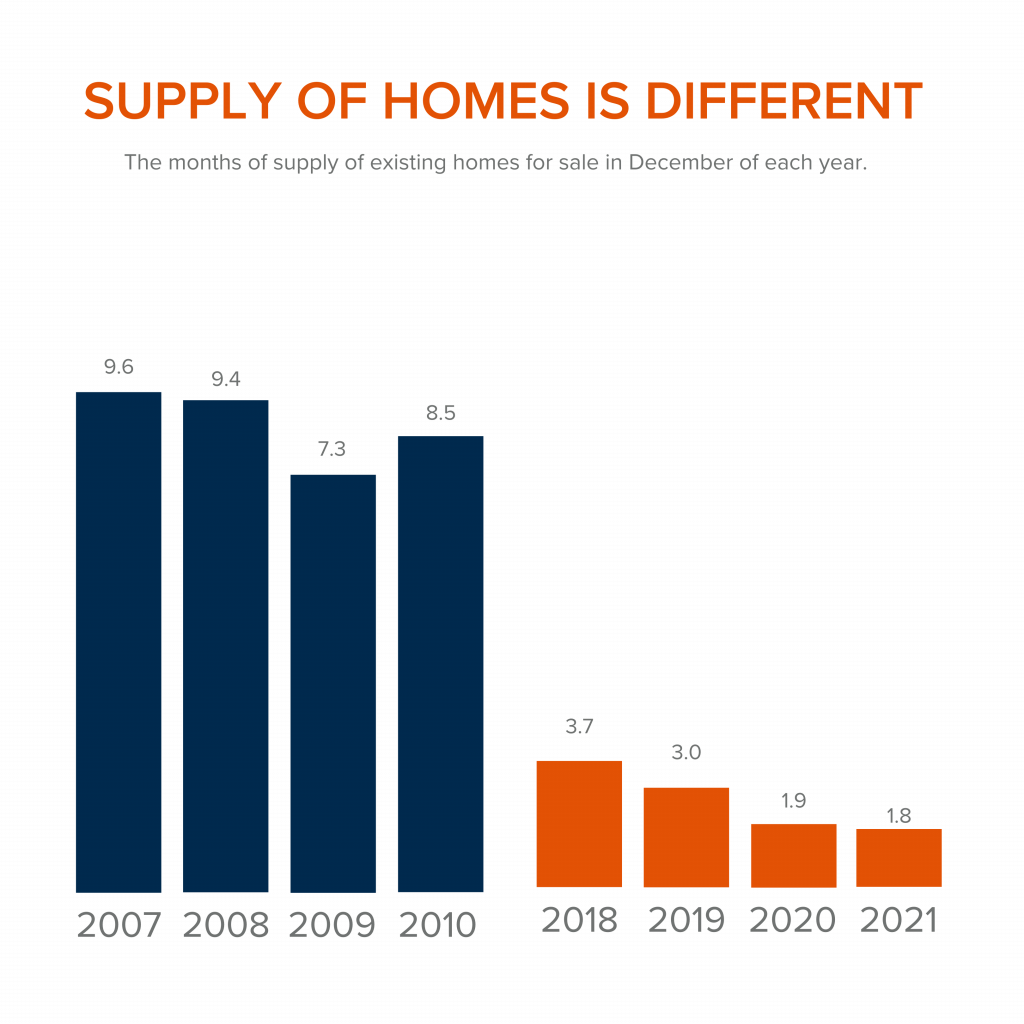

4. There is Not a Surplus of Homes on the Market – We Have a Shortage

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. The following graph demonstrates, the surplus of homes for sale between 2007 to 2010 (many of which were short sales and foreclosures). That caused prices to tumble. Today, there is a shortage of inventory, which is creating the increasing home values we are witnessing today.

Inventory is drastically different in comparison to last time. Prices are rising because there is a healthy demand for homeownership while at the same time there is a shortage of homes for sale.

At the end of the day,

if you are worried that we are making the same mistakes that led to the housing crash, the graphs above show data and insights to help alleviate your concerns. If you are considering buying or selling and would like to dive deeper into this subject we would be happy to schedule a consult with you. Call us today at 360.675.5953.

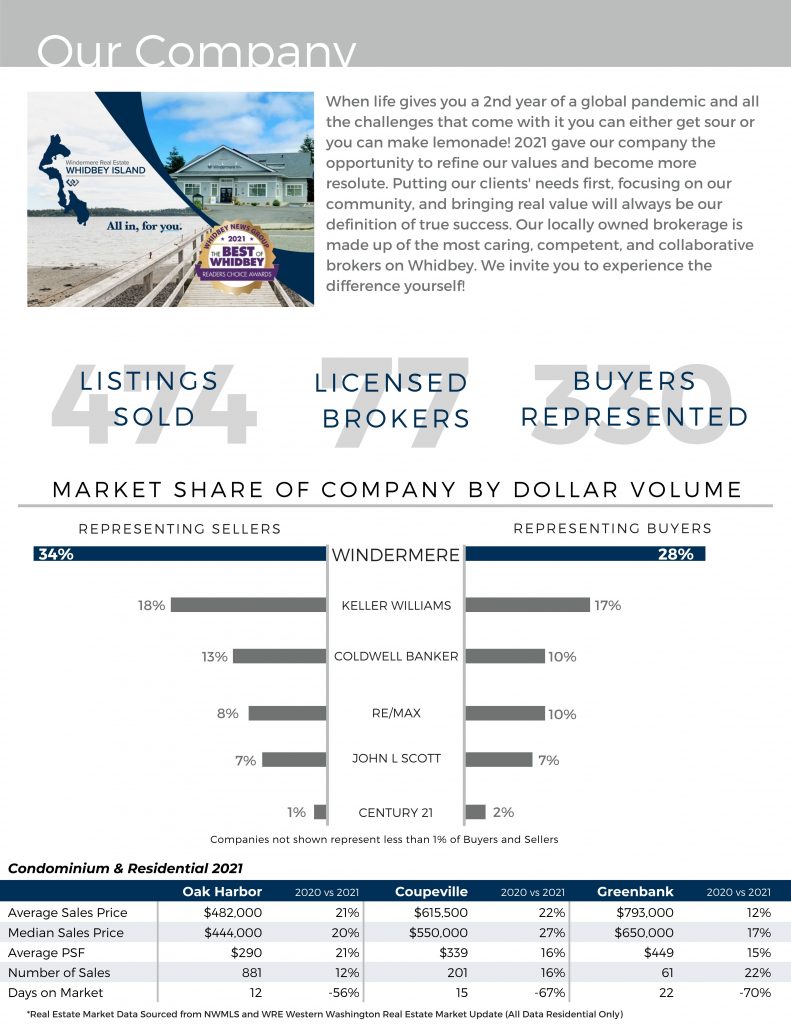

Annual Report 2021

Racial Discrimination in Real Estate

This room might seem simple to you, but to me, it marks the saddest day in my career. 💔

This picture was taken shortly after I had finished staging one of my client’s homes. I wanted to show the owners all I had done – admittedly looking for a pat on the back. Although I was showered with compliments for almost every other room in the home (all boho-themed to my aesthetic), I was given an off-putting request when they saw this photo.

This picture was taken shortly after I had finished staging one of my client’s homes. I wanted to show the owners all I had done – admittedly looking for a pat on the back. Although I was showered with compliments for almost every other room in the home (all boho-themed to my aesthetic), I was given an off-putting request when they saw this photo.

“Can you remove the painting?”

Having fallen in love with this painting months ago, I was fairly disappointed and a bit taken back by the request. I decided to inquire about the reasoning behind the request and my client’s response broke my heart into a million little pieces.

“We are afraid we’ll get less money if people know we’re Black.”

I was speechless.

In an attempt to comfort my clients and resolve the issue I made the mistake of saying ignorant things such as “that’s not as prevalent on the west coast” and “it’s just art, it won’t tell people who you are.” Ultimately though, the panting came down and was replaced by a lovely little beach scene.

Recently I was reminded of this interaction in the most heartbreaking way. In December of 2021 residents of San Francisco, California filed a lawsuit against their appraiser whose estimated value of the home came in nearly half a million dollars less than market value. After removing their family photos from the home and having it re-appraised it was clear that this discrepancy was in no small part due to the family’s race. You can read more about the story here.

My client was right. The fight is nowhere near over.

The real estate industry has a long and troubling history when it comes to the struggles of racial divide in America. In many ways, the housing industry served and serves as a stronghold for preserving racial discrimination long past the judicial end of segregation. In Richard Rothstein’s book The Color of Law, he delves into the multitude of ways in which the real estate industry fought to preserve racial segregation using subversive tactics that appeared innocent. By discreetly elongating the effects of racial segregation within the housing industry, the inability for people of color to obtain reasonable homes helped to widen the American wealth gap further than anyone thought possible.

How could the housing industry make such a profound impact on the financial prosperity of America’s minorities? The answer to this question is LONG and although I am not a professional economist, I can give you the two biggest reasons.

Real Estate is the Best Source of Generational Wealth

It is no surprise to anyone that land is one of, if not the most, finite resource we have in this world. Sure, there are always going to be those few who talk about building an underwater civilization or creating an outpost on Mars. However, if we are to assume that we do not live in a Syfy film – what we got is what we got. This means that real estate is one of the most secure investments you can make. Without the ability to create more supply and the fact that it is a basic necessity for all humans, the value of property really has little way to go other than up. This makes it a major player when it comes to building generational wealth.

A home is a unique asset in the fact that it not only provides vital accommodations to its owners but also greatly increases in value through the years and can be passed down from generation to generation. On top of that, those who own homes can withdraw equity from those homes to re-invest and grow that wealth even further.

This asset was withheld from minorities for multiple generations through the process of redlining while being generously provided to their Caucasian counterparts. By excluding minorities (especially the Black community) from the ability to build this kind of compound wealth, the prospect of even being able to buy into the investment grew further and further away with every increase in market prices. By the time segregation and redlining “ended,” the ability for minorities to purchase a suitable home was already too far gone and it would take more than just a few generations to close the gap.

Housing Taxes are Connected to Education

One of the cleaver and subversive ways in which the housing industry was able to sustain discrimination in real estate and the wealth gap was through intertwining housing taxes with access to education. By excluding minorities from suitable housing which was projected to rise in value at a far greater rate, early real estate developers were successfully able to ensure educational discrepancies between the two communities.

In exclusively Caucasian communities where home values greatly exceed their minority counterparts, schools were well funded through the taxation of those higher valued properties. As a result, the children of those communities were granted better educational programs, higher paid and more competent teachers, as well as better recognition from potential universities. Later in life, this would result in better and higher-paying jobs for the children of those exclusively Caucasian communities.

In contrast, the home systematically set aside for minority communities did not come close to meeting the values of their Caucasian counterparts. The result of this was that children raised in these communities would have fewer educational programs, poorly paid teachers, and would often have a “black mark” on their college applications due to their school’s reputation. As adults this lack of suitable education would result in working lower-paying jobs – only greatening the wealth divide.

Unfortunately, minorities today still face discrimination through illegal real estate practices such as steering and, as we saw with the San Francisco family, discriminatory appraisals. For people like me, it can be easy to think such things as “that’s all in the past” or “minorities can’t possibly still be affected by this.” However, it is through the fear in my client’s eyes as they looked at that beautiful painting that I see the truth – this battle is so far from over.

I am grateful, however, to work with Windermere Real Estate in fighting this injustice within our industry. In 2020 Windermere heard the call for equality and chose to answer. Windermere is one of the few Real Estate companies in the nation that have chosen to hire a consulting agency to help them promote Diversity, Equity, and Inclusion within our industry. Step-by-step they are helping their brokerages learn what it truly means to be inclusive and how we can all help to close the gap.

You can help too! Windermere Real Estate is partnering with HomeSight to increase Black homeownership in Washington state through what they are calling the “Hi Neighbor” fund. Through this fund, HomeSight is bridging the affordability gap for Black homebuyers so that they can increase their purchasing power. Starting in 2022 I will do my part by giving a portion of every commission I make to the fund. To learn more about this fund and to donate, click here!

This beautifully written article was submitted by our very own, Victoria Paris to discover more articles written by our agents click here.

The Benefits of Putting 20% Down on a House

If you read our, “How Long Does it Take to Save For a Down Payment?” article back in October, you know you don’t need a 20% downpayment to purchase a home because there are many alternative options available to you. However, while there are a plethora of options that you might qualify for, let’s look deeper into how putting 20% down could benefit you overall. You can find tried and true suggestions for saving up your downpayment here if you don’t have 20% saved up already. Keep in mind you can connect with us at any time to get personalized suggestions for what would work best for you in your unique situation.

In this article we are going to discuss how putting 20% down can help you get a lower interest rate, pay less overall, stand out in this competitive market, and avoid paying for PMI. Let’s get started.

Lower your interest rate:

A 20% down payment vs. a 3-5% down payment demonstrates to your lender that you are financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage interest rate will likely be.

Pay less overall:

The larger your down payment, the smaller your loan amount will be for your mortgage. If you are able to pay 20% of the cost of your new home at the start of the transaction, you will only pay interest on the remaining 80% of the cost of the home. If you put down 3.5 %, the additional 16.5% will be added to your loan and will accrue interest over time. This will end up costing you significantly more over the lifetime of your home loan.

Stand out in this competitive market:

In a market where many buyers are competing for the same home, sellers often like to see offers come in with 20% or larger down payments. Many buyers were hoping for the typical winter “slow-down” where they could see a less competitive market but that has proven not to be the case this year. Read more in our article, “Thinking the Housing Market is Going to Slow down this Winter? Think Again!” The seller in this current scenario gains the same confidence as the lender. You are seen as a stronger buyer with financing that is more likely to be approved. Therefore, there is a significantly higher chance that the deal will go through with a 20% downpayment.

Avoid paying for PMI:

You might be asking yourself, what is PMI? Freddie Mac explains,

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage.

It is not the same thing as homeowner’s insurance. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%. . . . Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment.”

As mentioned earlier, if you put down less than 20% when buying a home, your lender will see your loan as having more risk than those who do put 20% down. PMI helps lenders recover their investment in you in the case that you are unable to pay your loan. However, this insurance is not required if you are able to put down 20% or more. In turn, this saves you from paying those extra fees.

Oftentimes, sellers looking to move to a larger or more expensive home are able to take the equity they earn from the sale of their house to put 20% down on their next home. The equity homeowners have today, creates an advantageous opportunity to put those savings toward a larger down payment on a new home.

If you are considering buying or selling or just want to talk about this in more detail, connect with us. We are here to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link