A Sweet Treat from Zan Fiskum

“Maple Valley raised singer/songwriter Zan Fiskum uses her haunting and beautifully controlled singing to craft ethereal and brooding folk/pop songs.”

If that quote alone doesn’t make you want to get up and listen, I don’t know what will.

Like many of us, Zan grew up in the PNW. Her family volunteered at a diner theater called Auburn Avenue. Like most children, she remembers playing make-believe, except she was playing among the red velvet seats of the auditorium while her family prepared for their performances. When Zan followed suit and took to the stage she was a natural.

“At the age of 12 Zan broke away from the molds of her classical music training and experimented with enmeshing forthright lyrics, cinematic melodies and explosive synth sounds into her songwriting. She went on to release her first 6 singles and achieved over 2 million streams on Spotify alone.”

She found herself and began sharing her unique gift with the world.

“Just 2 years later, Zan made her national debut on NBC’s The Voice as a top 9 finalist and received recognition for her dynamic performing and voice from Billboard magazine, Maggie Rogers, Camila Cabello and the Indigo Girls.”

You might recognize her by her debut album “Sleeping Problems.” To learn more about Zan click here.

She recently has been performing in iconic Seattle venues such as The Moore Theater, The Triple Door, Sasquatch, and more. We are lucky enough to be welcoming her here to Whidbey Island Wednesday, August 10 as part of the Sounds of Summer Concert Series put on by the Oak Harbor Music Festival and Windermere Real Estate Whidbey Island. Mark your calendars every Wednesday evening in August for the first four Wednesdays. In addition to Zan Fiskum on August 10 you can catch Whidbey’s Saratoga Orchestra with featured guests The Gothard Sisters (Aug 3), The Chris Eger Band( Aug 17), and Janie Cribbs and the T.rust Band on (Aug 24). To learn more about the event and others like it click here.

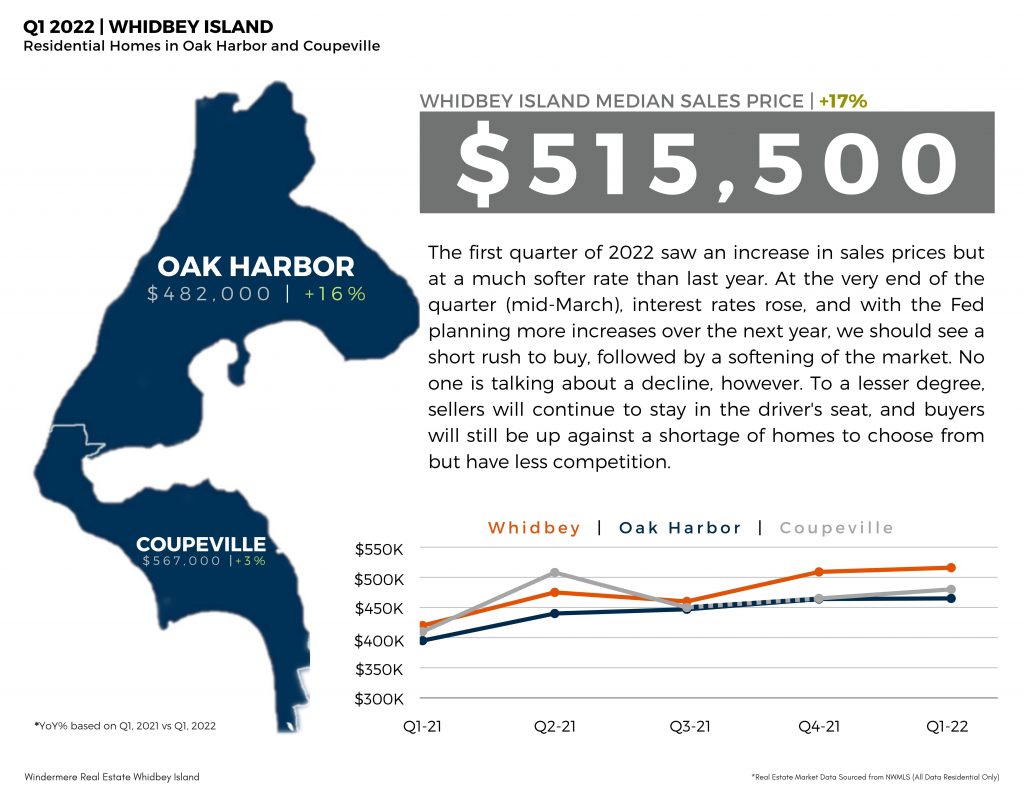

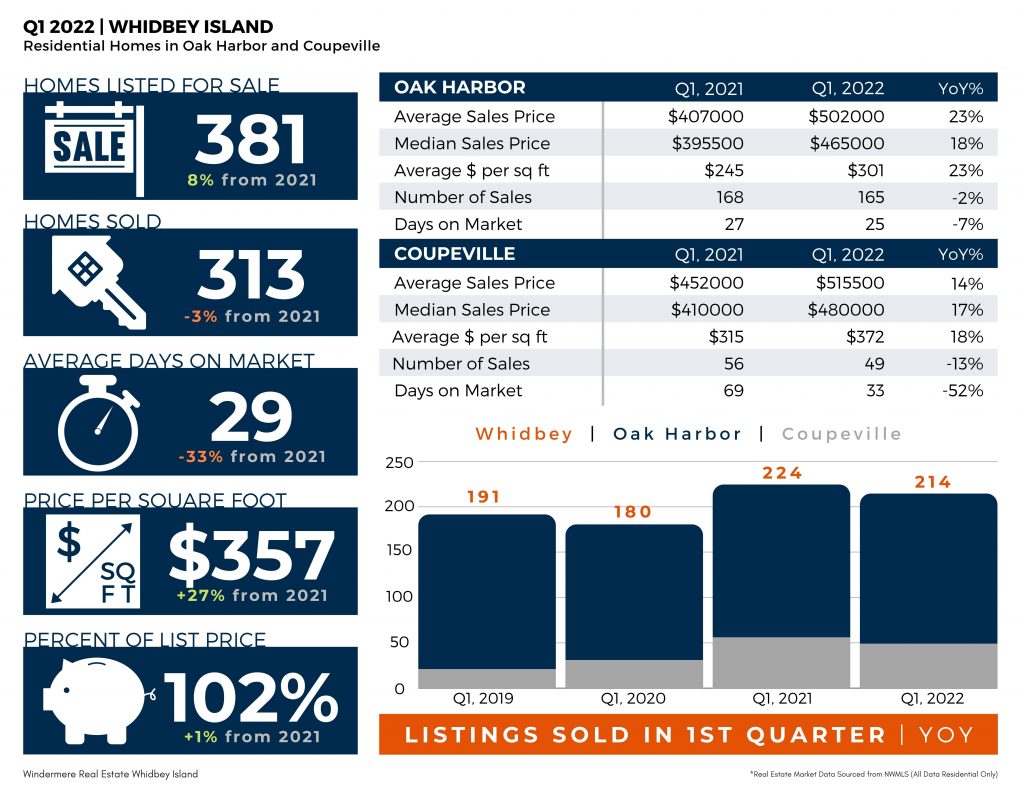

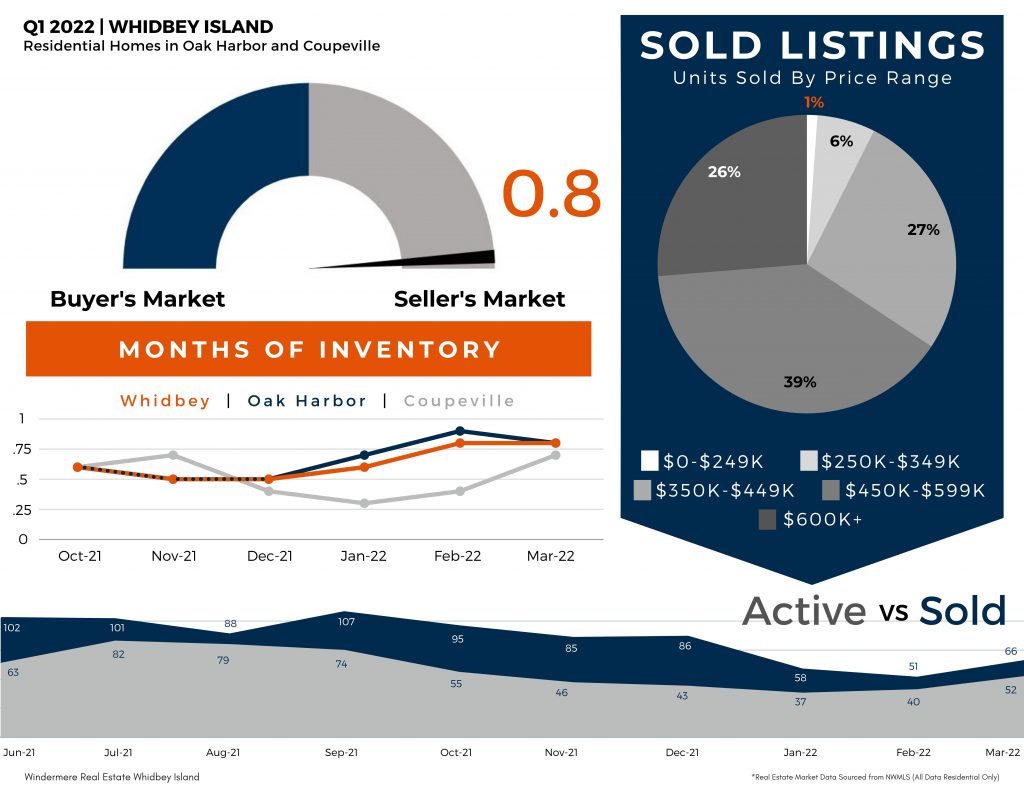

Q1 Whidbey Island Market Report 2022

Interested in digging deeper into the stats on Whidbey Island? Check out more stats here. Whether you are considering buying or selling let’s connect so that you have a trusted real estate advisor on your side who can help you strategize to achieve your dream of home ownership.

Racial Discrimination in Real Estate

This room might seem simple to you, but to me, it marks the saddest day in my career. 💔

This picture was taken shortly after I had finished staging one of my client’s homes. I wanted to show the owners all I had done – admittedly looking for a pat on the back. Although I was showered with compliments for almost every other room in the home (all boho-themed to my aesthetic), I was given an off-putting request when they saw this photo.

This picture was taken shortly after I had finished staging one of my client’s homes. I wanted to show the owners all I had done – admittedly looking for a pat on the back. Although I was showered with compliments for almost every other room in the home (all boho-themed to my aesthetic), I was given an off-putting request when they saw this photo.

“Can you remove the painting?”

Having fallen in love with this painting months ago, I was fairly disappointed and a bit taken back by the request. I decided to inquire about the reasoning behind the request and my client’s response broke my heart into a million little pieces.

“We are afraid we’ll get less money if people know we’re Black.”

I was speechless.

In an attempt to comfort my clients and resolve the issue I made the mistake of saying ignorant things such as “that’s not as prevalent on the west coast” and “it’s just art, it won’t tell people who you are.” Ultimately though, the panting came down and was replaced by a lovely little beach scene.

Recently I was reminded of this interaction in the most heartbreaking way. In December of 2021 residents of San Francisco, California filed a lawsuit against their appraiser whose estimated value of the home came in nearly half a million dollars less than market value. After removing their family photos from the home and having it re-appraised it was clear that this discrepancy was in no small part due to the family’s race. You can read more about the story here.

My client was right. The fight is nowhere near over.

The real estate industry has a long and troubling history when it comes to the struggles of racial divide in America. In many ways, the housing industry served and serves as a stronghold for preserving racial discrimination long past the judicial end of segregation. In Richard Rothstein’s book The Color of Law, he delves into the multitude of ways in which the real estate industry fought to preserve racial segregation using subversive tactics that appeared innocent. By discreetly elongating the effects of racial segregation within the housing industry, the inability for people of color to obtain reasonable homes helped to widen the American wealth gap further than anyone thought possible.

How could the housing industry make such a profound impact on the financial prosperity of America’s minorities? The answer to this question is LONG and although I am not a professional economist, I can give you the two biggest reasons.

Real Estate is the Best Source of Generational Wealth

It is no surprise to anyone that land is one of, if not the most, finite resource we have in this world. Sure, there are always going to be those few who talk about building an underwater civilization or creating an outpost on Mars. However, if we are to assume that we do not live in a Syfy film – what we got is what we got. This means that real estate is one of the most secure investments you can make. Without the ability to create more supply and the fact that it is a basic necessity for all humans, the value of property really has little way to go other than up. This makes it a major player when it comes to building generational wealth.

A home is a unique asset in the fact that it not only provides vital accommodations to its owners but also greatly increases in value through the years and can be passed down from generation to generation. On top of that, those who own homes can withdraw equity from those homes to re-invest and grow that wealth even further.

This asset was withheld from minorities for multiple generations through the process of redlining while being generously provided to their Caucasian counterparts. By excluding minorities (especially the Black community) from the ability to build this kind of compound wealth, the prospect of even being able to buy into the investment grew further and further away with every increase in market prices. By the time segregation and redlining “ended,” the ability for minorities to purchase a suitable home was already too far gone and it would take more than just a few generations to close the gap.

Housing Taxes are Connected to Education

One of the cleaver and subversive ways in which the housing industry was able to sustain discrimination in real estate and the wealth gap was through intertwining housing taxes with access to education. By excluding minorities from suitable housing which was projected to rise in value at a far greater rate, early real estate developers were successfully able to ensure educational discrepancies between the two communities.

In exclusively Caucasian communities where home values greatly exceed their minority counterparts, schools were well funded through the taxation of those higher valued properties. As a result, the children of those communities were granted better educational programs, higher paid and more competent teachers, as well as better recognition from potential universities. Later in life, this would result in better and higher-paying jobs for the children of those exclusively Caucasian communities.

In contrast, the home systematically set aside for minority communities did not come close to meeting the values of their Caucasian counterparts. The result of this was that children raised in these communities would have fewer educational programs, poorly paid teachers, and would often have a “black mark” on their college applications due to their school’s reputation. As adults this lack of suitable education would result in working lower-paying jobs – only greatening the wealth divide.

Unfortunately, minorities today still face discrimination through illegal real estate practices such as steering and, as we saw with the San Francisco family, discriminatory appraisals. For people like me, it can be easy to think such things as “that’s all in the past” or “minorities can’t possibly still be affected by this.” However, it is through the fear in my client’s eyes as they looked at that beautiful painting that I see the truth – this battle is so far from over.

I am grateful, however, to work with Windermere Real Estate in fighting this injustice within our industry. In 2020 Windermere heard the call for equality and chose to answer. Windermere is one of the few Real Estate companies in the nation that have chosen to hire a consulting agency to help them promote Diversity, Equity, and Inclusion within our industry. Step-by-step they are helping their brokerages learn what it truly means to be inclusive and how we can all help to close the gap.

You can help too! Windermere Real Estate is partnering with HomeSight to increase Black homeownership in Washington state through what they are calling the “Hi Neighbor” fund. Through this fund, HomeSight is bridging the affordability gap for Black homebuyers so that they can increase their purchasing power. Starting in 2022 I will do my part by giving a portion of every commission I make to the fund. To learn more about this fund and to donate, click here!

This beautifully written article was submitted by our very own, Victoria Paris to discover more articles written by our agents click here.

Penn Cove Mussels

Every city or county has that one thing they are famous for. Their claim to fame that puts them on the world map. For some it is a world-famous sports team, others it is a historical location, still some gain fame from the presence of rare exotic animals.

For Island County, it is our mussels.

No, not the Emerald Cup kind of muscles we didn’t make a typo, we mean our Penn Cove mussels.

The History of Penn Cove Mussels

You may not know this, but Island county is home to the oldest and largest mussel farm in the United States (and maybe the world). Penn Cove Mussels, Inc. began culturing mussels in 1975 with the desire to harness the cove’s naturally nutrient-rich water to harvest bigger and better mussels than the ones currently available. The results were incredible! Penn Cove mussels grow at a remarkable rate, enabling the mussels to reach harvest size within one year. This rapid growth rate causes Penn Cove mussels to have a firmer texture, sweeter flavor, and a thinner shell with more meat. As you can imagine, it makes them quite a crowd-pleaser.

Whidbey Island’s proximity to Seattle and the Sea-Tac Airport mean these wonderful shellfish don’t have to be a local secret. Instead, these mussels are quickly air-shipped all over the world for others to experience and enjoy. Mussels harvested in the morning are on the lunch plates of Seattle seafood lovers by that afternoon and dinner entrees in Houston by the evening.

Celebrated with a Festival

35 years our Penn Cove Mussels have been celebrated with a festival. The original celebrations consisted of a community chowder contest that has morphed over the years into 3 days’ worth of activities and fun. The most recent events have attracted more than 6,000 mussels enthusiasts from far and wide. This event alone significantly helps the local merchants recover from the slow winter months.

Musselfest festivities typically kick off on a Friday with the “Mussel Mingle.” This is a time where people gather at the Coupeville Recreational Hall to enjoy food, drink, and music. The next two days are packed full of mussel cooking demonstrations from incredible Seattle chefs, the massive mussel chowder competition involving 16 different local restaurants, the mussel eating competition, tours of Penn Cove Shellfish, Inc., a mountain bike event (“Mussels in the Kettles”) and more!

Musselfest is a massive community affair that requires all hands on deck to pull off. Dozens of volunteers from all over Coupeville donate their time, finances, and resources to make this festival work. For the past few years, Windermere Whidbey agents have volunteered their time at the Waterfront Beer Garden where they serve up some great local ale while listening to amazing local musicians.

Unfortunately, like most events, the Penn Cove Musselfest was canceled due to Covid this past year, but the long-standing love for the festival carried on with the traditional T-Shirt and posters for all of the collectors. Past posters can be purchased here while supplies last.

The 2022 Musselfest is anticipated to take place March 4th, 5th, and 6th pending the state of Covid and guidance from the state and county. Click here to check the status.

Maylor Point

In this amazing shot by Willie Shaw at Team Shaw Photography, you can see the actual harbor of Oak Harbor, the marina, Maylor Point with its iconic white radar dome, the spit to Polnell Point, and the snow-covered Cascade Mountains. Phenomenal views like this one can be seen while driving all over Whidbey Island. Winter makes these vistas even more stunning by providing clear air and snow-capped mountains in every direction. This is just one of the reasons a drive down the length of Whidbey is designated as an official scenic byway called the “Whidbey Scenic Isle Way”.

Fort Ebey Fort

Treading toward the pinhole of light at the end of the dark tunnel, you hear the creak of an old metal door as it’s caught by a slight breeze. Your steadiness escapes you as you break into a firm sprint until your eyes see the safety of the trees and vista. It’s hard to keep your imagination at bay when visiting Fort Ebey’s eerie bunkers. Built in 1942 as part of the coastal defense system for World War II, Fort Ebey was home to a state-of-the-art battery with two 6-inch guns. When its usefulness ran out, the property was purchased by the state who chose to keep elements of the old battery when opening up the park, making it possible for thousands to explore and enjoy these thrilling bunkers every year.

Fort Casey Forts

Standing tall along the western coast of Whidbey Island, these 10” barrel guns tell the story of a relationship to the United States Department of Defense that began long before any plane took flight. At the time of its construction in the late 1800s, Fort Casey was a military marvel. Part of the “Triangle of Fire,” this military outpost was one of many strategically placed along the Puget Sound as the first line of defense against aquatic attack. Unfortunately, this magnificent fort’s usefulness was short-lived. By the 1920s Fort Casey’s impressive disappearing guns had already become obsolete and in 1956 the property was purchased by Washington State Parks and Recreation. Today, this fort is one of the most frequented state parks in Washington and a deeply embedded part of Whidbey Island culture.

Check out the rest of Whidbey’s beautiful destinations from this series here.

Langley Village

Langley is known for its unique specialty shops and galleries, showcasing amazing local artisan talent. From the lovely greenery of Bayview Farm & Garden to seaside-inspired jewelry and home décor at Foamy Wader, Langley has something for everyone! Want to try your own hand at some specialty art? Visit Callahan’s Firehouse for a cup of espresso and an amazing glass blowing experience catered to all groups and ages. At the end of the meandering plaza of shops pictured in the postcard is Whidbey’s popular ramen restaurant, “Ultra House.” It’s tucked away from the main drag, makes you feel like you landed in Japan, and is one of the most addictive taste sensations on the whole island!

Check out the rest of Whidbey’s beautiful destinations from this series here.

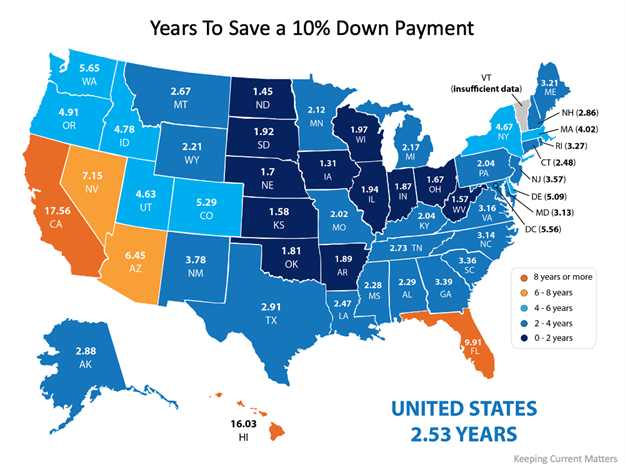

How Long Does it Take to Save For a Down Payment?

Saving enough money for a down payment on your first home can be one of the biggest obstacles to homeownership. Depending on your circumstance you might need anywhere from 3% – 20%. Speaking with a reputable local lender will help you find out exactly what your percentage will be.

But how long should it take, you ask!?

Follow along as we estimate the amount of time it takes a person earning a median income and paying a median rent to save up for a down payment on a median-priced home.

To accomplish this task we use the concept that homeowners should pay no more than 28% of their total monthly income on housing expenses. We use this information in combination with data from the U.S. Department of Housing, Urban Development (HUD), and Apartment List to determine our estimation.

According to the data pulled, the national average for the time it would take to save for a 10% down payment is roughly two and a half years (2.53). Looking at the diagram below you can also see that those living in Iowa can save for a down payment in as little as 1.31 years while those in California could take 17.56 years. The map below can help you determine the amount of time (in years) it can take for you to save in your state:

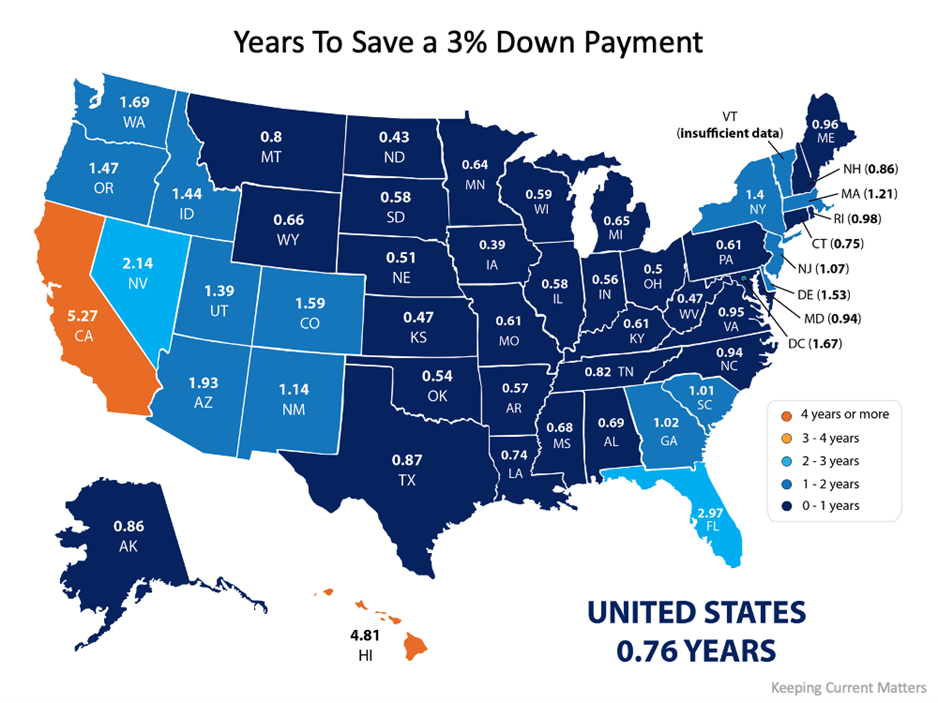

What if you only need to have a 3% down payment?

It is a common misconception that you need to have a 20% down payment to buy a home.

The reality is there are reasonable alternative options out there. First-time home buyers have an advantage with a plethora of down payment assistance programs available to them. You just have to find the right lender and ask. Need help finding a lender? Ask us to connect you with one here.

What if you qualify to take advantage of one of the 3% down payment programs?

If you qualify for a 3% down payment program, then you only have to come up with 3% of the total cost of the home at closing instead of ten or the typical 20% we have seen required in the past. Saving for a 3% down payment might not take you very long. In fact, it could take less than a year in most states, as shown in this map here:

At the end of the day

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Connect with us to explore the options available to you in our area and how they support your plans for buying a home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link