Your Home Should Be Your Relaxing Sanctuary

Your home should be a place to relax, spend time with loved ones, and unwind from the stresses of everyday life. Your home should be your relaxing sanctuary. Unfortunately, now more than ever before, the work/life balance lines have become grayed as many of us are still working in some sense from home. It is likely that work stressors bleed over into your personal time now more than they ever have in the past. If this is the case, your home might start to feel less like a sanctuary and more like the focal point for life’s anxieties. How do you overcome it? Can you find sanctuary in your home again?

Of course! We are here to help you create that space. If not in your current home, we can help you discover it in one that meets your new work/life needs if you have outgrown the old. Take a peek at what is available here.

If you are looking to reduce stress when you are home by turning your current space back into a place of rest, follow along for a few DIY projects that could just do the trick.

Feng Shui

The ancient practice of Feng Shui has been guiding people toward creating balanced, harmonious spaces for thousands of years. Whether or not you embrace the idea that positioning your bed with the headboard against the north wall can enhance your sleep, many Feng Shui principles are hard to argue with. One such timeless concept is bringing elements of nature into your home to foster a sense of calm and tranquility. You can achieve this by incorporating living plants, which not only purify the air but also infuse the space with vitality, or by adorning your walls with artwork that displays serene natural landscapes. Both approaches help create an atmosphere of peace and well-being, turning your home into a sanctuary.

If you implement this into your space, share what you have done with us by tagging us @windermere-whidbey-island on Instagram.

Declutter

Today, it is difficult to avoid the consumerism bandwagon. Many homeowners are finding themselves in a “maximalist” lifestyle regardless of whether they intentionally choose to. Unfortunately, clutter has a habit of stressing people out. To reduce stress, we suggest tidying your space. Go through your things regularly and get rid of items that aren’t sparking joy anymore. If you don’t wish to get rid of items, consider investing in attractive storage solutions that allow you to hold onto your items while attractively making use of your space. Consider placing a flip-top bench at the end of a hallway or at the foot of your bed to hide infrequently used items.

Rounded shapes

Clean lines and order can bring comfort to many. However, too many right angles can be overly stimulating. Circles and ovals, on the other hand, can create a soothing organic feel. Try adding round touches with circular ottomans, oval frames for mirrors and art, and spherical elements such as a globe or orbs on a bookshelf.

Color

The hues and shades you use in your home can have the biggest impact on your mood. Bright colors can be energizing, and reds are great for stimulating appetites in kitchen and dining rooms. But if you are looking to bring a sense of calm to a room, muted shades of blue and green or earth tones are best. Mental Health America says, “Bright, warm colors (reds, oranges, yellows) stimulate energy and happiness while cool, subdued colors (blues, greens, purples) are soothing and calming. Bright, warm colors are best in rooms for entertaining like dining rooms or kitchens, while cool colors work best in relaxing spaces like bedrooms or even bathrooms.” If you are reluctant to paint a whole room, try an accent wall or incorporating throw blankets, pillows, and artwork.

Lighting

The way we light our homes—and when we choose to turn off the lights—can significantly affect our mental well-being. Natural sunlight streaming through unobstructed windows is ideal for boosting your mood and increasing productivity during the day. However, if your home has limited windows or you value your privacy, incorporating lamps that emit warm, soft light can create a calming and cozy atmosphere.

A good night’s sleep is one of the best ways to manage stress, and the right lighting can help. As the evening sets in, dim your home’s lights to signal to your brain that it’s time to wind down. When it’s time for bed, consider using blackout curtains to achieve complete darkness for restful sleep. Avoid lightbulbs designed to mimic daylight, as these can interfere with your natural sleep cycle—unless you’re using them to combat Seasonal Affective Disorder (SAD) during the winter months.

For a cozy décor idea, switch off harsh overhead lighting and opt for lamps with dimmable or adjustable light settings to create a serene, adaptable ambiance in any room.

If these tips don’t work for you, maybe it is time to consider a new home that fits your new needs. If this is the case. Connect with us and we can help.

Real Estate 101

Location, location, location:

Costs and Financing:

Types of Real Estate:

When and How to Ask for Help:

Penn Cove Park

Welcome to Penn Cove Park. There is no doubt you will find a home you like here. There is an array of newer and older homes amongst this quiet community on the northern shoreline of Penn Cove off Monroe Landing. The central location between Oak Harbor and Coupeville provides not only more options for educational opportunities but also quick access to all the amenities both cities have to offer.

What sets this neighborhood apart from some of the others you might find on Whidbey Island is that residents not only have access to a private beach, but they also have a boat ramp. During the summer the water is warm enough to swim in because the cove is protected from the strong offshore winds that other water access areas are exposed to, making it likely the warmest beach on Whidbey Island. Not to mention, the incredible views of Penn Cove, gorgeous views of Saratoga Passage and the lovely historic Town of Coupeville. On sunny days you can spot snow covered mountains in the distance and a pod of Orca whales may be playing in the Cove.

One of the major benefits of living here is the short distance to the only Hospital on the island, Whidbey General Hospital. Downtown Coupeville offers quaint restaurants, galleries, shops, and a museum that overlook the cove offering luxurious views making for special trips all year round. Oak Harbor, just north of the neighborhood is home to Naval Air Station Whidbey Island where you will find an array of fast-food restaurants, car washes, and big-name shopping centers. In between the two discover the heart of Whidbey, with family farms like Three Sisters Market, small churches, and one of the very few left in the USA the Blue Fox Drive-in Movies with attractions like arcades, go-carts, and food!

Are you ready to get to know this Whidbey Island neighborhood better? Check it out here.

Have questions? We are happy to help. Connect with us here.

View this post on Instagram

Blonde Lawns on Whidbey Island

Blonde Lawns on Whidbey Island

Hello Summer! Can you believe it’s here? That beautiful time of year filled with beach walks, swimming lessons, trips to Kapaws Iskreme and so much more! Here on Whidbey we have countless summer traditions we treasure greatly. From our Old Fashioned 4th of July Celebration to the Whidbey Island Fair, there is so much to cherish about this time of year. One tradition you may be unaware of is actually more of a movement.

Blonde Lawns.

Through the course of the summer months you can watch the emerald grass of this evergreen island fade to a sandy shade. Before you know it, this rock will be rocking a brand new blonde look.

What’s with the lack luster lawns? Well, it all has to do with conservation.

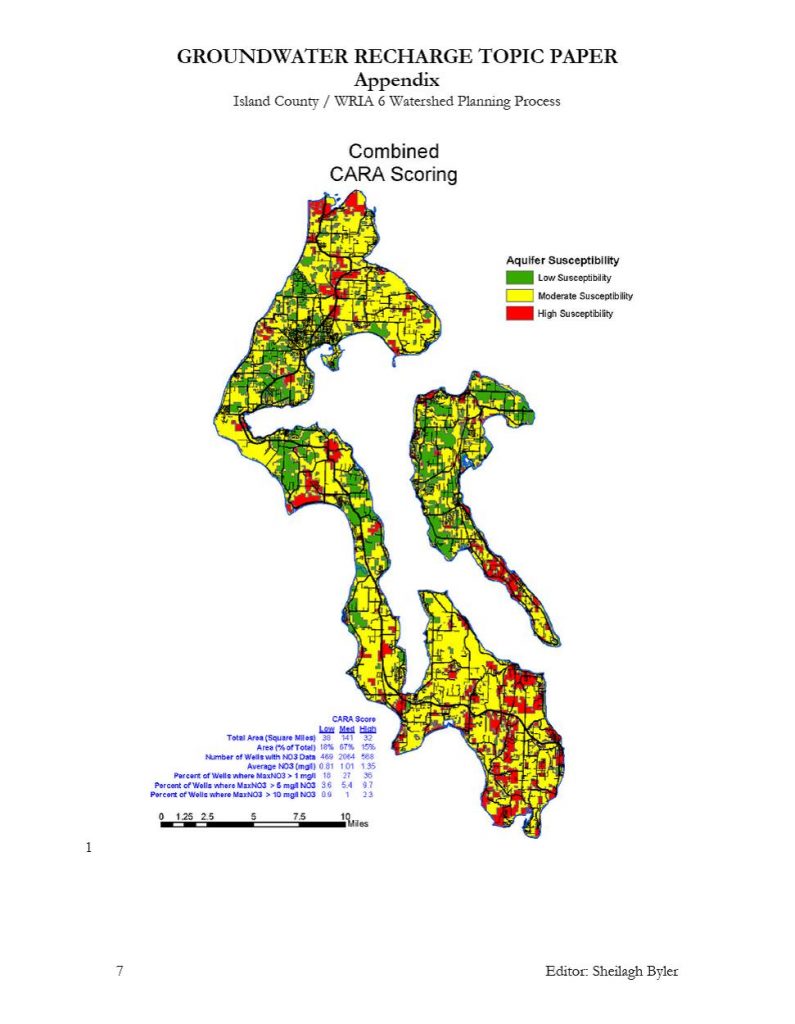

It’s no surprise to anyone that Whidbey tends to be a rather environmentally conscious. We love taking the extra step to ensure the beauty and resources we enjoy today will be around for tomorrow. One of those resources we care deeply about are our aquifers.

Aquifers:

Aquifers is the scientific term for ground water. Deep below the grass you walk on are pockets of “permeable” soil which store water that can then be tapped into for use. Annually these aquifers are recharged by the rain that falls to the ground.

According to Island County, Whidbey Island’s sole source of potable water comes from the ground.1 Sounds great, right? I mean, it’s Washington and it rains here. We should be good.

Unfortunately, not all is good in the aquifer hood.

According to a report released by the Washington State Department of Ecology, “increasing demands for water from ongoing population growth, declining stream flows and groundwater levels… have put Washington’s water supplies at risk.” Whidbey is by no means immune to this water depletion; in fact, seawater intrusion and our lack of rain fall in comparison to the rest of Western Washington puts us in a pretty tight spot.

So, what does this have to do with the blonde lawns of Whidbey (I think you can guess).

The summer months, when there is little rain, poses a particularly difficult dilemma for island aquifers. Between keeping ourselves hydrated in the summer sun, watering plants, animals, and filling the pool in the backyard we use A LOT of water.

This increase of use and lack of resource hits hard on our aquifers and our wallets! Many newcomers to Whidbey are shocked when that first summer water bill comes in. The rules of supply and demand are no strangers to Whidbey Island water.

So how can we save our aquifers (and our wallets)? By going blonde!

Grass is far more durable than people sometimes realize. More times than not the golden grass that takes over Whidbey in the summer will be green again by next spring. Blonde lawns DON’T mean dead grass.

So, save yourself time, money, hassle and save our precious resources. Let your lawn go blonde!

Resources:

- https://www.islandcountywa.gov/Planning/Pages/critaq.aspx

- https://fortress.wa.gov/ecy/publications/documents/1111011.pdf

You might also like:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link